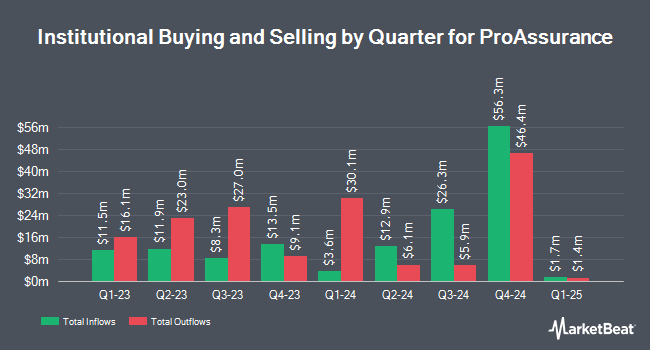

Zacks Investment Management bought a new position in ProAssurance Co. (NYSE:PRA - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 341,785 shares of the insurance provider's stock, valued at approximately $5,140,000. Zacks Investment Management owned about 0.67% of ProAssurance as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other large investors have also made changes to their positions in the company. Commonwealth Equity Services LLC increased its stake in shares of ProAssurance by 2.5% in the 2nd quarter. Commonwealth Equity Services LLC now owns 32,346 shares of the insurance provider's stock worth $395,000 after purchasing an additional 800 shares in the last quarter. Arizona State Retirement System increased its position in ProAssurance by 8.1% in the second quarter. Arizona State Retirement System now owns 15,136 shares of the insurance provider's stock worth $185,000 after buying an additional 1,128 shares in the last quarter. The Manufacturers Life Insurance Company raised its stake in shares of ProAssurance by 7.8% in the second quarter. The Manufacturers Life Insurance Company now owns 21,106 shares of the insurance provider's stock worth $258,000 after buying an additional 1,521 shares during the period. Price T Rowe Associates Inc. MD lifted its position in shares of ProAssurance by 3.8% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 44,323 shares of the insurance provider's stock valued at $570,000 after buying an additional 1,619 shares in the last quarter. Finally, Jacobs Levy Equity Management Inc. grew its stake in shares of ProAssurance by 0.3% during the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 587,901 shares of the insurance provider's stock valued at $8,842,000 after acquiring an additional 1,738 shares during the period. 85.58% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have weighed in on PRA shares. Truist Financial lifted their price target on shares of ProAssurance from $14.00 to $18.00 and gave the company a "hold" rating in a report on Tuesday, November 12th. StockNews.com downgraded shares of ProAssurance from a "buy" rating to a "hold" rating in a report on Tuesday, November 19th. Finally, Piper Sandler cut ProAssurance from an "overweight" rating to a "neutral" rating and set a $18.00 price target on the stock. in a report on Monday, November 11th.

Check Out Our Latest Research Report on PRA

ProAssurance Price Performance

Shares of NYSE:PRA traded down $0.33 during midday trading on Friday, reaching $16.90. 153,621 shares of the company were exchanged, compared to its average volume of 241,180. The stock has a market cap of $864.60 million, a PE ratio of 20.36 and a beta of 0.28. The business's fifty day moving average is $15.82 and its two-hundred day moving average is $13.94. ProAssurance Co. has a one year low of $10.76 and a one year high of $17.79. The company has a current ratio of 0.28, a quick ratio of 0.28 and a debt-to-equity ratio of 0.35.

ProAssurance Profile

(

Free Report)

ProAssurance Corporation, through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States. The company operates through Specialty Property and Casualty, Workers' Compensation Insurance, and Segregated Portfolio Cell Reinsurance segments. It offers professional liability insurance to healthcare providers and institutions, and attorneys and their firms; medical technology liability insurance to medical technology and life sciences companies; and custom alternative risk solutions, including assumed reinsurance, loss portfolio transfers, and captive cell programs for healthcare professional liability insureds.

Featured Articles

Before you consider ProAssurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProAssurance wasn't on the list.

While ProAssurance currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.