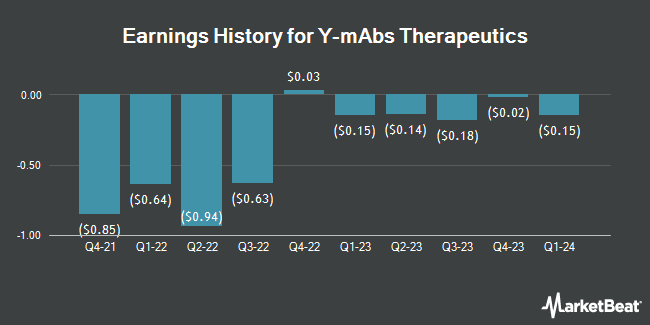

Y-mAbs Therapeutics (NASDAQ:YMAB - Get Free Report) released its earnings results on Friday. The company reported ($0.16) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.14) by ($0.02), RTT News reports. The business had revenue of $18.46 million during the quarter, compared to analysts' expectations of $23.38 million. Y-mAbs Therapeutics had a negative net margin of 28.44% and a negative return on equity of 24.88%. During the same quarter in the previous year, the company earned ($0.18) EPS. Y-mAbs Therapeutics updated its FY 2024 guidance to EPS.

Y-mAbs Therapeutics Price Performance

Shares of NASDAQ:YMAB traded down $0.07 during trading on Friday, reaching $15.48. The stock had a trading volume of 580,428 shares, compared to its average volume of 330,577. Y-mAbs Therapeutics has a 52 week low of $4.69 and a 52 week high of $20.90. The business's 50-day moving average price is $14.11 and its 200 day moving average price is $13.17. The stock has a market capitalization of $689.94 million, a PE ratio of -27.64 and a beta of 0.68.

Insider Buying and Selling

In related news, insider Thomas Gad sold 65,000 shares of the business's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $13.47, for a total value of $875,550.00. Following the completion of the transaction, the insider now owns 97,681 shares in the company, valued at $1,315,763.07. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In other Y-mAbs Therapeutics news, COO Joris Wilms sold 5,000 shares of Y-mAbs Therapeutics stock in a transaction on Monday, August 26th. The shares were sold at an average price of $14.69, for a total transaction of $73,450.00. Following the completion of the sale, the chief operating officer now owns 30,600 shares of the company's stock, valued at approximately $449,514. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Thomas Gad sold 65,000 shares of Y-mAbs Therapeutics stock in a transaction on Friday, September 13th. The stock was sold at an average price of $13.47, for a total transaction of $875,550.00. Following the sale, the insider now directly owns 97,681 shares of the company's stock, valued at $1,315,763.07. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 100,000 shares of company stock worth $1,338,100 in the last quarter. Insiders own 22.50% of the company's stock.

Analyst Ratings Changes

Several research firms have weighed in on YMAB. Wedbush restated an "outperform" rating and set a $23.00 target price on shares of Y-mAbs Therapeutics in a report on Tuesday, September 10th. BMO Capital Markets lowered their price target on Y-mAbs Therapeutics from $26.00 to $25.00 and set an "outperform" rating on the stock in a research report on Tuesday, August 13th. HC Wainwright reaffirmed a "buy" rating and issued a $22.00 price target on shares of Y-mAbs Therapeutics in a research report on Tuesday, August 13th. Canaccord Genuity Group raised Y-mAbs Therapeutics to a "strong-buy" rating in a research report on Tuesday, August 13th. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $20.00 price target on shares of Y-mAbs Therapeutics in a research report on Monday, September 9th. One equities research analyst has rated the stock with a sell rating, six have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $21.14.

Get Our Latest Stock Report on YMAB

About Y-mAbs Therapeutics

(

Get Free Report)

Y-mAbs Therapeutics, Inc, a commercial-stage biopharmaceutical company, focuses on the development and commercialization of antibody based therapeutic products for the treatment of cancer in the United States and internationally. It offers DANYELZA, a monoclonal antibody in combination with granulocyte-macrophage colony-stimulating factor for the treatment of pediatric patients with relapsed or refractory high-risk neuroblastoma in the bone or bone marrow.

Featured Stories

Before you consider Y-mAbs Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Y-mAbs Therapeutics wasn't on the list.

While Y-mAbs Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.