Y Intercept Hong Kong Ltd purchased a new stake in GameStop Corp. (NYSE:GME - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 71,306 shares of the company's stock, valued at approximately $1,635,000.

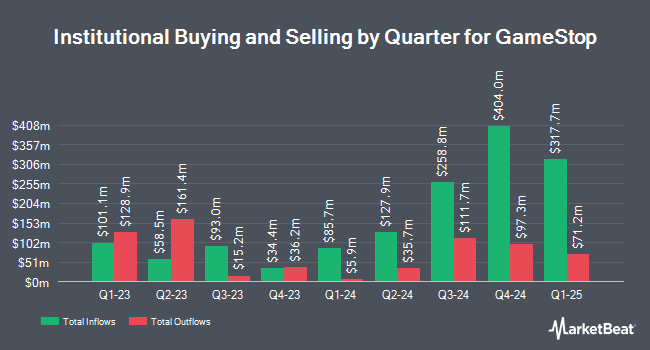

A number of other hedge funds have also added to or reduced their stakes in the company. State Street Corp increased its stake in GameStop by 38.0% in the third quarter. State Street Corp now owns 11,143,759 shares of the company's stock valued at $255,526,000 after acquiring an additional 3,070,571 shares during the last quarter. Charles Schwab Investment Management Inc. increased its stake in GameStop by 22.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 3,502,910 shares of the company's stock valued at $80,322,000 after acquiring an additional 646,488 shares during the last quarter. Van ECK Associates Corp increased its stake in GameStop by 8.1% in the third quarter. Van ECK Associates Corp now owns 1,825,837 shares of the company's stock valued at $41,866,000 after acquiring an additional 136,785 shares during the last quarter. Renaissance Technologies LLC increased its stake in GameStop by 34.0% in the second quarter. Renaissance Technologies LLC now owns 1,347,136 shares of the company's stock valued at $33,261,000 after acquiring an additional 342,178 shares during the last quarter. Finally, Swiss National Bank increased its stake in GameStop by 46.0% in the third quarter. Swiss National Bank now owns 790,528 shares of the company's stock valued at $18,127,000 after acquiring an additional 249,100 shares during the last quarter. 29.21% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of research analysts recently issued reports on the stock. Wedbush reissued an "underperform" rating and issued a $10.00 price objective on shares of GameStop in a research note on Friday, December 6th. StockNews.com raised shares of GameStop to a "sell" rating in a research note on Saturday, October 19th.

Read Our Latest Research Report on GME

GameStop Stock Up 7.7 %

Shares of NYSE GME traded up $2.07 during midday trading on Wednesday, reaching $29.00. 20,424,314 shares of the company were exchanged, compared to its average volume of 19,129,570. The stock's 50-day moving average price is $24.67 and its 200-day moving average price is $24.08. The stock has a market cap of $12.37 billion, a P/E ratio of 223.09 and a beta of -0.11. GameStop Corp. has a one year low of $9.95 and a one year high of $64.83.

GameStop (NYSE:GME - Get Free Report) last posted its earnings results on Tuesday, December 10th. The company reported $0.06 earnings per share for the quarter, topping analysts' consensus estimates of ($0.03) by $0.09. The firm had revenue of $860.30 million for the quarter, compared to analysts' expectations of $887.68 million. GameStop had a net margin of 0.93% and a return on equity of 1.79%. The company's revenue was down 20.2% on a year-over-year basis. On average, equities research analysts anticipate that GameStop Corp. will post 0.01 EPS for the current year.

Insider Transactions at GameStop

In other news, insider Daniel William Moore sold 2,624 shares of GameStop stock in a transaction on Friday, October 11th. The shares were sold at an average price of $21.00, for a total transaction of $55,104.00. Following the transaction, the insider now owns 32,280 shares in the company, valued at approximately $677,880. The trade was a 7.52 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, General Counsel Mark Haymond Robinson sold 4,667 shares of GameStop stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $21.96, for a total transaction of $102,487.32. Following the transaction, the general counsel now owns 54,927 shares in the company, valued at approximately $1,206,196.92. This trade represents a 7.83 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 22,639 shares of company stock worth $481,000. Company insiders own 12.28% of the company's stock.

GameStop Company Profile

(

Free Report)

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

See Also

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.