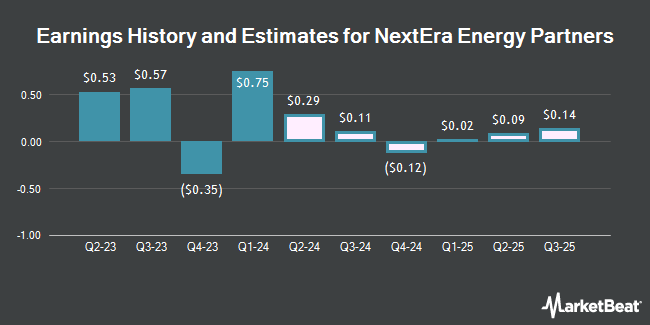

NextEra Energy Partners, LP (NYSE:NEP - Free Report) - Analysts at Zacks Research increased their Q2 2025 EPS estimates for shares of NextEra Energy Partners in a research note issued on Wednesday, November 13th. Zacks Research analyst J. Saha now expects that the solar energy provider will earn $0.34 per share for the quarter, up from their prior estimate of $0.27. The consensus estimate for NextEra Energy Partners' current full-year earnings is $1.41 per share. Zacks Research also issued estimates for NextEra Energy Partners' Q2 2026 earnings at $0.21 EPS.

Several other analysts also recently commented on NEP. BMO Capital Markets dropped their target price on shares of NextEra Energy Partners from $28.00 to $26.00 and set an "outperform" rating on the stock in a report on Monday, October 21st. JPMorgan Chase & Co. raised shares of NextEra Energy Partners from an "underweight" rating to a "neutral" rating and decreased their price target for the stock from $25.00 to $22.00 in a research note on Thursday, October 24th. BNP Paribas assumed coverage on shares of NextEra Energy Partners in a research note on Tuesday, October 1st. They set an "underperform" rating and a $15.00 price target for the company. Mizuho decreased their price target on shares of NextEra Energy Partners from $33.00 to $26.00 and set a "neutral" rating for the company in a research note on Wednesday, October 9th. Finally, StockNews.com raised shares of NextEra Energy Partners to a "sell" rating in a research note on Thursday, July 25th. Four equities research analysts have rated the stock with a sell rating, ten have given a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $26.69.

View Our Latest Analysis on NEP

NextEra Energy Partners Trading Down 4.1 %

Shares of NEP stock traded down $0.69 on Friday, hitting $16.29. The stock had a trading volume of 1,227,635 shares, compared to its average volume of 1,569,160. The firm has a market cap of $1.52 billion, a P/E ratio of 7.79 and a beta of 1.10. NextEra Energy Partners has a twelve month low of $15.55 and a twelve month high of $35.15. The company has a current ratio of 2.02, a quick ratio of 1.78 and a debt-to-equity ratio of 0.37. The company has a fifty day moving average price of $23.73 and a two-hundred day moving average price of $26.80.

NextEra Energy Partners (NYSE:NEP - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The solar energy provider reported ($0.43) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.51 by ($0.94). NextEra Energy Partners had a net margin of 17.47% and a negative return on equity of 1.07%. The business had revenue of $319.00 million during the quarter, compared to the consensus estimate of $332.25 million. During the same period last year, the business posted $0.57 EPS. The firm's revenue for the quarter was up 3.6% compared to the same quarter last year.

Hedge Funds Weigh In On NextEra Energy Partners

Several hedge funds have recently made changes to their positions in the stock. M&G Plc bought a new stake in NextEra Energy Partners during the first quarter worth about $83,069,000. Thrivent Financial for Lutherans bought a new stake in NextEra Energy Partners during the third quarter worth about $16,186,000. M&G PLC lifted its stake in NextEra Energy Partners by 19.3% during the third quarter. M&G PLC now owns 3,062,083 shares of the solar energy provider's stock worth $85,738,000 after purchasing an additional 496,383 shares during the last quarter. Swedbank AB bought a new stake in NextEra Energy Partners during the first quarter worth about $9,927,000. Finally, ClearBridge Investments Ltd lifted its stake in NextEra Energy Partners by 6.4% during the first quarter. ClearBridge Investments Ltd now owns 4,161,433 shares of the solar energy provider's stock worth $125,176,000 after purchasing an additional 250,456 shares during the last quarter. 66.01% of the stock is currently owned by hedge funds and other institutional investors.

NextEra Energy Partners Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, November 14th. Investors of record on Wednesday, November 6th were issued a $0.9175 dividend. The ex-dividend date was Wednesday, November 6th. This represents a $3.67 annualized dividend and a yield of 22.53%. This is a positive change from NextEra Energy Partners's previous quarterly dividend of $0.91. NextEra Energy Partners's dividend payout ratio (DPR) is 168.35%.

NextEra Energy Partners Company Profile

(

Get Free Report)

NextEra Energy Partners, LP acquires, owns, and manages contracted clean energy projects in the United States. It owns a portfolio of contracted renewable generation assets consisting of wind, solar, and battery storage projects. The company owns contracted natural gas pipeline assets. NextEra Energy Partners, LP was incorporated in 2014 and is based in Juno Beach, Florida.

Featured Stories

Before you consider NextEra Energy Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextEra Energy Partners wasn't on the list.

While NextEra Energy Partners currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.