Y Intercept Hong Kong Ltd acquired a new stake in shares of Astera Labs, Inc. (NASDAQ:ALAB - Free Report) in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund acquired 65,376 shares of the company's stock, valued at approximately $3,425,000.

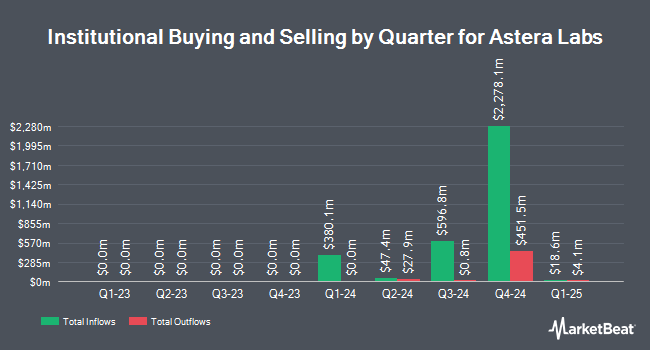

Other large investors have also made changes to their positions in the company. Hollencrest Capital Management acquired a new position in Astera Labs during the third quarter valued at $26,000. US Bancorp DE acquired a new position in shares of Astera Labs in the 3rd quarter valued at about $46,000. First Horizon Advisors Inc. purchased a new stake in shares of Astera Labs in the third quarter worth about $49,000. Allworth Financial LP grew its holdings in Astera Labs by 445.5% during the third quarter. Allworth Financial LP now owns 1,091 shares of the company's stock worth $57,000 after acquiring an additional 891 shares during the period. Finally, Amalgamated Bank purchased a new position in Astera Labs during the second quarter valued at approximately $74,000. 60.47% of the stock is owned by hedge funds and other institutional investors.

Astera Labs Stock Performance

Shares of NASDAQ ALAB traded up $1.63 during midday trading on Monday, hitting $122.03. The stock had a trading volume of 4,000,295 shares, compared to its average volume of 3,227,524. The stock has a 50 day simple moving average of $82.77 and a 200-day simple moving average of $62.69. Astera Labs, Inc. has a 1 year low of $36.22 and a 1 year high of $123.40.

Astera Labs (NASDAQ:ALAB - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported $0.23 earnings per share for the quarter, beating analysts' consensus estimates of $0.17 by $0.06. Astera Labs had a negative return on equity of 15.57% and a negative net margin of 30.69%. The company had revenue of $113.10 million for the quarter, compared to analyst estimates of $97.50 million. The business's revenue was up 47.1% compared to the same quarter last year. As a group, equities research analysts anticipate that Astera Labs, Inc. will post -0.45 EPS for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts have commented on ALAB shares. Roth Mkm upped their price objective on Astera Labs from $80.00 to $105.00 and gave the stock a "buy" rating in a research report on Tuesday, November 5th. Citigroup began coverage on shares of Astera Labs in a research report on Monday, November 18th. They set a "buy" rating and a $120.00 price target on the stock. JPMorgan Chase & Co. lifted their price objective on shares of Astera Labs from $70.00 to $110.00 and gave the company an "overweight" rating in a report on Tuesday, November 5th. Morgan Stanley increased their target price on shares of Astera Labs from $74.00 to $94.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. Finally, Craig Hallum lifted their price target on Astera Labs from $75.00 to $105.00 and gave the company a "buy" rating in a research note on Tuesday, November 5th. Twelve equities research analysts have rated the stock with a buy rating, According to MarketBeat, the company has a consensus rating of "Buy" and an average target price of $94.67.

Check Out Our Latest Research Report on ALAB

Insider Buying and Selling

In other Astera Labs news, CFO Michael Truett Tate sold 16,000 shares of the business's stock in a transaction on Wednesday, December 4th. The stock was sold at an average price of $117.84, for a total transaction of $1,885,440.00. Following the transaction, the chief financial officer now owns 1,412,888 shares of the company's stock, valued at approximately $166,494,721.92. The trade was a 1.12 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, insider Sanjay Gajendra sold 76,701 shares of the company's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $45.32, for a total value of $3,476,089.32. Following the completion of the sale, the insider now owns 855,000 shares of the company's stock, valued at approximately $38,748,600. The trade was a 8.23 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 2,154,820 shares of company stock worth $195,106,438.

Astera Labs Company Profile

(

Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

Further Reading

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.