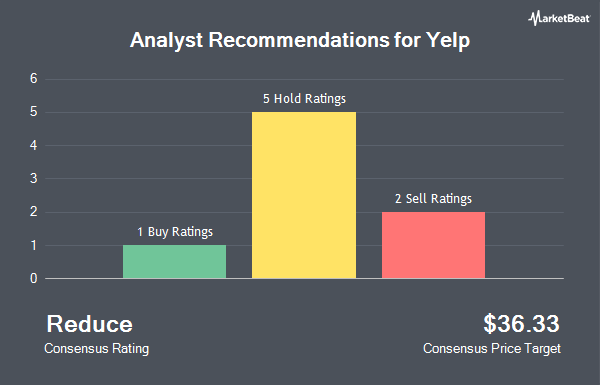

Yelp Inc. (NYSE:YELP - Get Free Report) has earned a consensus rating of "Reduce" from the nine analysts that are covering the firm, MarketBeat Ratings reports. Two research analysts have rated the stock with a sell rating, six have issued a hold rating and one has issued a buy rating on the company. The average 12-month target price among brokers that have issued ratings on the stock in the last year is $37.00.

Several equities analysts have commented on the company. Bank of America started coverage on Yelp in a report on Monday, September 16th. They set an "underperform" rating and a $30.00 price target on the stock. JPMorgan Chase & Co. reduced their price target on shares of Yelp from $38.00 to $35.00 and set a "neutral" rating for the company in a report on Monday, August 12th. Evercore ISI upgraded shares of Yelp to a "hold" rating in a research note on Monday. The Goldman Sachs Group lowered Yelp from a "buy" rating to a "neutral" rating and decreased their price objective for the stock from $46.00 to $38.00 in a report on Monday, October 14th. Finally, StockNews.com upgraded shares of Yelp from a "buy" rating to a "strong-buy" rating in a research note on Monday.

Get Our Latest Analysis on Yelp

Insider Activity

In other news, COO Joseph R. Nachman sold 7,000 shares of the company's stock in a transaction dated Friday, October 4th. The stock was sold at an average price of $34.02, for a total value of $238,140.00. Following the completion of the sale, the chief operating officer now directly owns 255,558 shares of the company's stock, valued at $8,694,083.16. This represents a 2.67 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, insider Carmen Amara sold 12,854 shares of Yelp stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $38.17, for a total transaction of $490,637.18. Following the transaction, the insider now directly owns 88,813 shares in the company, valued at $3,389,992.21. The trade was a 12.64 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 30,630 shares of company stock valued at $1,105,937. 7.40% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Yelp

Institutional investors have recently modified their holdings of the business. Millennium Management LLC lifted its stake in Yelp by 1,089.2% in the second quarter. Millennium Management LLC now owns 188,371 shares of the local business review company's stock valued at $6,960,000 after buying an additional 172,531 shares in the last quarter. Robeco Institutional Asset Management B.V. lifted its position in Yelp by 114.3% in the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 279,180 shares of the local business review company's stock valued at $9,794,000 after acquiring an additional 148,917 shares in the last quarter. Barclays PLC boosted its stake in Yelp by 347.9% in the 3rd quarter. Barclays PLC now owns 160,363 shares of the local business review company's stock worth $5,627,000 after purchasing an additional 124,561 shares during the period. Pacer Advisors Inc. raised its stake in shares of Yelp by 4.3% in the 2nd quarter. Pacer Advisors Inc. now owns 2,695,536 shares of the local business review company's stock valued at $99,600,000 after purchasing an additional 111,936 shares during the period. Finally, Bridgewater Associates LP grew its holdings in shares of Yelp by 136.5% during the third quarter. Bridgewater Associates LP now owns 181,622 shares of the local business review company's stock worth $6,371,000 after buying an additional 104,839 shares in the last quarter. Institutional investors own 90.11% of the company's stock.

Yelp Price Performance

Yelp stock traded down $0.47 during midday trading on Friday, reaching $35.96. The stock had a trading volume of 577,239 shares, compared to its average volume of 729,092. Yelp has a twelve month low of $32.56 and a twelve month high of $48.99. The firm has a market cap of $2.41 billion, a price-to-earnings ratio of 21.53, a PEG ratio of 0.68 and a beta of 1.33. The firm's fifty day simple moving average is $34.58 and its two-hundred day simple moving average is $35.65.

About Yelp

(

Get Free ReportYelp Inc operates a platform that connects consumers with local businesses in the United States and internationally. The company's platform covers various categories, including restaurants, shopping, beauty and fitness, health, and other categories, as well as home, local, auto, professional, pets, events, real estate, and financial services.

Featured Articles

Before you consider Yelp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yelp wasn't on the list.

While Yelp currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.