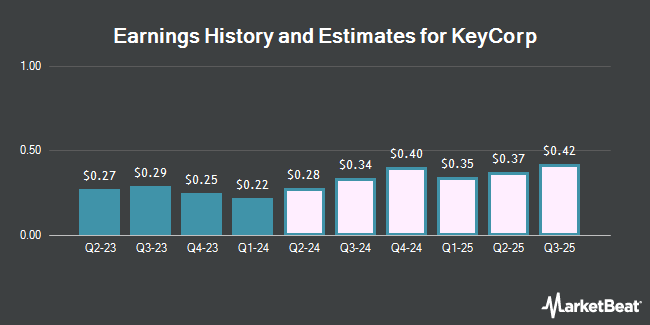

KeyCorp (NYSE:KEY - Free Report) - Equities researchers at Zacks Research raised their FY2024 earnings estimates for KeyCorp in a report released on Thursday, December 12th. Zacks Research analyst R. Department now expects that the financial services provider will post earnings per share of $1.09 for the year, up from their previous forecast of $1.08. The consensus estimate for KeyCorp's current full-year earnings is $1.09 per share. Zacks Research also issued estimates for KeyCorp's Q3 2025 earnings at $0.40 EPS, FY2025 earnings at $1.53 EPS and FY2026 earnings at $1.74 EPS.

KeyCorp (NYSE:KEY - Get Free Report) last issued its quarterly earnings data on Thursday, October 17th. The financial services provider reported $0.30 EPS for the quarter, topping analysts' consensus estimates of $0.27 by $0.03. KeyCorp had a return on equity of 8.24% and a net margin of 0.76%. The firm had revenue of $1.60 billion during the quarter, compared to the consensus estimate of $1.59 billion.

Other analysts have also issued reports about the stock. UBS Group increased their price target on shares of KeyCorp from $17.00 to $18.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 23rd. DA Davidson lifted their price target on KeyCorp from $19.00 to $20.00 and gave the company a "buy" rating in a report on Monday, October 21st. Evercore ISI increased their price objective on KeyCorp from $18.50 to $20.00 and gave the stock an "outperform" rating in a report on Wednesday, October 2nd. Jefferies Financial Group lifted their target price on shares of KeyCorp from $18.00 to $19.00 and gave the company a "buy" rating in a research note on Monday, August 19th. Finally, Robert W. Baird lowered shares of KeyCorp from an "outperform" rating to a "neutral" rating and dropped their price target for the stock from $18.00 to $17.00 in a research note on Monday, October 14th. Nine equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $19.16.

Check Out Our Latest Report on KeyCorp

KeyCorp Price Performance

NYSE:KEY traded up $0.07 during trading hours on Monday, reaching $18.20. 10,794,473 shares of the company's stock were exchanged, compared to its average volume of 13,462,240. KeyCorp has a 12 month low of $12.94 and a 12 month high of $20.04. The business's 50-day simple moving average is $18.24 and its two-hundred day simple moving average is $16.39. The company has a market capitalization of $18.04 billion, a P/E ratio of 1,823.00, a price-to-earnings-growth ratio of 1.00 and a beta of 1.25. The company has a quick ratio of 0.88, a current ratio of 0.88 and a debt-to-equity ratio of 1.09.

Institutional Investors Weigh In On KeyCorp

A number of institutional investors and hedge funds have recently made changes to their positions in KEY. Wealth Enhancement Advisory Services LLC raised its position in shares of KeyCorp by 4.2% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 81,879 shares of the financial services provider's stock valued at $1,164,000 after acquiring an additional 3,306 shares during the last quarter. Envestnet Portfolio Solutions Inc. boosted its holdings in KeyCorp by 3.4% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 58,601 shares of the financial services provider's stock worth $833,000 after buying an additional 1,927 shares during the last quarter. Blue Trust Inc. grew its position in shares of KeyCorp by 37.9% during the 2nd quarter. Blue Trust Inc. now owns 23,171 shares of the financial services provider's stock worth $329,000 after buying an additional 6,365 shares during the period. Brookstone Capital Management bought a new stake in shares of KeyCorp in the 2nd quarter valued at about $145,000. Finally, Raymond James & Associates increased its stake in shares of KeyCorp by 9.5% in the 2nd quarter. Raymond James & Associates now owns 1,457,354 shares of the financial services provider's stock valued at $20,709,000 after acquiring an additional 126,404 shares during the last quarter. Institutional investors own 79.69% of the company's stock.

Insider Activity

In other KeyCorp news, insider Angela G. Mago sold 15,011 shares of the business's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $19.59, for a total value of $294,065.49. Following the completion of the transaction, the insider now directly owns 234,582 shares of the company's stock, valued at approximately $4,595,461.38. The trade was a 6.01 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, Director Carlton L. Highsmith sold 9,000 shares of the company's stock in a transaction that occurred on Tuesday, November 5th. The stock was sold at an average price of $17.14, for a total transaction of $154,260.00. Following the transaction, the director now owns 37,864 shares in the company, valued at $648,988.96. The trade was a 19.20 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.61% of the stock is currently owned by corporate insiders.

KeyCorp Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, December 13th. Stockholders of record on Tuesday, December 3rd were issued a dividend of $0.205 per share. This represents a $0.82 annualized dividend and a dividend yield of 4.51%. The ex-dividend date was Tuesday, December 3rd. KeyCorp's payout ratio is 8,200.00%.

About KeyCorp

(

Get Free Report)

KeyCorp operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States. It operates in two segments, Consumer Bank and Commercial Bank. The company offers various deposits, investment products and services; commercial leasing, investment management, consumer finance; and personal finance and financial wellness, student loan refinancing, mortgage and home equity, lending, credit card, treasury, business advisory, wealth management, asset management, cash management, portfolio management, and trust and related services to individuals and small and medium-sized businesses.

Featured Stories

Before you consider KeyCorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KeyCorp wasn't on the list.

While KeyCorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.