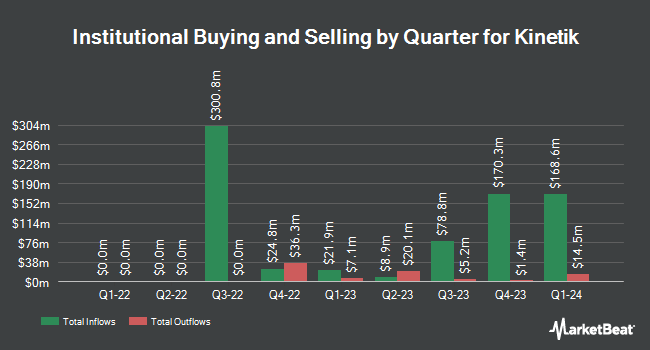

Y Intercept Hong Kong Ltd lessened its position in Kinetik Holdings Inc. (NASDAQ:KNTK - Free Report) by 77.3% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 6,723 shares of the company's stock after selling 22,905 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in Kinetik were worth $381,000 at the end of the most recent reporting period.

Other large investors have also recently made changes to their positions in the company. Fifth Third Bancorp purchased a new stake in shares of Kinetik in the fourth quarter worth approximately $26,000. GAMMA Investing LLC increased its stake in Kinetik by 72.0% in the fourth quarter. GAMMA Investing LLC now owns 509 shares of the company's stock worth $29,000 after purchasing an additional 213 shares during the period. Ashton Thomas Securities LLC bought a new stake in shares of Kinetik during the third quarter worth $46,000. Covestor Ltd boosted its stake in shares of Kinetik by 13,790.0% during the third quarter. Covestor Ltd now owns 4,167 shares of the company's stock valued at $189,000 after purchasing an additional 4,137 shares during the period. Finally, Bright Futures Wealth Management LLC. bought a new position in shares of Kinetik in the fourth quarter worth about $189,000. 21.11% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms have issued reports on KNTK. JPMorgan Chase & Co. boosted their price objective on shares of Kinetik from $63.00 to $65.00 and gave the company an "overweight" rating in a research report on Wednesday, January 15th. Scotiabank decreased their target price on Kinetik from $64.00 to $62.00 and set a "sector outperform" rating for the company in a research report on Tuesday, January 21st. Barclays increased their price target on Kinetik from $47.00 to $61.00 and gave the stock an "equal weight" rating in a research report on Monday, January 13th. Wells Fargo & Company decreased their price objective on Kinetik from $60.00 to $58.00 and set an "equal weight" rating for the company in a report on Friday, February 28th. Finally, Citigroup upped their price objective on shares of Kinetik from $54.00 to $58.00 and gave the stock a "neutral" rating in a research note on Monday, December 16th. Three analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $59.00.

Get Our Latest Report on KNTK

Kinetik Stock Down 1.5 %

Shares of Kinetik stock traded down $0.84 on Wednesday, reaching $54.04. The stock had a trading volume of 1,390,974 shares, compared to its average volume of 582,994. Kinetik Holdings Inc. has a 1 year low of $34.27 and a 1 year high of $67.60. The company has a 50 day moving average price of $61.00 and a 200 day moving average price of $54.37. The stock has a market capitalization of $8.51 billion, a P/E ratio of 19.94, a P/E/G ratio of 1.52 and a beta of 2.89.

Kinetik Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, February 12th. Stockholders of record on Monday, February 3rd were given a $0.78 dividend. The ex-dividend date of this dividend was Monday, February 3rd. This represents a $3.12 dividend on an annualized basis and a dividend yield of 5.77%. Kinetik's payout ratio is 305.88%.

Kinetik Profile

(

Free Report)

Kinetik Holdings Inc operates as a midstream company in the Texas Delaware Basin. The company operates through two segments, Midstream Logistics and Pipeline Transportation. It provides gathering, transportation, compression, processing, stabilization, treating, storage, and transportation services for companies that produce natural gas, natural gas liquids, and crude oil; and water gathering and disposal services.

Featured Stories

Before you consider Kinetik, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinetik wasn't on the list.

While Kinetik currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.