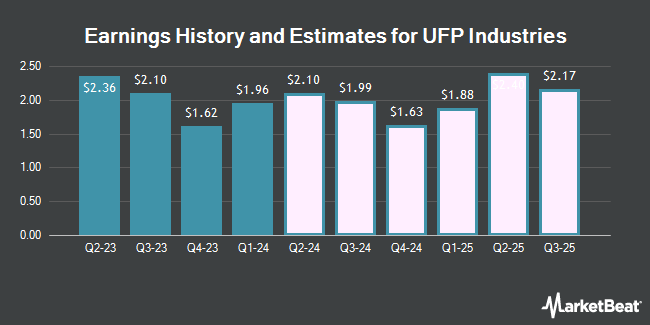

UFP Industries, Inc. (NASDAQ:UFPI - Free Report) - Equities researchers at Zacks Research lowered their FY2024 earnings estimates for shares of UFP Industries in a report issued on Monday, November 25th. Zacks Research analyst R. Department now anticipates that the construction company will post earnings of $6.91 per share for the year, down from their previous forecast of $6.93. The consensus estimate for UFP Industries' current full-year earnings is $6.89 per share. Zacks Research also issued estimates for UFP Industries' Q4 2024 earnings at $1.26 EPS, Q1 2025 earnings at $1.71 EPS, Q2 2025 earnings at $2.16 EPS, Q3 2025 earnings at $1.93 EPS, Q4 2025 earnings at $1.57 EPS, FY2025 earnings at $7.38 EPS, Q1 2026 earnings at $1.87 EPS, Q3 2026 earnings at $2.01 EPS and FY2026 earnings at $8.03 EPS.

UFP Industries (NASDAQ:UFPI - Get Free Report) last announced its quarterly earnings results on Monday, October 28th. The construction company reported $1.64 earnings per share for the quarter, missing the consensus estimate of $1.89 by ($0.25). UFP Industries had a return on equity of 14.45% and a net margin of 6.70%. The business had revenue of $1.65 billion during the quarter, compared to the consensus estimate of $1.76 billion. During the same quarter in the prior year, the firm posted $2.10 EPS. The company's revenue for the quarter was down 9.8% on a year-over-year basis.

A number of other equities analysts have also recently commented on UFPI. StockNews.com cut UFP Industries from a "buy" rating to a "hold" rating in a report on Monday. Wedbush reaffirmed an "outperform" rating and set a $155.00 price objective on shares of UFP Industries in a research note on Monday, November 4th. BMO Capital Markets increased their target price on shares of UFP Industries from $115.00 to $125.00 and gave the company a "market perform" rating in a research note on Wednesday, July 31st. Stifel Nicolaus raised their target price on shares of UFP Industries from $125.00 to $157.00 and gave the stock a "buy" rating in a report on Wednesday, July 31st. Finally, Benchmark upped their price target on shares of UFP Industries from $133.00 to $155.00 and gave the company a "buy" rating in a report on Wednesday, July 31st. Two investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, UFP Industries has a consensus rating of "Moderate Buy" and an average target price of $148.00.

Read Our Latest Report on UFPI

UFP Industries Trading Down 1.7 %

Shares of NASDAQ:UFPI traded down $2.27 during trading on Wednesday, reaching $135.26. The company's stock had a trading volume of 220,459 shares, compared to its average volume of 279,253. The firm's 50 day simple moving average is $131.39 and its two-hundred day simple moving average is $122.77. The company has a current ratio of 4.31, a quick ratio of 3.25 and a debt-to-equity ratio of 0.07. UFP Industries has a 12 month low of $107.49 and a 12 month high of $141.33. The stock has a market capitalization of $8.21 billion, a PE ratio of 18.63 and a beta of 1.39.

Institutional Investors Weigh In On UFP Industries

Several hedge funds have recently made changes to their positions in UFPI. UMB Bank n.a. raised its stake in UFP Industries by 300.0% in the third quarter. UMB Bank n.a. now owns 192 shares of the construction company's stock worth $25,000 after buying an additional 144 shares in the last quarter. Headlands Technologies LLC bought a new stake in UFP Industries during the second quarter valued at about $29,000. Signaturefd LLC grew its stake in UFP Industries by 31.8% in the third quarter. Signaturefd LLC now owns 315 shares of the construction company's stock valued at $41,000 after purchasing an additional 76 shares during the last quarter. Triad Wealth Partners LLC bought a new position in UFP Industries in the second quarter worth about $56,000. Finally, GAMMA Investing LLC lifted its position in shares of UFP Industries by 84.2% during the second quarter. GAMMA Investing LLC now owns 512 shares of the construction company's stock valued at $57,000 after buying an additional 234 shares during the last quarter. 81.81% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at UFP Industries

In related news, CEO Matthew J. Missad sold 15,000 shares of the business's stock in a transaction that occurred on Friday, November 22nd. The stock was sold at an average price of $131.03, for a total value of $1,965,450.00. Following the completion of the sale, the chief executive officer now owns 314,450 shares in the company, valued at approximately $41,202,383.50. The trade was a 4.55 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 2.58% of the company's stock.

UFP Industries Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be paid a dividend of $0.33 per share. This represents a $1.32 dividend on an annualized basis and a dividend yield of 0.98%. The ex-dividend date of this dividend is Monday, December 2nd. UFP Industries's dividend payout ratio is currently 18.16%.

About UFP Industries

(

Get Free Report)

UFP Industries, Inc, through its subsidiaries, designs, manufactures, and markets wood and non-wood composites, and other materials in North America, Europe, Asia, and Australia. It operates through Retail, Packaging, and Construction segments. The Retail segment offers treated lumber products, including decking, fencing, lattice, and other products; pressure-treated and fire-retardant products used primarily for outdoor decking environments; and lawn and garden products, consisting of wood and vinyl fencing options, garden beds and planters, pergolas, picnic tables, and other landscaping products.

Recommended Stories

Before you consider UFP Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UFP Industries wasn't on the list.

While UFP Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.