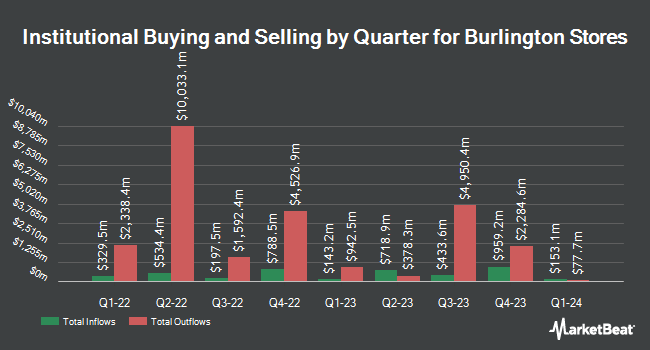

Y Intercept Hong Kong Ltd purchased a new position in shares of Burlington Stores, Inc. (NYSE:BURL - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 8,042 shares of the company's stock, valued at approximately $2,119,000.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Massachusetts Financial Services Co. MA lifted its position in shares of Burlington Stores by 1,048.8% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 730,524 shares of the company's stock valued at $192,478,000 after buying an additional 666,934 shares in the last quarter. AQR Capital Management LLC lifted its holdings in Burlington Stores by 2,542.2% during the second quarter. AQR Capital Management LLC now owns 247,970 shares of the company's stock valued at $59,114,000 after purchasing an additional 238,585 shares in the last quarter. Dimensional Fund Advisors LP grew its position in shares of Burlington Stores by 54.8% in the second quarter. Dimensional Fund Advisors LP now owns 587,376 shares of the company's stock valued at $140,968,000 after purchasing an additional 207,959 shares during the period. Marshall Wace LLP acquired a new stake in shares of Burlington Stores in the second quarter valued at about $47,725,000. Finally, Assenagon Asset Management S.A. increased its stake in shares of Burlington Stores by 1,917.3% during the second quarter. Assenagon Asset Management S.A. now owns 207,260 shares of the company's stock worth $49,742,000 after purchasing an additional 196,986 shares in the last quarter.

Burlington Stores Trading Down 0.4 %

BURL traded down $1.04 during trading hours on Tuesday, reaching $290.30. The company's stock had a trading volume of 832,740 shares, compared to its average volume of 901,027. The business's 50-day moving average is $265.84 and its 200-day moving average is $256.23. The company has a debt-to-equity ratio of 1.35, a current ratio of 1.17 and a quick ratio of 0.54. The stock has a market cap of $18.43 billion, a PE ratio of 39.77, a P/E/G ratio of 1.54 and a beta of 1.64. Burlington Stores, Inc. has a fifty-two week low of $174.64 and a fifty-two week high of $298.89.

Burlington Stores (NYSE:BURL - Get Free Report) last released its quarterly earnings results on Tuesday, November 26th. The company reported $1.55 earnings per share for the quarter, topping analysts' consensus estimates of $1.54 by $0.01. The business had revenue of $2.53 billion during the quarter, compared to analysts' expectations of $2.55 billion. Burlington Stores had a return on equity of 47.52% and a net margin of 4.49%. The company's revenue was up 10.5% compared to the same quarter last year. During the same period in the prior year, the business posted $0.98 EPS. As a group, equities research analysts predict that Burlington Stores, Inc. will post 7.93 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Burlington Stores news, CMO Jennifer Vecchio sold 494 shares of the business's stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $293.89, for a total value of $145,181.66. Following the completion of the transaction, the chief marketing officer now owns 59,931 shares in the company, valued at $17,613,121.59. The trade was a 0.82 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at the SEC website. Also, Director Paul Sullivan sold 1,705 shares of the company's stock in a transaction on Thursday, September 19th. The stock was sold at an average price of $277.05, for a total value of $472,370.25. Following the sale, the director now directly owns 7,393 shares in the company, valued at $2,048,230.65. This represents a 18.74 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 2,283 shares of company stock valued at $638,628. Company insiders own 0.91% of the company's stock.

Analyst Ratings Changes

Several equities research analysts recently issued reports on BURL shares. StockNews.com cut Burlington Stores from a "buy" rating to a "hold" rating in a report on Wednesday, October 23rd. Barclays lowered their price target on Burlington Stores from $327.00 to $317.00 and set an "overweight" rating on the stock in a research note on Wednesday, November 27th. TD Cowen boosted their price target on Burlington Stores from $288.00 to $334.00 and gave the stock a "buy" rating in a research report on Monday, November 25th. UBS Group raised their price objective on Burlington Stores from $270.00 to $280.00 and gave the company a "neutral" rating in a report on Thursday, November 14th. Finally, Telsey Advisory Group reaffirmed an "outperform" rating and set a $310.00 target price on shares of Burlington Stores in a report on Tuesday, November 26th. Two investment analysts have rated the stock with a hold rating and fifteen have given a buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $307.69.

Get Our Latest Analysis on Burlington Stores

Burlington Stores Profile

(

Free Report)

Burlington Stores, Inc operates as a retailer of branded merchandise in the United States. The company provides fashion-focused merchandise, including women's ready-to-wear apparel, menswear, youth apparel, footwear, accessories, toys, gifts, and coats, as well as baby, home, and beauty products.

Read More

Before you consider Burlington Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Burlington Stores wasn't on the list.

While Burlington Stores currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.