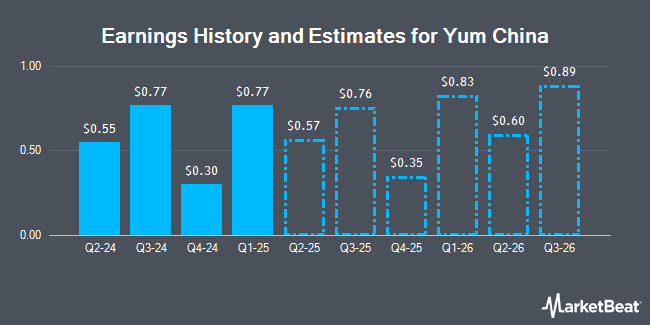

Yum China Holdings, Inc. (NYSE:YUMC - Free Report) - Research analysts at Zacks Research dropped their Q3 2025 earnings per share estimates for Yum China in a report issued on Tuesday, December 17th. Zacks Research analyst H. Ray now anticipates that the company will post earnings per share of $0.80 for the quarter, down from their prior estimate of $0.81. The consensus estimate for Yum China's current full-year earnings is $2.33 per share. Zacks Research also issued estimates for Yum China's FY2026 earnings at $2.99 EPS.

A number of other brokerages have also weighed in on YUMC. StockNews.com lowered shares of Yum China from a "buy" rating to a "hold" rating in a research report on Friday, December 13th. JPMorgan Chase & Co. upgraded Yum China from a "neutral" rating to an "overweight" rating and boosted their price objective for the stock from $35.50 to $60.00 in a research report on Tuesday, November 5th. Finally, Citigroup upgraded Yum China to a "strong-buy" rating in a research report on Monday, September 30th. One analyst has rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Buy" and an average price target of $49.57.

Read Our Latest Report on YUMC

Yum China Price Performance

Yum China stock traded down $0.39 during mid-day trading on Friday, reaching $48.58. 2,855,577 shares of the company were exchanged, compared to its average volume of 3,144,488. The company has a fifty day simple moving average of $47.02 and a 200-day simple moving average of $39.02. The firm has a market cap of $18.45 billion, a PE ratio of 21.50, a PEG ratio of 1.76 and a beta of 0.36. The company has a debt-to-equity ratio of 0.01, a current ratio of 1.29 and a quick ratio of 1.15. Yum China has a 12 month low of $28.50 and a 12 month high of $52.00.

Yum China (NYSE:YUMC - Get Free Report) last announced its earnings results on Monday, November 4th. The company reported $0.77 earnings per share for the quarter, topping analysts' consensus estimates of $0.68 by $0.09. Yum China had a return on equity of 13.39% and a net margin of 7.97%. The company had revenue of $3.07 billion for the quarter, compared to analyst estimates of $3.03 billion. During the same quarter last year, the company earned $0.59 earnings per share. The firm's quarterly revenue was up 5.4% compared to the same quarter last year.

Yum China Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, December 17th. Investors of record on Tuesday, November 26th were given a $0.16 dividend. This represents a $0.64 dividend on an annualized basis and a yield of 1.32%. The ex-dividend date was Tuesday, November 26th. Yum China's payout ratio is currently 28.32%.

Insider Buying and Selling at Yum China

In other news, insider Duoduo (Howard) Huang sold 6,377 shares of the company's stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $47.47, for a total value of $302,716.19. Following the completion of the transaction, the insider now directly owns 16,641 shares of the company's stock, valued at $789,948.27. This represents a 27.70 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Company insiders own 0.30% of the company's stock.

Hedge Funds Weigh In On Yum China

Several institutional investors have recently added to or reduced their stakes in YUMC. Tyro Capital Management LLC bought a new position in Yum China during the third quarter valued at $10,086,000. Franklin Resources Inc. lifted its position in shares of Yum China by 4.6% during the 3rd quarter. Franklin Resources Inc. now owns 1,804,882 shares of the company's stock valued at $85,023,000 after buying an additional 79,048 shares during the last quarter. Peapack Gladstone Financial Corp bought a new position in shares of Yum China during the 3rd quarter worth $944,000. Wilmington Savings Fund Society FSB bought a new position in shares of Yum China during the 3rd quarter worth $229,000. Finally, World Investment Advisors LLC purchased a new stake in Yum China in the 3rd quarter worth about $868,000. Institutional investors own 85.58% of the company's stock.

Yum China Company Profile

(

Get Free Report)

Yum China Holdings, Inc owns, operates, and franchises restaurants in the People's Republic of China. The company operates through KFC, Pizza Hut, and All Other segments. It operates restaurants under the KFC, Pizza Hut, Taco Bell, Lavazza, Little Sheep, and Huang Ji Huang concepts. The company also operates V-Gold Mall, a mobile e-commerce platform to sell products; and offers online food deliver services.

Featured Articles

Before you consider Yum China, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yum China wasn't on the list.

While Yum China currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.