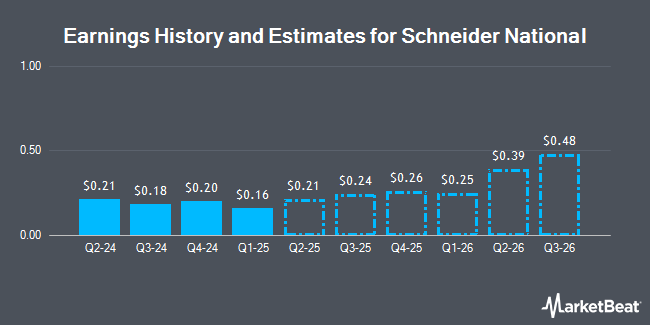

Schneider National, Inc. (NYSE:SNDR - Free Report) - Analysts at Zacks Research raised their Q2 2026 earnings estimates for Schneider National in a report released on Wednesday, November 20th. Zacks Research analyst S. Goswami now anticipates that the company will earn $0.52 per share for the quarter, up from their prior forecast of $0.49. The consensus estimate for Schneider National's current full-year earnings is $0.70 per share.

Other analysts have also issued reports about the company. Stifel Nicolaus raised their price objective on Schneider National from $25.00 to $27.00 and gave the company a "hold" rating in a report on Monday, November 11th. Bank of America upgraded shares of Schneider National from an "underperform" rating to a "buy" rating and upped their price objective for the stock from $27.00 to $34.00 in a research report on Thursday, November 7th. Susquehanna dropped their target price on shares of Schneider National from $29.00 to $26.00 and set a "neutral" rating on the stock in a research report on Thursday, November 7th. Evercore ISI reduced their price target on shares of Schneider National from $27.00 to $26.00 and set an "in-line" rating for the company in a research report on Thursday, November 7th. Finally, Citigroup lowered shares of Schneider National from a "neutral" rating to a "sell" rating and decreased their price target for the company from $32.00 to $30.00 in a research note on Tuesday, November 12th. One research analyst has rated the stock with a sell rating, eight have given a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $28.31.

Check Out Our Latest Report on Schneider National

Schneider National Price Performance

Shares of Schneider National stock traded up $0.41 during trading hours on Monday, reaching $32.02. The stock had a trading volume of 886,627 shares, compared to its average volume of 816,118. The stock's 50 day moving average is $28.79 and its 200 day moving average is $26.07. The company has a current ratio of 1.66, a quick ratio of 1.53 and a debt-to-equity ratio of 0.04. Schneider National has a twelve month low of $20.50 and a twelve month high of $32.71. The firm has a market capitalization of $5.61 billion, a PE ratio of 50.98, a PEG ratio of 3.83 and a beta of 0.85.

Schneider National (NYSE:SNDR - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The company reported $0.18 EPS for the quarter, missing analysts' consensus estimates of $0.23 by ($0.05). Schneider National had a return on equity of 3.92% and a net margin of 2.10%. The firm had revenue of $1.32 billion for the quarter, compared to analyst estimates of $1.33 billion.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently modified their holdings of the company. The Manufacturers Life Insurance Company increased its stake in Schneider National by 3.6% during the second quarter. The Manufacturers Life Insurance Company now owns 14,136 shares of the company's stock worth $342,000 after acquiring an additional 493 shares during the last quarter. CANADA LIFE ASSURANCE Co raised its holdings in Schneider National by 3.2% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 19,917 shares of the company's stock valued at $451,000 after buying an additional 618 shares during the period. Hilltop National Bank raised its holdings in Schneider National by 28.5% in the 2nd quarter. Hilltop National Bank now owns 3,044 shares of the company's stock valued at $74,000 after buying an additional 676 shares during the period. California State Teachers Retirement System lifted its position in Schneider National by 1.7% in the first quarter. California State Teachers Retirement System now owns 55,889 shares of the company's stock valued at $1,265,000 after buying an additional 958 shares during the last quarter. Finally, Comerica Bank boosted its stake in Schneider National by 11.8% during the first quarter. Comerica Bank now owns 12,283 shares of the company's stock worth $278,000 after buying an additional 1,297 shares during the period. Institutional investors and hedge funds own 28.54% of the company's stock.

Schneider National Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 8th. Shareholders of record on Friday, December 13th will be paid a $0.095 dividend. This represents a $0.38 dividend on an annualized basis and a dividend yield of 1.19%. The ex-dividend date is Friday, December 13th. Schneider National's dividend payout ratio (DPR) is presently 61.29%.

About Schneider National

(

Get Free Report)

Schneider National, Inc, together with its subsidiaries, provides surface transportation and logistics solutions in the United States, Canada, and Mexico. It operates through three segments: Truckload, Intermodal, and Logistics. The Truckload segment offers over the road freight transportation services primarily through dry van, bulk, temperature-controlled, and flat-bed trailers across either network or dedicated configurations.

Further Reading

Before you consider Schneider National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schneider National wasn't on the list.

While Schneider National currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.