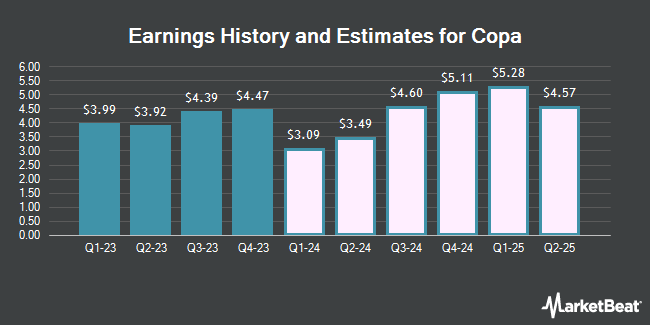

Copa Holdings, S.A. (NYSE:CPA - Free Report) - Equities researchers at Zacks Research increased their Q4 2024 earnings estimates for Copa in a research report issued on Wednesday, December 4th. Zacks Research analyst M. Basu now expects that the transportation company will earn $4.07 per share for the quarter, up from their previous estimate of $4.02. The consensus estimate for Copa's current full-year earnings is $14.50 per share. Zacks Research also issued estimates for Copa's Q3 2025 earnings at $3.49 EPS, Q4 2025 earnings at $2.97 EPS, FY2025 earnings at $14.66 EPS and Q1 2026 earnings at $4.32 EPS.

Copa (NYSE:CPA - Get Free Report) last issued its earnings results on Wednesday, November 20th. The transportation company reported $3.50 earnings per share for the quarter, beating analysts' consensus estimates of $3.48 by $0.02. The firm had revenue of $854.71 million for the quarter, compared to analysts' expectations of $864.90 million. Copa had a return on equity of 28.46% and a net margin of 18.20%. The firm's revenue for the quarter was down 1.5% compared to the same quarter last year. During the same quarter last year, the firm earned $4.39 earnings per share.

CPA has been the topic of a number of other research reports. Evercore ISI reduced their price objective on Copa from $165.00 to $150.00 and set an "outperform" rating on the stock in a research note on Thursday, August 8th. TD Cowen decreased their target price on Copa from $145.00 to $130.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Deutsche Bank Aktiengesellschaft dropped their price target on Copa from $145.00 to $130.00 and set a "buy" rating on the stock in a research report on Thursday, August 8th. StockNews.com downgraded Copa from a "buy" rating to a "hold" rating in a report on Monday, November 25th. Finally, JPMorgan Chase & Co. lowered their price objective on Copa from $180.00 to $175.00 and set an "overweight" rating for the company in a research note on Thursday, August 29th. One research analyst has rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Buy" and a consensus price target of $148.83.

Check Out Our Latest Report on CPA

Copa Stock Performance

Shares of NYSE:CPA remained flat at $89.63 during trading on Friday. The stock had a trading volume of 341,659 shares, compared to its average volume of 289,375. The company has a 50-day moving average price of $97.10 and a 200-day moving average price of $94.17. The firm has a market capitalization of $3.53 billion, a price-to-earnings ratio of 5.95, a price-to-earnings-growth ratio of 0.71 and a beta of 1.45. Copa has a 1-year low of $80.01 and a 1-year high of $114.00. The company has a debt-to-equity ratio of 0.56, a quick ratio of 0.99 and a current ratio of 1.09.

Copa Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Monday, December 2nd will be given a dividend of $1.61 per share. This represents a $6.44 annualized dividend and a yield of 7.19%. The ex-dividend date of this dividend is Monday, December 2nd. Copa's payout ratio is presently 42.59%.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the company. Hexagon Capital Partners LLC boosted its stake in shares of Copa by 14.9% in the 2nd quarter. Hexagon Capital Partners LLC now owns 892 shares of the transportation company's stock valued at $85,000 after purchasing an additional 116 shares in the last quarter. Bell Investment Advisors Inc grew its position in shares of Copa by 29.6% in the 3rd quarter. Bell Investment Advisors Inc now owns 626 shares of the transportation company's stock valued at $59,000 after purchasing an additional 143 shares during the period. Carson Advisory Inc. lifted its position in Copa by 9.1% in the 2nd quarter. Carson Advisory Inc. now owns 3,696 shares of the transportation company's stock valued at $352,000 after acquiring an additional 308 shares in the last quarter. Quantinno Capital Management LP boosted its position in Copa by 10.3% during the third quarter. Quantinno Capital Management LP now owns 5,219 shares of the transportation company's stock valued at $490,000 after purchasing an additional 488 shares during the last quarter. Finally, Bank of New York Mellon Corp lifted its stake in Copa by 15.1% in the second quarter. Bank of New York Mellon Corp now owns 4,336 shares of the transportation company's stock valued at $413,000 after acquiring an additional 569 shares during the last quarter. 70.09% of the stock is currently owned by institutional investors and hedge funds.

Copa Company Profile

(

Get Free Report)

Copa Holdings, SA, through its subsidiaries, provides airline passenger and cargo services. The company offers approximately 375 daily scheduled flights to 82 destinations in 32 countries in North, Central, and South America, as well as the Caribbean from its Panama City hub. As of December 31, 2023, it operated a fleet of 106 aircraft comprising 76 Boeing 737-Next Generation aircraft, 29 Boeing 737 MAX 9 aircraft, and one Boeing 737-800 Boeing Converted Freighter.

Featured Stories

Before you consider Copa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Copa wasn't on the list.

While Copa currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.