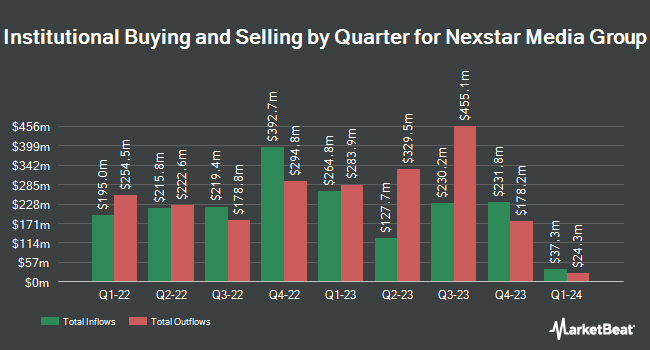

Y Intercept Hong Kong Ltd purchased a new position in Nexstar Media Group, Inc. (NASDAQ:NXST - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 4,967 shares of the company's stock, valued at approximately $821,000.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in NXST. Dimensional Fund Advisors LP increased its position in shares of Nexstar Media Group by 4.9% during the second quarter. Dimensional Fund Advisors LP now owns 1,326,476 shares of the company's stock valued at $220,189,000 after acquiring an additional 62,331 shares in the last quarter. Charles Schwab Investment Management Inc. increased its holdings in shares of Nexstar Media Group by 0.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,083,451 shares of the company's stock worth $179,149,000 after purchasing an additional 7,117 shares in the last quarter. Copeland Capital Management LLC increased its holdings in shares of Nexstar Media Group by 18.1% in the 3rd quarter. Copeland Capital Management LLC now owns 547,728 shares of the company's stock worth $90,567,000 after purchasing an additional 83,829 shares in the last quarter. Bank of New York Mellon Corp lifted its holdings in shares of Nexstar Media Group by 0.5% during the second quarter. Bank of New York Mellon Corp now owns 418,815 shares of the company's stock valued at $69,528,000 after purchasing an additional 2,145 shares in the last quarter. Finally, Van Lanschot Kempen Investment Management N.V. lifted its holdings in shares of Nexstar Media Group by 4.7% during the second quarter. Van Lanschot Kempen Investment Management N.V. now owns 201,940 shares of the company's stock valued at $33,524,000 after purchasing an additional 9,084 shares in the last quarter. Institutional investors own 95.30% of the company's stock.

Nexstar Media Group Stock Performance

Shares of NXST stock traded down $0.40 during mid-day trading on Friday, reaching $164.60. 455,016 shares of the company's stock traded hands, compared to its average volume of 327,648. The company has a debt-to-equity ratio of 2.98, a quick ratio of 1.68 and a current ratio of 1.68. The firm has a market capitalization of $5.11 billion, a PE ratio of 9.52, a price-to-earnings-growth ratio of 0.20 and a beta of 1.45. Nexstar Media Group, Inc. has a 12 month low of $147.25 and a 12 month high of $191.86. The firm has a 50 day moving average price of $170.11 and a two-hundred day moving average price of $167.39.

Nexstar Media Group (NASDAQ:NXST - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported $5.27 EPS for the quarter, missing analysts' consensus estimates of $5.51 by ($0.24). Nexstar Media Group had a return on equity of 26.03% and a net margin of 11.39%. The company had revenue of $1.37 billion during the quarter, compared to analysts' expectations of $1.37 billion. During the same quarter in the previous year, the company earned $0.70 EPS. The business's quarterly revenue was up 20.7% compared to the same quarter last year. On average, research analysts forecast that Nexstar Media Group, Inc. will post 24.53 EPS for the current year.

Nexstar Media Group Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, November 29th. Shareholders of record on Friday, November 15th were issued a dividend of $1.69 per share. This represents a $6.76 annualized dividend and a yield of 4.11%. The ex-dividend date of this dividend was Friday, November 15th. Nexstar Media Group's dividend payout ratio is currently 39.10%.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on NXST shares. Benchmark reiterated a "buy" rating and issued a $215.00 price objective on shares of Nexstar Media Group in a report on Friday, November 8th. StockNews.com raised shares of Nexstar Media Group from a "hold" rating to a "buy" rating in a report on Friday, November 8th. Barrington Research restated an "outperform" rating and set a $200.00 price objective on shares of Nexstar Media Group in a research report on Thursday, November 7th. Loop Capital downgraded shares of Nexstar Media Group from a "buy" rating to a "hold" rating and cut their target price for the stock from $200.00 to $190.00 in a research report on Friday, November 8th. Finally, Guggenheim lowered their price target on Nexstar Media Group from $200.00 to $198.00 and set a "buy" rating on the stock in a report on Friday, October 4th. One analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat, Nexstar Media Group presently has a consensus rating of "Moderate Buy" and a consensus price target of $204.29.

View Our Latest Stock Analysis on NXST

Insider Buying and Selling at Nexstar Media Group

In other news, Director D Geoffrey Armstrong sold 2,000 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $166.38, for a total value of $332,760.00. Following the transaction, the director now directly owns 7,250 shares in the company, valued at $1,206,255. The trade was a 21.62 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Perry A. Sook sold 12,239 shares of the business's stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $190.28, for a total value of $2,328,836.92. Following the completion of the transaction, the chief executive officer now directly owns 674,694 shares in the company, valued at approximately $128,380,774.32. This represents a 1.78 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 45,798 shares of company stock valued at $7,989,464 over the last 90 days. 6.30% of the stock is currently owned by corporate insiders.

About Nexstar Media Group

(

Free Report)

Nexstar Media Group, Inc operates as a diversified media company that produces and distributes engaging local and national news, sports and entertainment content across the television and digital platforms in the United States. It owns, operates, programs, or provides sales and other services to various markets; and offers television programming services.

Featured Stories

Before you consider Nexstar Media Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nexstar Media Group wasn't on the list.

While Nexstar Media Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.