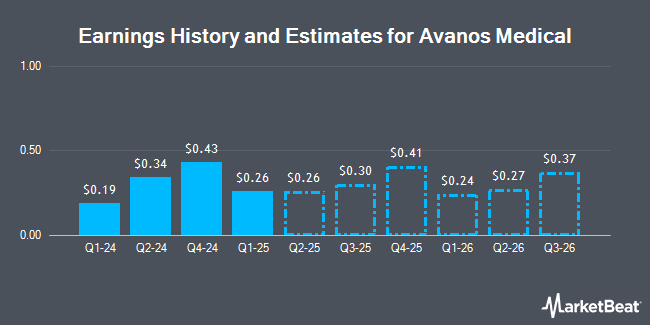

Avanos Medical, Inc. (NYSE:AVNS - Free Report) - Investment analysts at Zacks Research increased their Q3 2025 earnings estimates for shares of Avanos Medical in a research report issued on Tuesday, December 3rd. Zacks Research analyst R. Department now anticipates that the company will post earnings of $0.43 per share for the quarter, up from their prior forecast of $0.41. The consensus estimate for Avanos Medical's current full-year earnings is $1.32 per share. Zacks Research also issued estimates for Avanos Medical's FY2025 earnings at $1.66 EPS, Q1 2026 earnings at $0.42 EPS and Q2 2026 earnings at $0.44 EPS.

Separately, StockNews.com lowered Avanos Medical from a "strong-buy" rating to a "buy" rating in a research note on Sunday, November 3rd.

Read Our Latest Stock Analysis on AVNS

Avanos Medical Stock Down 2.2 %

Shares of Avanos Medical stock traded down $0.42 during trading hours on Friday, hitting $18.47. 191,036 shares of the company's stock traded hands, compared to its average volume of 286,231. The company has a quick ratio of 1.46, a current ratio of 2.22 and a debt-to-equity ratio of 0.12. Avanos Medical has a twelve month low of $17.39 and a twelve month high of $25.36. The stock has a 50 day simple moving average of $20.77 and a 200-day simple moving average of $21.47. The company has a market cap of $848.88 million, a PE ratio of 54.32 and a beta of 0.95.

Institutional Trading of Avanos Medical

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Paradice Investment Management LLC lifted its holdings in Avanos Medical by 5.4% during the 2nd quarter. Paradice Investment Management LLC now owns 1,344,949 shares of the company's stock worth $26,791,000 after buying an additional 69,389 shares during the last quarter. Geode Capital Management LLC raised its position in shares of Avanos Medical by 1.5% during the 3rd quarter. Geode Capital Management LLC now owns 1,054,162 shares of the company's stock valued at $25,337,000 after acquiring an additional 16,065 shares in the last quarter. Foundry Partners LLC lifted its stake in Avanos Medical by 1.1% during the third quarter. Foundry Partners LLC now owns 163,030 shares of the company's stock worth $3,918,000 after purchasing an additional 1,800 shares during the last quarter. AQR Capital Management LLC boosted its holdings in Avanos Medical by 21.0% in the second quarter. AQR Capital Management LLC now owns 146,983 shares of the company's stock worth $2,875,000 after purchasing an additional 25,467 shares during the period. Finally, FMR LLC increased its stake in Avanos Medical by 34.6% during the third quarter. FMR LLC now owns 133,844 shares of the company's stock valued at $3,216,000 after purchasing an additional 34,421 shares during the last quarter. Institutional investors own 95.17% of the company's stock.

Avanos Medical Company Profile

(

Get Free Report)

Avanos Medical, Inc, a medical technology company, offers medical device solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. It offers a portfolio of chronic care products that include digestive health products, such as Mic-Key enteral feeding tubes, Corpak patient feeding solutions, and NeoMed neonatal and pediatric feeding solutions.

Featured Stories

Before you consider Avanos Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avanos Medical wasn't on the list.

While Avanos Medical currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.