Y Intercept Hong Kong Ltd acquired a new stake in Maplebear Inc. (NASDAQ:CART - Free Report) during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm acquired 84,547 shares of the company's stock, valued at approximately $3,444,000.

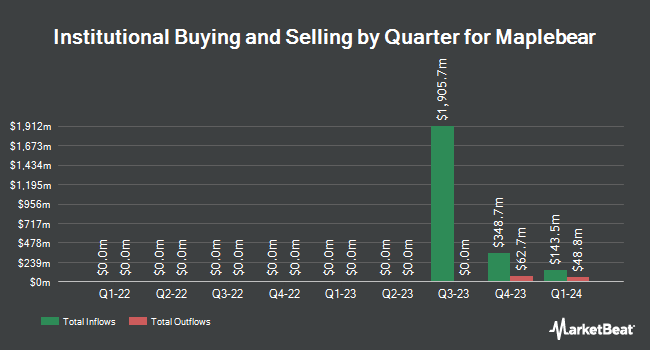

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Pacer Advisors Inc. bought a new position in Maplebear in the third quarter valued at $158,701,000. Maverick Capital Ltd. boosted its stake in shares of Maplebear by 19.7% during the 3rd quarter. Maverick Capital Ltd. now owns 2,684,425 shares of the company's stock worth $109,363,000 after buying an additional 441,156 shares during the last quarter. State Street Corp grew its holdings in shares of Maplebear by 48.3% in the 3rd quarter. State Street Corp now owns 2,552,617 shares of the company's stock valued at $103,994,000 after acquiring an additional 831,795 shares in the last quarter. Southpoint Capital Advisors LP increased its position in shares of Maplebear by 56.3% in the third quarter. Southpoint Capital Advisors LP now owns 2,500,000 shares of the company's stock valued at $101,850,000 after acquiring an additional 900,000 shares during the last quarter. Finally, Sculptor Capital LP bought a new stake in Maplebear during the second quarter worth about $77,361,000. 63.09% of the stock is currently owned by institutional investors and hedge funds.

Maplebear Stock Performance

Shares of CART stock traded down $1.72 during trading on Monday, hitting $42.47. The company had a trading volume of 4,040,593 shares, compared to its average volume of 3,992,253. The stock's 50-day moving average price is $43.61 and its 200 day moving average price is $37.53. Maplebear Inc. has a one year low of $22.13 and a one year high of $50.01. The firm has a market capitalization of $10.91 billion, a P/E ratio of 28.59, a price-to-earnings-growth ratio of 1.15 and a beta of 0.94.

Maplebear (NASDAQ:CART - Get Free Report) last released its earnings results on Tuesday, November 12th. The company reported $0.42 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.22 by $0.20. Maplebear had a return on equity of 13.78% and a net margin of 13.37%. The company had revenue of $852.00 million for the quarter, compared to analyst estimates of $844.03 million. During the same period in the prior year, the firm posted ($20.86) EPS. Maplebear's quarterly revenue was up 11.5% on a year-over-year basis. On average, research analysts anticipate that Maplebear Inc. will post 1.4 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CAO Alan Ramsay sold 2,247 shares of the firm's stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $41.06, for a total value of $92,261.82. Following the sale, the chief accounting officer now directly owns 89,982 shares of the company's stock, valued at $3,694,660.92. This trade represents a 2.44 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CEO Fidji Simo sold 20,750 shares of the business's stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $42.97, for a total value of $891,627.50. Following the transaction, the chief executive officer now directly owns 1,804,243 shares of the company's stock, valued at approximately $77,528,321.71. The trade was a 1.14 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 110,954 shares of company stock worth $4,890,405 over the last ninety days. Corporate insiders own 36.00% of the company's stock.

Analysts Set New Price Targets

CART has been the topic of several recent analyst reports. Barclays boosted their price target on Maplebear from $48.00 to $56.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 13th. JPMorgan Chase & Co. upped their price target on shares of Maplebear from $47.00 to $52.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 13th. Deutsche Bank Aktiengesellschaft began coverage on shares of Maplebear in a research report on Tuesday, December 3rd. They issued a "hold" rating and a $37.00 price objective for the company. Loop Capital upped their target price on shares of Maplebear from $49.00 to $56.00 and gave the company a "buy" rating in a report on Monday. Finally, Piper Sandler lifted their price target on Maplebear from $50.00 to $58.00 and gave the stock an "overweight" rating in a report on Wednesday, November 13th. Thirteen analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $47.14.

View Our Latest Stock Report on CART

About Maplebear

(

Free Report)

Maplebear Inc, doing business as Instacart, engages in the provision of online grocery shopping services to households in North America. It sells and delivers grocery products, as well as pickup services through a mobile application and website. It also operates virtual convenience stores; and provides software-as-a-service solutions to retailers.

Further Reading

Before you consider Maplebear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maplebear wasn't on the list.

While Maplebear currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.