Y Intercept Hong Kong Ltd trimmed its holdings in Central Garden & Pet (NASDAQ:CENTA - Free Report) by 52.7% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 13,359 shares of the company's stock after selling 14,863 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in Central Garden & Pet were worth $419,000 at the end of the most recent reporting period.

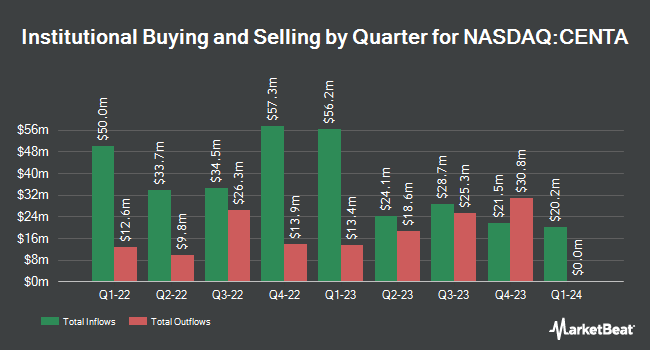

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in CENTA. Quarry LP increased its holdings in Central Garden & Pet by 503.2% in the second quarter. Quarry LP now owns 754 shares of the company's stock valued at $25,000 after buying an additional 629 shares in the last quarter. Federated Hermes Inc. purchased a new position in shares of Central Garden & Pet in the 2nd quarter valued at about $26,000. Quest Partners LLC acquired a new position in Central Garden & Pet in the 2nd quarter worth about $37,000. CWM LLC raised its holdings in Central Garden & Pet by 3,558.1% in the 2nd quarter. CWM LLC now owns 1,134 shares of the company's stock worth $37,000 after purchasing an additional 1,103 shares during the period. Finally, Point72 Asia Singapore Pte. Ltd. acquired a new stake in Central Garden & Pet in the second quarter valued at approximately $61,000. 50.82% of the stock is owned by institutional investors and hedge funds.

Central Garden & Pet Stock Up 6.0 %

Central Garden & Pet stock traded up $2.09 during trading on Tuesday, reaching $36.73. The stock had a trading volume of 560,196 shares, compared to its average volume of 281,664. Central Garden & Pet has a 52-week low of $27.70 and a 52-week high of $41.03. The business has a 50 day moving average price of $31.71 and a 200 day moving average price of $32.74. The company has a quick ratio of 2.19, a current ratio of 3.66 and a debt-to-equity ratio of 0.76. The stock has a market cap of $2.41 billion, a PE ratio of 22.67 and a beta of 0.78.

Analyst Ratings Changes

Several research analysts have recently weighed in on CENTA shares. JPMorgan Chase & Co. reduced their target price on Central Garden & Pet from $34.00 to $32.00 and set a "neutral" rating for the company in a research note on Friday, October 11th. StockNews.com downgraded shares of Central Garden & Pet from a "buy" rating to a "hold" rating in a report on Wednesday, October 16th. Two research analysts have rated the stock with a hold rating, two have assigned a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus price target of $41.33.

Get Our Latest Stock Report on Central Garden & Pet

Central Garden & Pet Profile

(

Free Report)

Central Garden & Pet Company produces and distributes various products for the lawn and garden, and pet supplies markets in the United States. It operates through two segments: Pet and Garden. The Pet segment provides dog and cat supplies, such as dog treats and chews, toys, pet beds and containment, grooming products, waste management, and training pads; supplies for aquatics, small animals, reptiles, and pet birds, including toys, cages and habitats, bedding, and food and supplements; products for equine and livestock; animal and household health and insect control products; aquariums and terrariums, including fixtures and stands, water conditioners and supplements, water pumps and filters, and lighting systems and accessories; and live fish and small animals, as well as outdoor cushions.

Read More

Before you consider Central Garden & Pet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Central Garden & Pet wasn't on the list.

While Central Garden & Pet currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.