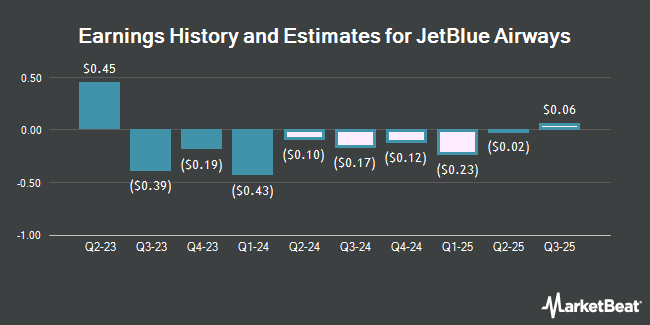

JetBlue Airways Co. (NASDAQ:JBLU - Free Report) - Equities research analysts at Zacks Research increased their Q2 2026 earnings estimates for JetBlue Airways in a research report issued to clients and investors on Tuesday, November 12th. Zacks Research analyst M. Basu now anticipates that the transportation company will earn $0.18 per share for the quarter, up from their previous forecast of $0.16. The consensus estimate for JetBlue Airways' current full-year earnings is ($0.94) per share. Zacks Research also issued estimates for JetBlue Airways' FY2026 earnings at $0.32 EPS.

Other research analysts have also issued reports about the company. Evercore ISI lifted their target price on JetBlue Airways from $4.00 to $5.00 and gave the stock an "in-line" rating in a report on Thursday, October 3rd. StockNews.com upgraded shares of JetBlue Airways to a "sell" rating in a report on Thursday, November 7th. Barclays increased their target price on shares of JetBlue Airways from $5.00 to $7.00 and gave the company an "underweight" rating in a research note on Thursday. Bank of America upgraded shares of JetBlue Airways from an "underperform" rating to a "neutral" rating and lifted their price target for the stock from $3.00 to $6.00 in a research report on Monday, September 9th. Finally, Susquehanna increased their price objective on JetBlue Airways from $6.00 to $7.00 and gave the company a "neutral" rating in a research report on Wednesday, October 9th. Three analysts have rated the stock with a sell rating, six have given a hold rating and one has issued a buy rating to the company. According to MarketBeat, JetBlue Airways has an average rating of "Hold" and a consensus target price of $6.53.

Read Our Latest Stock Analysis on JBLU

JetBlue Airways Price Performance

Shares of JBLU stock traded up $0.17 during mid-day trading on Thursday, hitting $7.11. 16,816,821 shares of the stock traded hands, compared to its average volume of 15,773,219. The company has a debt-to-equity ratio of 2.98, a quick ratio of 1.18 and a current ratio of 1.21. The firm has a market cap of $2.47 billion, a price-to-earnings ratio of -2.81 and a beta of 1.92. The company's 50-day simple moving average is $6.40 and its 200-day simple moving average is $5.89. JetBlue Airways has a twelve month low of $4.09 and a twelve month high of $8.07.

JetBlue Airways (NASDAQ:JBLU - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The transportation company reported ($0.16) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.26) by $0.10. JetBlue Airways had a negative net margin of 9.17% and a negative return on equity of 8.35%. The business had revenue of $2.37 billion during the quarter, compared to analysts' expectations of $2.36 billion. During the same period last year, the firm posted ($0.39) earnings per share. The business's revenue was up .5% on a year-over-year basis.

Institutional Investors Weigh In On JetBlue Airways

A number of institutional investors have recently bought and sold shares of JBLU. Allspring Global Investments Holdings LLC purchased a new position in shares of JetBlue Airways during the 1st quarter valued at $25,000. Texas Permanent School Fund Corp increased its position in JetBlue Airways by 1.4% in the 1st quarter. Texas Permanent School Fund Corp now owns 291,021 shares of the transportation company's stock worth $2,159,000 after purchasing an additional 4,157 shares during the last quarter. SG Americas Securities LLC purchased a new stake in shares of JetBlue Airways during the 1st quarter worth about $1,285,000. ProShare Advisors LLC lifted its holdings in shares of JetBlue Airways by 7.4% during the 1st quarter. ProShare Advisors LLC now owns 67,717 shares of the transportation company's stock valued at $502,000 after buying an additional 4,663 shares during the last quarter. Finally, State Board of Administration of Florida Retirement System increased its holdings in JetBlue Airways by 208.0% in the first quarter. State Board of Administration of Florida Retirement System now owns 391,614 shares of the transportation company's stock worth $2,851,000 after buying an additional 264,460 shares during the last quarter. 83.71% of the stock is currently owned by institutional investors and hedge funds.

JetBlue Airways Company Profile

(

Get Free Report)

JetBlue Airways Corporation provides air transportation services. The company operates a fleet of Airbus A321, Airbus A220, Airbus A321neo, Airbus A320 Restyled, Airbus A320, Airbus A321 with Mint, Airbus A321neo with Mint, Airbus A321neoLR with Mint, and Embraer E190 aircraft. It also serves 100 destinations across the United States, the Caribbean and Latin America, Canada, and Europe.

See Also

Before you consider JetBlue Airways, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JetBlue Airways wasn't on the list.

While JetBlue Airways currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.