Y Intercept Hong Kong Ltd lifted its position in shares of MercadoLibre, Inc. (NASDAQ:MELI - Free Report) by 40.0% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,728 shares of the company's stock after acquiring an additional 780 shares during the period. Y Intercept Hong Kong Ltd's holdings in MercadoLibre were worth $5,598,000 as of its most recent filing with the Securities and Exchange Commission.

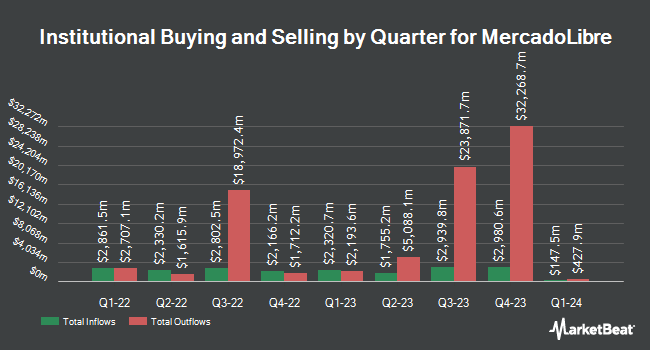

Several other large investors have also made changes to their positions in MELI. D.B. Root & Company LLC acquired a new position in MercadoLibre during the second quarter worth about $419,000. Dynamic Advisor Solutions LLC boosted its position in MercadoLibre by 1.9% in the second quarter. Dynamic Advisor Solutions LLC now owns 837 shares of the company's stock valued at $1,376,000 after buying an additional 16 shares in the last quarter. Alpha Cubed Investments LLC grew its stake in shares of MercadoLibre by 4.1% during the second quarter. Alpha Cubed Investments LLC now owns 201 shares of the company's stock worth $330,000 after buying an additional 8 shares during the last quarter. NorthCrest Asset Manangement LLC increased its holdings in shares of MercadoLibre by 1.7% during the second quarter. NorthCrest Asset Manangement LLC now owns 8,390 shares of the company's stock worth $13,788,000 after buying an additional 140 shares in the last quarter. Finally, Wealth Enhancement Advisory Services LLC increased its holdings in shares of MercadoLibre by 4.0% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 2,582 shares of the company's stock worth $4,243,000 after buying an additional 100 shares in the last quarter. Institutional investors and hedge funds own 87.62% of the company's stock.

MercadoLibre Stock Performance

Shares of MELI stock traded down $102.88 on Monday, hitting $1,844.30. 583,192 shares of the stock were exchanged, compared to its average volume of 369,864. The firm's 50 day moving average is $2,002.64 and its two-hundred day moving average is $1,878.11. MercadoLibre, Inc. has a one year low of $1,324.99 and a one year high of $2,161.73. The firm has a market capitalization of $93.51 billion, a PE ratio of 65.08, a P/E/G ratio of 1.33 and a beta of 1.57. The company has a current ratio of 1.25, a quick ratio of 1.22 and a debt-to-equity ratio of 0.78.

Insiders Place Their Bets

In related news, Director Emiliano Calemzuk sold 50 shares of the company's stock in a transaction that occurred on Friday, November 29th. The shares were sold at an average price of $1,984.98, for a total transaction of $99,249.00. Following the sale, the director now owns 238 shares of the company's stock, valued at approximately $472,425.24. This represents a 17.36 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Company insiders own 0.06% of the company's stock.

Wall Street Analysts Forecast Growth

MELI has been the topic of a number of recent research reports. BTIG Research cut their price target on shares of MercadoLibre from $2,250.00 to $2,200.00 and set a "buy" rating on the stock in a report on Thursday, November 7th. Barclays lowered their price target on shares of MercadoLibre from $2,500.00 to $2,200.00 and set an "overweight" rating for the company in a report on Tuesday, November 12th. Cantor Fitzgerald reduced their price objective on shares of MercadoLibre from $2,530.00 to $2,300.00 and set an "overweight" rating on the stock in a research note on Thursday, November 7th. Morgan Stanley dropped their target price on shares of MercadoLibre from $2,500.00 to $2,450.00 and set an "overweight" rating on the stock in a report on Monday, November 11th. Finally, Bank of America upped their price target on shares of MercadoLibre from $2,250.00 to $2,500.00 and gave the company a "buy" rating in a research report on Thursday, September 12th. Three research analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, MercadoLibre has an average rating of "Moderate Buy" and an average price target of $2,267.67.

Get Our Latest Stock Report on MELI

MercadoLibre Company Profile

(

Free Report)

MercadoLibre, Inc operates online commerce platforms in the United States. It operates Mercado Libre Marketplace, an automated online commerce platform that enables businesses, merchants, and individuals to list merchandise and conduct sales and purchases digitally; and Mercado Pago FinTech platform, a financial technology solution platform, which facilitates transactions on and off its marketplaces by providing a mechanism that allows its users to send and receive payments online, as well as allows users to transfer money through their websites or on the apps.

Read More

Before you consider MercadoLibre, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MercadoLibre wasn't on the list.

While MercadoLibre currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.