Zacks Investment Management raised its stake in shares of e.l.f. Beauty, Inc. (NYSE:ELF - Free Report) by 14.3% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 112,368 shares of the company's stock after buying an additional 14,041 shares during the period. Zacks Investment Management owned 0.20% of e.l.f. Beauty worth $12,251,000 at the end of the most recent quarter.

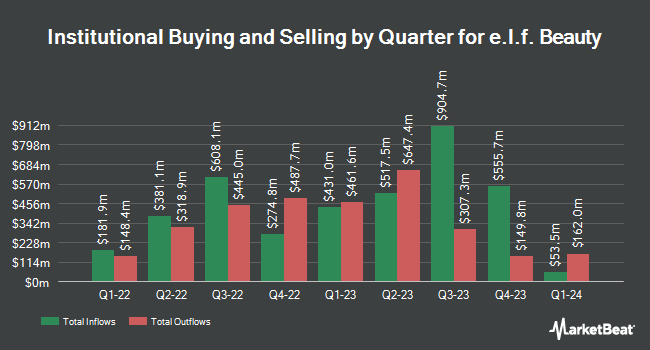

Other institutional investors and hedge funds also recently made changes to their positions in the company. Baillie Gifford & Co. bought a new stake in shares of e.l.f. Beauty during the 2nd quarter worth $801,693,000. Champlain Investment Partners LLC acquired a new stake in shares of e.l.f. Beauty in the third quarter valued at about $121,558,000. Swedbank AB bought a new position in shares of e.l.f. Beauty in the third quarter worth about $76,321,000. Clearbridge Investments LLC lifted its position in shares of e.l.f. Beauty by 84.4% during the 2nd quarter. Clearbridge Investments LLC now owns 1,259,644 shares of the company's stock worth $265,432,000 after purchasing an additional 576,383 shares during the last quarter. Finally, Thrivent Financial for Lutherans lifted its position in shares of e.l.f. Beauty by 223.2% during the 3rd quarter. Thrivent Financial for Lutherans now owns 555,287 shares of the company's stock worth $60,543,000 after purchasing an additional 383,478 shares during the last quarter. Institutional investors and hedge funds own 92.44% of the company's stock.

Insider Activity

In other e.l.f. Beauty news, Director Maureen C. Watson sold 785 shares of the stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $130.00, for a total transaction of $102,050.00. Following the sale, the director now owns 1,888 shares of the company's stock, valued at $245,440. This represents a 29.37 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 3.50% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

A number of analysts have issued reports on the company. Canaccord Genuity Group lowered their target price on e.l.f. Beauty from $250.00 to $200.00 and set a "buy" rating on the stock in a report on Thursday, November 7th. Piper Sandler restated an "overweight" rating and issued a $165.00 price objective (up previously from $162.00) on shares of e.l.f. Beauty in a research note on Thursday, November 7th. Truist Financial cut their target price on shares of e.l.f. Beauty from $210.00 to $130.00 and set a "buy" rating for the company in a research note on Wednesday, October 16th. Bank of America decreased their price target on shares of e.l.f. Beauty from $190.00 to $165.00 and set a "buy" rating on the stock in a research report on Tuesday, October 15th. Finally, TD Cowen dropped their price objective on shares of e.l.f. Beauty from $235.00 to $150.00 and set a "buy" rating on the stock in a report on Thursday, September 12th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating, twelve have assigned a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $173.53.

Read Our Latest Stock Report on e.l.f. Beauty

e.l.f. Beauty Price Performance

ELF stock traded up $8.37 during trading on Friday, hitting $139.60. The company had a trading volume of 2,648,336 shares, compared to its average volume of 3,198,737. The company has a fifty day moving average price of $115.83 and a two-hundred day moving average price of $150.48. e.l.f. Beauty, Inc. has a fifty-two week low of $98.50 and a fifty-two week high of $221.83. The company has a market cap of $7.86 billion, a P/E ratio of 75.46, a P/E/G ratio of 2.99 and a beta of 1.49. The company has a current ratio of 1.78, a quick ratio of 1.01 and a debt-to-equity ratio of 0.22.

e.l.f. Beauty (NYSE:ELF - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported $0.77 EPS for the quarter, beating the consensus estimate of $0.43 by $0.34. e.l.f. Beauty had a net margin of 8.87% and a return on equity of 19.34%. The company had revenue of $301.10 million for the quarter, compared to the consensus estimate of $289.43 million. During the same quarter in the previous year, the company earned $0.66 EPS. The firm's revenue for the quarter was up 39.7% compared to the same quarter last year. Equities research analysts expect that e.l.f. Beauty, Inc. will post 2.8 earnings per share for the current fiscal year.

e.l.f. Beauty Profile

(

Free Report)

e.l.f. Beauty, Inc, together with its subsidiaries, provides cosmetic and skin care products under the e.l.f. Cosmetics, e.l.f. Skin, Well People, and Keys Soulcare brand names worldwide. The company offers eye, lip, face, face, paw, and skin care products. It sells its products through national and international retailers and direct-to-consumer channels, which include e-commerce platforms in the United States, and internationally primarily through distributors.

Recommended Stories

Before you consider e.l.f. Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and e.l.f. Beauty wasn't on the list.

While e.l.f. Beauty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.