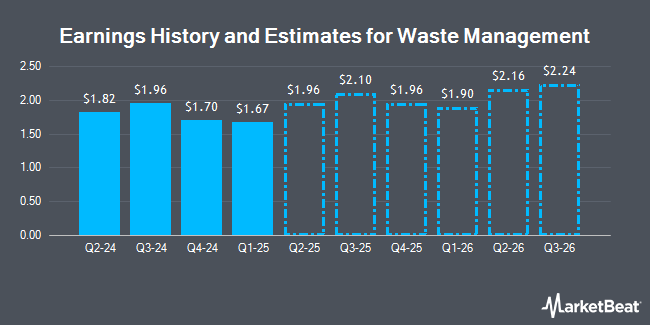

Waste Management, Inc. (NYSE:WM - Free Report) - Research analysts at Zacks Research upped their FY2024 EPS estimates for shares of Waste Management in a report issued on Monday, November 18th. Zacks Research analyst R. Department now forecasts that the business services provider will post earnings of $7.29 per share for the year, up from their previous estimate of $7.11. The consensus estimate for Waste Management's current full-year earnings is $7.30 per share. Zacks Research also issued estimates for Waste Management's Q1 2025 earnings at $1.75 EPS, Q2 2025 earnings at $1.98 EPS, Q3 2025 earnings at $2.01 EPS, Q4 2025 earnings at $1.95 EPS, FY2025 earnings at $7.69 EPS, Q1 2026 earnings at $2.01 EPS, Q2 2026 earnings at $2.32 EPS and Q3 2026 earnings at $2.25 EPS.

Waste Management (NYSE:WM - Get Free Report) last issued its earnings results on Monday, October 28th. The business services provider reported $1.96 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.89 by $0.07. The business had revenue of $5.61 billion during the quarter, compared to the consensus estimate of $5.51 billion. Waste Management had a return on equity of 39.88% and a net margin of 12.35%. The company's revenue for the quarter was up 7.9% on a year-over-year basis. During the same period last year, the company earned $1.63 EPS.

Other equities research analysts have also recently issued research reports about the company. StockNews.com cut Waste Management from a "strong-buy" rating to a "buy" rating in a report on Friday, November 15th. Robert W. Baird lowered their price target on Waste Management from $226.00 to $216.00 and set a "neutral" rating for the company in a report on Friday, July 26th. The Goldman Sachs Group upgraded Waste Management to a "strong-buy" rating in a report on Friday, July 26th. Morgan Stanley increased their target price on shares of Waste Management from $214.00 to $227.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 30th. Finally, CIBC boosted their price objective on Waste Management from $213.00 to $228.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 30th. Eleven investment analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, Waste Management presently has an average rating of "Moderate Buy" and a consensus target price of $226.11.

View Our Latest Stock Analysis on WM

Waste Management Trading Down 0.7 %

WM stock traded down $1.47 during midday trading on Wednesday, hitting $217.58. 284,639 shares of the company's stock were exchanged, compared to its average volume of 1,607,352. Waste Management has a 1-year low of $168.73 and a 1-year high of $226.84. The company has a current ratio of 0.89, a quick ratio of 0.85 and a debt-to-equity ratio of 2.00. The stock has a market capitalization of $87.33 billion, a PE ratio of 33.49, a P/E/G ratio of 2.30 and a beta of 0.74. The business has a 50-day simple moving average of $212.02 and a two-hundred day simple moving average of $209.86.

Waste Management Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, December 6th will be given a $0.75 dividend. This represents a $3.00 annualized dividend and a yield of 1.38%. The ex-dividend date of this dividend is Friday, December 6th. Waste Management's dividend payout ratio (DPR) is presently 45.87%.

Insider Activity at Waste Management

In related news, Director Maryrose Sylvester sold 310 shares of Waste Management stock in a transaction that occurred on Tuesday, November 5th. The stock was sold at an average price of $215.47, for a total transaction of $66,795.70. Following the completion of the sale, the director now directly owns 3,875 shares of the company's stock, valued at approximately $834,946.25. This trade represents a 7.41 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. 0.18% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Waste Management

Several institutional investors and hedge funds have recently added to or reduced their stakes in the business. Activest Wealth Management grew its holdings in Waste Management by 4,000.0% in the third quarter. Activest Wealth Management now owns 123 shares of the business services provider's stock worth $26,000 after purchasing an additional 120 shares during the period. Thurston Springer Miller Herd & Titak Inc. acquired a new position in shares of Waste Management during the second quarter valued at about $31,000. Fairway Wealth LLC raised its holdings in shares of Waste Management by 62.9% in the 2nd quarter. Fairway Wealth LLC now owns 171 shares of the business services provider's stock worth $36,000 after acquiring an additional 66 shares during the last quarter. Fairscale Capital LLC bought a new stake in Waste Management during the second quarter worth $39,000. Finally, Strategic Investment Solutions Inc. IL bought a new stake in shares of Waste Management in the 2nd quarter worth $36,000. 80.40% of the stock is currently owned by institutional investors and hedge funds.

Waste Management Company Profile

(

Get Free Report)

Waste Management, Inc, through its subsidiaries, engages in the provision of environmental solutions to residential, commercial, industrial, and municipal customers in the United States and Canada. It offers collection services, including picking up and transporting waste and recyclable materials from where it was generated to a transfer station, material recovery facility (MRF), or disposal site; and owns and operates transfer stations, as well as owns, develops, and operates landfill facilities that produce landfill gas used as renewable natural gas for generating electricity.

Featured Stories

Before you consider Waste Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waste Management wasn't on the list.

While Waste Management currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.