Y Intercept Hong Kong Ltd reduced its holdings in shares of Bath & Body Works, Inc. (NYSE:BBWI - Free Report) by 85.0% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 15,150 shares of the company's stock after selling 86,008 shares during the period. Y Intercept Hong Kong Ltd's holdings in Bath & Body Works were worth $484,000 at the end of the most recent quarter.

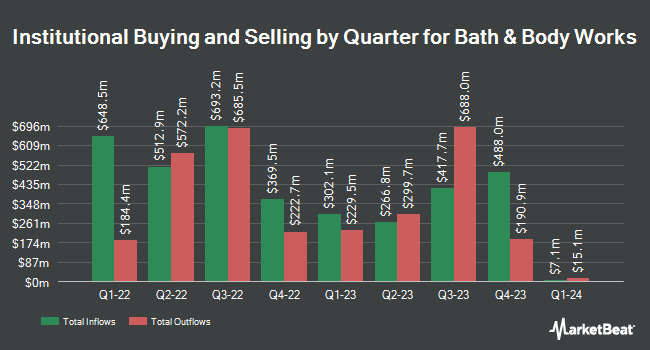

Several other institutional investors have also added to or reduced their stakes in BBWI. True Wealth Design LLC grew its stake in shares of Bath & Body Works by 5,270.0% during the 3rd quarter. True Wealth Design LLC now owns 1,074 shares of the company's stock valued at $34,000 after acquiring an additional 1,054 shares during the period. Livforsakringsbolaget Skandia Omsesidigt boosted its position in shares of Bath & Body Works by 300.0% in the third quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 1,200 shares of the company's stock worth $38,000 after purchasing an additional 900 shares during the period. Meeder Asset Management Inc. increased its stake in shares of Bath & Body Works by 480.3% in the third quarter. Meeder Asset Management Inc. now owns 1,735 shares of the company's stock worth $55,000 after purchasing an additional 1,436 shares in the last quarter. GAMMA Investing LLC raised its position in shares of Bath & Body Works by 34.4% during the 3rd quarter. GAMMA Investing LLC now owns 2,481 shares of the company's stock valued at $79,000 after purchasing an additional 635 shares during the period. Finally, Abich Financial Wealth Management LLC purchased a new position in shares of Bath & Body Works during the 3rd quarter valued at $103,000. 95.14% of the stock is currently owned by institutional investors.

Insider Activity at Bath & Body Works

In other Bath & Body Works news, CEO Gina Boswell purchased 6,000 shares of the business's stock in a transaction that occurred on Wednesday, October 9th. The shares were bought at an average price of $29.64 per share, for a total transaction of $177,840.00. Following the acquisition, the chief executive officer now owns 242,987 shares in the company, valued at $7,202,134.68. This represents a 2.53 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through the SEC website. 0.27% of the stock is owned by insiders.

Bath & Body Works Stock Performance

NYSE:BBWI traded up $0.42 during trading hours on Monday, reaching $38.64. The company's stock had a trading volume of 4,863,334 shares, compared to its average volume of 4,020,750. The stock has a 50 day moving average price of $32.76 and a two-hundred day moving average price of $34.50. The company has a market capitalization of $8.37 billion, a P/E ratio of 9.42, a price-to-earnings-growth ratio of 1.44 and a beta of 1.83. Bath & Body Works, Inc. has a 12 month low of $26.20 and a 12 month high of $52.99.

Bath & Body Works (NYSE:BBWI - Get Free Report) last issued its quarterly earnings results on Monday, November 25th. The company reported $0.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.46 by $0.03. Bath & Body Works had a negative return on equity of 44.03% and a net margin of 12.43%. The business had revenue of $1.61 billion for the quarter, compared to the consensus estimate of $1.58 billion. During the same period in the prior year, the firm posted $0.48 earnings per share. The business's quarterly revenue was up 3.1% on a year-over-year basis. As a group, analysts predict that Bath & Body Works, Inc. will post 3.26 EPS for the current fiscal year.

Bath & Body Works Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, December 6th. Stockholders of record on Friday, November 22nd were issued a dividend of $0.20 per share. This represents a $0.80 dividend on an annualized basis and a dividend yield of 2.07%. The ex-dividend date was Friday, November 22nd. Bath & Body Works's dividend payout ratio (DPR) is presently 19.51%.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on the stock. Piper Sandler upped their target price on shares of Bath & Body Works from $35.00 to $36.00 and gave the stock a "neutral" rating in a research report on Tuesday, November 26th. Robert W. Baird dropped their price objective on shares of Bath & Body Works from $54.00 to $45.00 and set an "outperform" rating for the company in a report on Thursday, August 29th. The Goldman Sachs Group reduced their target price on Bath & Body Works from $60.00 to $49.00 and set a "buy" rating on the stock in a report on Thursday, August 29th. Barclays increased their price target on Bath & Body Works from $28.00 to $34.00 and gave the company an "underweight" rating in a research note on Tuesday, November 26th. Finally, BMO Capital Markets reaffirmed an "outperform" rating and issued a $50.00 price objective (down previously from $52.00) on shares of Bath & Body Works in a research note on Thursday, August 29th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and nine have assigned a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $42.50.

Check Out Our Latest Analysis on Bath & Body Works

Bath & Body Works Profile

(

Free Report)

Bath & Body Works, Inc operates a specialty retailer of home fragrance, body care, and soaps and sanitizer products. It sells its products under the Bath & Body Works, White Barn, and other brand names through retail stores and e-commerce sites located in the United States and Canada, as well as through international stores operated by partners under franchise, license, and wholesale arrangements.

See Also

Before you consider Bath & Body Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bath & Body Works wasn't on the list.

While Bath & Body Works currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.