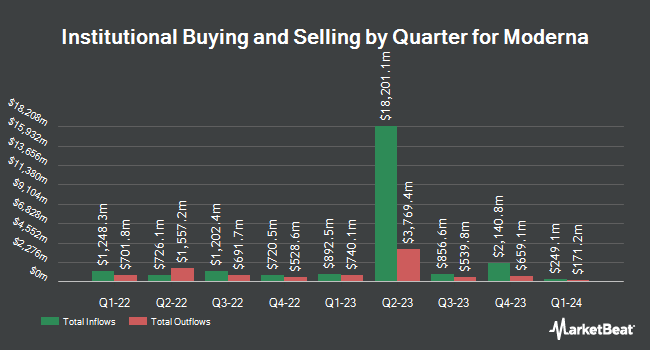

Y Intercept Hong Kong Ltd grew its holdings in Moderna, Inc. (NASDAQ:MRNA - Free Report) by 30.9% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 101,159 shares of the company's stock after purchasing an additional 23,881 shares during the period. Moderna comprises 0.4% of Y Intercept Hong Kong Ltd's portfolio, making the stock its 24th largest holding. Y Intercept Hong Kong Ltd's holdings in Moderna were worth $6,760,000 as of its most recent SEC filing.

A number of other large investors also recently made changes to their positions in the business. MML Investors Services LLC increased its holdings in shares of Moderna by 21.6% in the 3rd quarter. MML Investors Services LLC now owns 33,895 shares of the company's stock valued at $2,265,000 after purchasing an additional 6,018 shares during the period. Orion Portfolio Solutions LLC increased its holdings in shares of Moderna by 65.1% in the 3rd quarter. Orion Portfolio Solutions LLC now owns 3,661 shares of the company's stock valued at $245,000 after purchasing an additional 1,443 shares during the period. XTX Topco Ltd increased its holdings in shares of Moderna by 889.4% in the 3rd quarter. XTX Topco Ltd now owns 28,256 shares of the company's stock valued at $1,888,000 after purchasing an additional 25,400 shares during the period. National Bank of Canada FI increased its holdings in shares of Moderna by 62.8% in the 3rd quarter. National Bank of Canada FI now owns 235,266 shares of the company's stock valued at $15,723,000 after purchasing an additional 90,739 shares during the period. Finally, iA Global Asset Management Inc. increased its holdings in shares of Moderna by 4.1% in the 3rd quarter. iA Global Asset Management Inc. now owns 39,184 shares of the company's stock valued at $2,619,000 after purchasing an additional 1,536 shares during the period. Institutional investors and hedge funds own 75.33% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on MRNA shares. Wolfe Research started coverage on Moderna in a report on Friday, November 15th. They issued an "underperform" rating and a $40.00 price objective on the stock. Hsbc Global Res upgraded Moderna from a "hold" rating to a "strong-buy" rating in a report on Monday, November 18th. Barclays dropped their price objective on Moderna from $125.00 to $111.00 and set an "overweight" rating on the stock in a report on Friday, November 8th. JPMorgan Chase & Co. dropped their price objective on Moderna from $59.00 to $45.00 and set an "underweight" rating on the stock in a report on Tuesday, November 26th. Finally, Piper Sandler restated an "overweight" rating and issued a $69.00 price objective (down previously from $115.00) on shares of Moderna in a report on Monday, November 18th. Three research analysts have rated the stock with a sell rating, twelve have assigned a hold rating, five have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $83.33.

View Our Latest Stock Analysis on MRNA

Moderna Stock Performance

Shares of MRNA traded up $1.21 during mid-day trading on Monday, hitting $45.65. The company's stock had a trading volume of 7,270,377 shares, compared to its average volume of 4,950,780. Moderna, Inc. has a one year low of $35.80 and a one year high of $170.47. The company has a debt-to-equity ratio of 0.05, a quick ratio of 4.20 and a current ratio of 4.39. The firm has a market capitalization of $17.57 billion, a PE ratio of -7.84 and a beta of 1.58. The stock's 50-day moving average is $49.84 and its two-hundred day moving average is $86.50.

Moderna (NASDAQ:MRNA - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The company reported $0.03 earnings per share for the quarter, beating the consensus estimate of ($1.89) by $1.92. Moderna had a negative return on equity of 17.68% and a negative net margin of 43.77%. The company had revenue of $1.90 billion during the quarter, compared to analysts' expectations of $1.25 billion. During the same period in the prior year, the business earned ($1.39) earnings per share. Moderna's revenue for the quarter was up 3.8% compared to the same quarter last year. As a group, sell-side analysts anticipate that Moderna, Inc. will post -9.32 EPS for the current year.

Insider Activity

In related news, insider Shannon Thyme Klinger sold 1,418 shares of the company's stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $42.79, for a total value of $60,676.22. Following the sale, the insider now owns 19,717 shares of the company's stock, valued at $843,690.43. The trade was a 6.71 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO James M. Mock sold 715 shares of the firm's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $60.12, for a total transaction of $42,985.80. Following the transaction, the chief financial officer now owns 9,505 shares of the company's stock, valued at approximately $571,440.60. This represents a 7.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 2,850 shares of company stock valued at $134,560. 15.70% of the stock is owned by company insiders.

Moderna Profile

(

Free Report)

Moderna, Inc, a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. Its respiratory vaccines include COVID-19, influenza, and respiratory syncytial virus, spikevax, and hMPV/PIV3 vaccines; latent vaccines comprise cytomegalovirus, epstein-barr virus, herpes simplex virus, varicella zoster virus, and human immunodeficiency virus vaccines; public health vaccines consists of Zika, Nipah, Mpox vaccines; and infectious diseases vaccines, such as lyme and norovirus vaccines.

Featured Stories

Before you consider Moderna, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moderna wasn't on the list.

While Moderna currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.