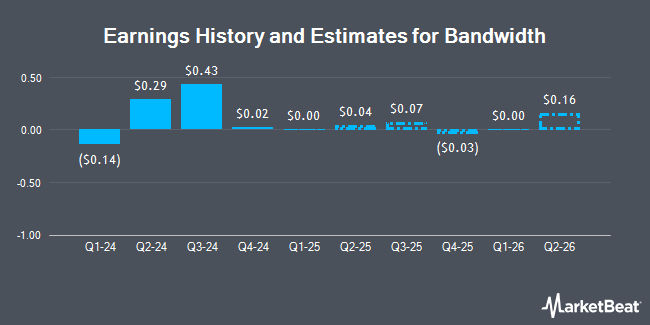

Bandwidth Inc. (NASDAQ:BAND - Free Report) - Zacks Research increased their FY2026 earnings estimates for shares of Bandwidth in a note issued to investors on Monday, November 25th. Zacks Research analyst R. Department now forecasts that the company will earn $0.47 per share for the year, up from their prior forecast of $0.45. The consensus estimate for Bandwidth's current full-year earnings is $0.08 per share.

Several other research firms also recently commented on BAND. Barclays decreased their target price on shares of Bandwidth from $28.00 to $25.00 and set an "overweight" rating for the company in a research report on Friday, August 2nd. Robert W. Baird increased their price objective on Bandwidth from $19.00 to $22.00 and gave the stock a "neutral" rating in a research note on Friday, November 1st. Needham & Company LLC reaffirmed a "hold" rating on shares of Bandwidth in a research report on Friday, November 1st. Finally, JMP Securities reiterated a "market outperform" rating and set a $36.00 price target on shares of Bandwidth in a report on Tuesday, August 27th. One investment analyst has rated the stock with a sell rating, two have given a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $28.33.

Get Our Latest Research Report on Bandwidth

Bandwidth Stock Up 1.6 %

BAND traded up $0.35 during trading on Thursday, hitting $21.61. 144,509 shares of the company's stock were exchanged, compared to its average volume of 308,655. Bandwidth has a fifty-two week low of $10.60 and a fifty-two week high of $25.02. The stock has a market cap of $594.49 million, a P/E ratio of -23.24 and a beta of 1.50. The business's 50 day moving average is $18.42 and its two-hundred day moving average is $18.34. The company has a quick ratio of 1.29, a current ratio of 1.29 and a debt-to-equity ratio of 0.83.

Bandwidth (NASDAQ:BAND - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported $0.43 earnings per share for the quarter, topping analysts' consensus estimates of $0.32 by $0.11. Bandwidth had a negative return on equity of 0.89% and a negative net margin of 2.23%. The business had revenue of $193.90 million for the quarter, compared to the consensus estimate of $182.05 million. During the same period in the prior year, the business earned $0.03 EPS. The firm's revenue for the quarter was up 27.6% on a year-over-year basis.

Institutional Investors Weigh In On Bandwidth

Several large investors have recently added to or reduced their stakes in BAND. Franklin Resources Inc. lifted its holdings in Bandwidth by 40.9% during the third quarter. Franklin Resources Inc. now owns 77,481 shares of the company's stock valued at $1,325,000 after purchasing an additional 22,505 shares during the last quarter. Geode Capital Management LLC raised its position in shares of Bandwidth by 3.6% in the third quarter. Geode Capital Management LLC now owns 568,667 shares of the company's stock valued at $9,960,000 after purchasing an additional 19,832 shares during the period. Barclays PLC lifted its stake in shares of Bandwidth by 9.1% during the 3rd quarter. Barclays PLC now owns 224,497 shares of the company's stock valued at $3,931,000 after buying an additional 18,778 shares in the last quarter. Y Intercept Hong Kong Ltd bought a new position in Bandwidth in the 3rd quarter worth approximately $453,000. Finally, State Street Corp grew its stake in Bandwidth by 3.7% in the 3rd quarter. State Street Corp now owns 655,768 shares of the company's stock valued at $11,482,000 after buying an additional 23,352 shares in the last quarter. Hedge funds and other institutional investors own 68.53% of the company's stock.

Insider Buying and Selling at Bandwidth

In other news, CFO Daryl Raiford sold 4,350 shares of the company's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $16.97, for a total transaction of $73,819.50. Following the transaction, the chief financial officer now owns 71,546 shares of the company's stock, valued at $1,214,135.62. This represents a 5.73 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Insiders have sold a total of 4,455 shares of company stock worth $75,786 over the last three months. 6.20% of the stock is currently owned by insiders.

About Bandwidth

(

Get Free Report)

Bandwidth is a leading enterprise cloud communications company. Companies like Cisco, Google, Microsoft, RingCentral, Uber, and Zoom use Bandwidth's APIs to easily embed voice, messaging, and emergency services into software and applications. Bandwidth is the first and only CPaaS provider offering a robust selection of communications APIs built around their own IP voice network.

Further Reading

Before you consider Bandwidth, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bandwidth wasn't on the list.

While Bandwidth currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.