Y Intercept Hong Kong Ltd purchased a new stake in shares of Calix, Inc. (NYSE:CALX - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 19,995 shares of the communications equipment provider's stock, valued at approximately $776,000.

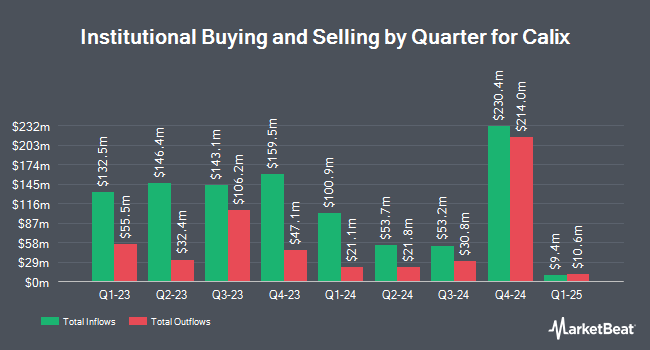

Several other institutional investors have also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP boosted its stake in Calix by 2.6% in the second quarter. Dimensional Fund Advisors LP now owns 1,793,545 shares of the communications equipment provider's stock worth $63,546,000 after purchasing an additional 45,656 shares in the last quarter. Congress Asset Management Co. raised its holdings in shares of Calix by 30.1% in the third quarter. Congress Asset Management Co. now owns 1,565,471 shares of the communications equipment provider's stock valued at $60,725,000 after buying an additional 361,805 shares during the last quarter. Paradigm Capital Management Inc. NY lifted its position in Calix by 9.5% during the 2nd quarter. Paradigm Capital Management Inc. NY now owns 1,336,900 shares of the communications equipment provider's stock worth $47,366,000 after buying an additional 115,500 shares in the last quarter. Kornitzer Capital Management Inc. KS grew its holdings in Calix by 9.2% during the 2nd quarter. Kornitzer Capital Management Inc. KS now owns 812,053 shares of the communications equipment provider's stock worth $28,771,000 after acquiring an additional 68,300 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. increased its position in Calix by 2.1% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 601,146 shares of the communications equipment provider's stock valued at $23,318,000 after acquiring an additional 12,637 shares in the last quarter. 98.14% of the stock is owned by institutional investors.

Calix Price Performance

Shares of CALX stock traded down $0.29 during trading hours on Friday, reaching $35.11. The company had a trading volume of 628,110 shares, compared to its average volume of 757,648. Calix, Inc. has a 1-year low of $26.76 and a 1-year high of $45.15. The company has a 50 day moving average of $34.96 and a 200 day moving average of $35.91. The firm has a market cap of $2.33 billion, a price-to-earnings ratio of -146.29 and a beta of 1.70.

Calix (NYSE:CALX - Get Free Report) last released its earnings results on Monday, October 28th. The communications equipment provider reported $0.13 earnings per share for the quarter, beating the consensus estimate of $0.09 by $0.04. The firm had revenue of $200.95 million for the quarter, compared to analyst estimates of $201.06 million. Calix had a positive return on equity of 1.33% and a negative net margin of 1.79%. The company's quarterly revenue was down 23.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.25 earnings per share. As a group, sell-side analysts forecast that Calix, Inc. will post -0.34 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

CALX has been the topic of a number of research reports. Needham & Company LLC reiterated a "buy" rating and set a $45.00 target price on shares of Calix in a research report on Tuesday, October 29th. Rosenblatt Securities reiterated a "buy" rating and issued a $45.00 price objective on shares of Calix in a research report on Thursday, October 3rd. Finally, StockNews.com upgraded Calix from a "sell" rating to a "hold" rating in a research report on Tuesday, October 8th. Three equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. Based on data from MarketBeat, Calix presently has an average rating of "Moderate Buy" and an average target price of $42.50.

Get Our Latest Analysis on CALX

Calix Company Profile

(

Free Report)

Calix, Inc, together with its subsidiaries, engages in the provision of cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific. Its cloud and software platforms, and systems and services enable broadband service providers (BSPs) to provide a range of services.

Featured Stories

Before you consider Calix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calix wasn't on the list.

While Calix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.