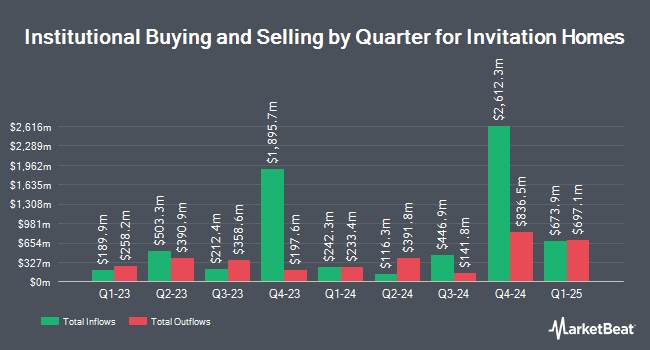

Y Intercept Hong Kong Ltd increased its position in Invitation Homes Inc. (NYSE:INVH - Free Report) by 89.6% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 146,398 shares of the company's stock after purchasing an additional 69,177 shares during the period. Y Intercept Hong Kong Ltd's holdings in Invitation Homes were worth $4,680,000 at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of the company. Fjarde AP Fonden Fourth Swedish National Pension Fund lifted its holdings in shares of Invitation Homes by 54.4% in the 4th quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund now owns 116,133 shares of the company's stock worth $3,713,000 after purchasing an additional 40,900 shares in the last quarter. Paradigm Asset Management Co. LLC purchased a new stake in Invitation Homes in the 4th quarter valued at $914,000. Handelsbanken Fonder AB raised its position in Invitation Homes by 11.3% in the 4th quarter. Handelsbanken Fonder AB now owns 421,425 shares of the company's stock valued at $13,473,000 after buying an additional 42,625 shares during the last quarter. CIBC Asset Management Inc raised its position in Invitation Homes by 4.6% in the 4th quarter. CIBC Asset Management Inc now owns 88,154 shares of the company's stock valued at $2,818,000 after buying an additional 3,878 shares during the last quarter. Finally, Sanctuary Advisors LLC raised its position in Invitation Homes by 105.0% in the 4th quarter. Sanctuary Advisors LLC now owns 29,142 shares of the company's stock valued at $903,000 after buying an additional 14,929 shares during the last quarter. 96.79% of the stock is currently owned by institutional investors.

Invitation Homes Stock Down 1.1 %

INVH stock opened at $31.90 on Monday. The company has a debt-to-equity ratio of 0.54, a quick ratio of 0.24 and a current ratio of 0.24. The company has a market capitalization of $19.54 billion, a price-to-earnings ratio of 44.92, a PEG ratio of 4.70 and a beta of 1.04. Invitation Homes Inc. has a fifty-two week low of $30.13 and a fifty-two week high of $37.80. The stock has a fifty day moving average of $31.48 and a 200-day moving average of $33.52.

Invitation Homes Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, January 17th. Stockholders of record on Thursday, December 26th were paid a dividend of $0.29 per share. This is an increase from Invitation Homes's previous quarterly dividend of $0.28. The ex-dividend date was Thursday, December 26th. This represents a $1.16 annualized dividend and a dividend yield of 3.64%. Invitation Homes's dividend payout ratio is presently 163.38%.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on the company. Morgan Stanley lowered Invitation Homes from an "overweight" rating to an "equal weight" rating and lowered their price target for the company from $39.00 to $35.00 in a research report on Friday, January 24th. Keefe, Bruyette & Woods lowered their price target on Invitation Homes from $37.00 to $35.00 and set a "market perform" rating for the company in a research report on Wednesday, November 6th. Barclays lowered their price target on Invitation Homes from $38.00 to $36.00 and set an "overweight" rating for the company in a research report on Friday, January 24th. JMP Securities reissued a "market outperform" rating and issued a $40.00 price target on shares of Invitation Homes in a research report on Thursday, December 12th. Finally, Deutsche Bank Aktiengesellschaft lowered Invitation Homes from a "buy" rating to a "hold" rating and lowered their price target for the company from $41.00 to $33.00 in a research report on Tuesday, January 21st. Eleven analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. According to MarketBeat.com, Invitation Homes has a consensus rating of "Hold" and an average target price of $37.47.

Get Our Latest Report on INVH

Invitation Homes Company Profile

(

Free Report)

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools. The company's mission, Together with you, we make a house a home, reflects its commitment to providing homes where individuals and families can thrive and high-touch service that continuously enhances residents' living experiences.

See Also

Want to see what other hedge funds are holding INVH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Invitation Homes Inc. (NYSE:INVH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Invitation Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invitation Homes wasn't on the list.

While Invitation Homes currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.