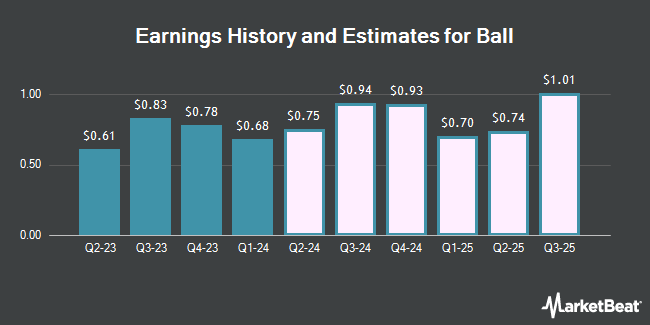

Ball Co. (NYSE:BALL - Free Report) - Investment analysts at Zacks Research upped their Q4 2024 earnings per share estimates for shares of Ball in a report issued on Wednesday, December 11th. Zacks Research analyst M. Das now forecasts that the company will post earnings per share of $0.82 for the quarter, up from their previous estimate of $0.81. The consensus estimate for Ball's current full-year earnings is $3.15 per share.

A number of other analysts have also recently commented on the company. Citigroup lifted their price target on Ball from $66.00 to $69.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 2nd. Morgan Stanley raised Ball from an "equal weight" rating to an "overweight" rating and lifted their target price for the stock from $69.00 to $78.00 in a report on Wednesday, September 4th. Wells Fargo & Company cut their price target on shares of Ball from $63.00 to $61.00 and set an "equal weight" rating on the stock in a report on Friday, November 1st. Mizuho upgraded shares of Ball from a "neutral" rating to an "outperform" rating and set a $67.00 price objective for the company in a research note on Tuesday, December 10th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $75.00 price objective on shares of Ball in a report on Monday, November 4th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $70.75.

Read Our Latest Analysis on BALL

Ball Stock Down 0.7 %

Shares of BALL stock traded down $0.42 during trading hours on Monday, reaching $57.82. 2,198,549 shares of the company's stock were exchanged, compared to its average volume of 1,839,285. Ball has a 1 year low of $54.06 and a 1 year high of $71.32. The company has a current ratio of 1.09, a quick ratio of 0.82 and a debt-to-equity ratio of 0.79. The stock has a market cap of $17.25 billion, a PE ratio of 4.39, a PEG ratio of 1.44 and a beta of 0.91. The stock's fifty day moving average price is $62.05 and its two-hundred day moving average price is $63.32.

Ball (NYSE:BALL - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported $0.91 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.87 by $0.04. Ball had a net margin of 34.05% and a return on equity of 17.46%. The business had revenue of $3.08 billion for the quarter, compared to analyst estimates of $3.13 billion. During the same period in the previous year, the company earned $0.83 earnings per share. The business's revenue for the quarter was down .9% on a year-over-year basis.

Institutional Trading of Ball

A number of hedge funds have recently bought and sold shares of BALL. Blue Trust Inc. grew its holdings in Ball by 58.6% in the 2nd quarter. Blue Trust Inc. now owns 1,521 shares of the company's stock valued at $91,000 after buying an additional 562 shares in the last quarter. Raymond James & Associates increased its position in Ball by 17.5% during the second quarter. Raymond James & Associates now owns 1,621,553 shares of the company's stock worth $97,326,000 after purchasing an additional 241,502 shares during the last quarter. Western Wealth Management LLC raised its stake in Ball by 4.9% during the second quarter. Western Wealth Management LLC now owns 5,351 shares of the company's stock worth $321,000 after purchasing an additional 251 shares during the period. Fifth Third Bancorp boosted its holdings in Ball by 2.0% in the 2nd quarter. Fifth Third Bancorp now owns 8,743 shares of the company's stock valued at $525,000 after purchasing an additional 174 shares during the last quarter. Finally, JB Capital LLC grew its stake in shares of Ball by 9.9% in the 2nd quarter. JB Capital LLC now owns 47,193 shares of the company's stock valued at $2,833,000 after buying an additional 4,243 shares during the period. Institutional investors and hedge funds own 86.51% of the company's stock.

Ball Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be given a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 1.38%. The ex-dividend date of this dividend is Monday, December 2nd. Ball's dividend payout ratio (DPR) is 6.03%.

Ball Company Profile

(

Get Free Report)

Ball Corporation supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally. The company manufactures and sells aluminum beverage containers to fillers of carbonated soft drinks, beer, energy drinks, and other beverages.

Featured Stories

Before you consider Ball, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ball wasn't on the list.

While Ball currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.