Y Intercept Hong Kong Ltd bought a new position in shares of First Hawaiian, Inc. (NASDAQ:FHB - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 27,288 shares of the bank's stock, valued at approximately $632,000.

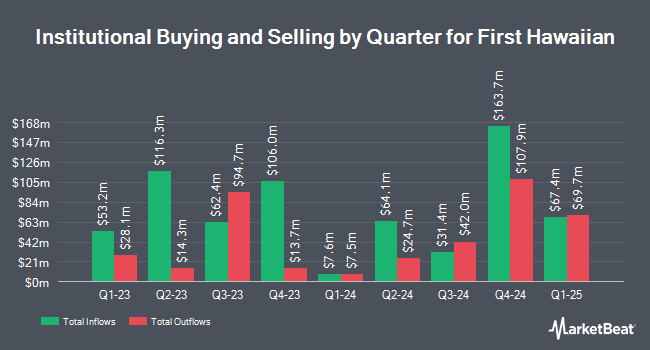

A number of other institutional investors have also added to or reduced their stakes in FHB. SG Americas Securities LLC purchased a new position in First Hawaiian in the second quarter worth $568,000. Raymond James & Associates increased its position in shares of First Hawaiian by 5.5% during the 2nd quarter. Raymond James & Associates now owns 1,079,969 shares of the bank's stock valued at $22,420,000 after purchasing an additional 56,445 shares during the last quarter. Louisiana State Employees Retirement System lifted its position in First Hawaiian by 1.7% in the 2nd quarter. Louisiana State Employees Retirement System now owns 64,300 shares of the bank's stock worth $1,335,000 after buying an additional 1,100 shares during the last quarter. Whittier Trust Co. boosted its stake in First Hawaiian by 68.7% in the second quarter. Whittier Trust Co. now owns 1,245 shares of the bank's stock worth $26,000 after buying an additional 507 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank grew its position in First Hawaiian by 28.0% during the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 29,733 shares of the bank's stock valued at $617,000 after acquiring an additional 6,505 shares during the last quarter. 97.63% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on FHB. Barclays increased their target price on First Hawaiian from $25.00 to $27.00 and gave the company an "equal weight" rating in a report on Thursday, December 5th. The Goldman Sachs Group increased their price objective on First Hawaiian from $22.00 to $26.00 and gave the company a "sell" rating in a research note on Tuesday, November 26th. Stephens initiated coverage on shares of First Hawaiian in a research note on Wednesday, November 27th. They issued an "equal weight" rating and a $30.00 target price on the stock. JPMorgan Chase & Co. dropped their price target on shares of First Hawaiian from $24.00 to $23.00 and set an "underweight" rating for the company in a research report on Wednesday, October 9th. Finally, Keefe, Bruyette & Woods boosted their price objective on shares of First Hawaiian from $25.00 to $28.00 and gave the company a "market perform" rating in a research report on Wednesday, December 4th. Four investment analysts have rated the stock with a sell rating and four have assigned a hold rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $26.14.

View Our Latest Stock Analysis on First Hawaiian

First Hawaiian Trading Down 0.7 %

First Hawaiian stock traded down $0.20 during mid-day trading on Friday, hitting $27.06. The company had a trading volume of 705,179 shares, compared to its average volume of 653,250. The company has a market capitalization of $3.46 billion, a PE ratio of 15.46 and a beta of 0.98. First Hawaiian, Inc. has a 12 month low of $19.48 and a 12 month high of $28.80. The stock's 50 day moving average price is $25.95 and its two-hundred day moving average price is $23.71.

First Hawaiian Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, November 29th. Investors of record on Monday, November 18th were given a dividend of $0.26 per share. The ex-dividend date was Monday, November 18th. This represents a $1.04 annualized dividend and a dividend yield of 3.84%. First Hawaiian's dividend payout ratio (DPR) is presently 59.43%.

First Hawaiian Profile

(

Free Report)

First Hawaiian, Inc operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States. It operates in three segments: Retail Banking, Commercial Banking, and Treasury and Other. The company offers various deposit products, including checking, savings, and time deposit accounts, and other deposit accounts.

Featured Stories

Before you consider First Hawaiian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Hawaiian wasn't on the list.

While First Hawaiian currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.