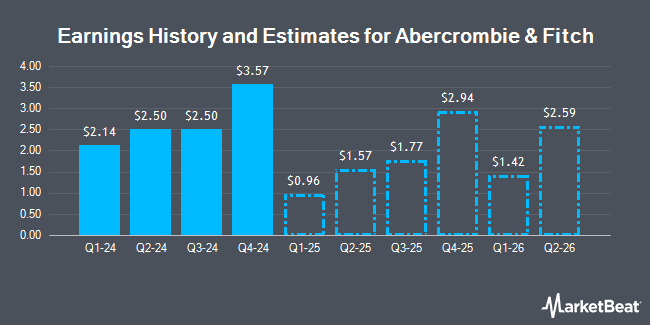

Abercrombie & Fitch Co. (NYSE:ANF - Free Report) - Analysts at Zacks Research upped their FY2025 earnings estimates for shares of Abercrombie & Fitch in a research note issued to investors on Tuesday, December 10th. Zacks Research analyst R. Lohia now forecasts that the apparel retailer will earn $10.54 per share for the year, up from their prior estimate of $10.06. The consensus estimate for Abercrombie & Fitch's current full-year earnings is $10.52 per share. Zacks Research also issued estimates for Abercrombie & Fitch's Q4 2025 earnings at $3.40 EPS, Q1 2026 earnings at $1.88 EPS, Q2 2026 earnings at $2.56 EPS, Q3 2026 earnings at $2.60 EPS, Q4 2026 earnings at $3.88 EPS, Q1 2027 earnings at $1.92 EPS and Q2 2027 earnings at $2.63 EPS.

Abercrombie & Fitch (NYSE:ANF - Get Free Report) last announced its earnings results on Tuesday, November 26th. The apparel retailer reported $2.50 earnings per share for the quarter, topping analysts' consensus estimates of $2.32 by $0.18. The firm had revenue of $1.21 billion during the quarter, compared to analyst estimates of $1.19 billion. Abercrombie & Fitch had a net margin of 11.16% and a return on equity of 46.50%. The company's revenue for the quarter was up 14.4% compared to the same quarter last year. During the same period in the prior year, the business earned $1.83 EPS.

A number of other equities analysts also recently commented on ANF. Jefferies Financial Group increased their price objective on shares of Abercrombie & Fitch from $215.00 to $220.00 and gave the stock a "buy" rating in a research note on Wednesday, September 4th. Raymond James initiated coverage on shares of Abercrombie & Fitch in a research note on Friday, December 6th. They set an "outperform" rating and a $180.00 price objective for the company. Telsey Advisory Group restated an "outperform" rating and set a $190.00 price objective on shares of Abercrombie & Fitch in a research note on Tuesday, November 26th. JPMorgan Chase & Co. increased their price objective on shares of Abercrombie & Fitch from $194.00 to $195.00 and gave the stock an "overweight" rating in a research note on Friday, October 4th. Finally, Citigroup upgraded shares of Abercrombie & Fitch from a "neutral" rating to a "buy" rating and set a $190.00 price objective for the company in a research note on Friday, August 30th. Three research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $178.38.

View Our Latest Stock Analysis on Abercrombie & Fitch

Abercrombie & Fitch Stock Performance

NYSE ANF traded up $0.29 on Thursday, reaching $137.50. The company had a trading volume of 1,643,748 shares, compared to its average volume of 1,706,990. The firm has a market capitalization of $7.02 billion, a price-to-earnings ratio of 13.57 and a beta of 1.52. Abercrombie & Fitch has a 1-year low of $82.60 and a 1-year high of $196.99. The company's fifty day moving average is $145.55 and its 200-day moving average is $154.10.

Insider Activity at Abercrombie & Fitch

In other Abercrombie & Fitch news, COO Scott D. Lipesky sold 8,605 shares of the stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $150.20, for a total value of $1,292,471.00. Following the transaction, the chief operating officer now directly owns 97,850 shares of the company's stock, valued at $14,697,070. This represents a 8.08 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, EVP Samir Desai sold 5,926 shares of the stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $148.51, for a total transaction of $880,070.26. Following the completion of the transaction, the executive vice president now directly owns 22,059 shares in the company, valued at approximately $3,275,982.09. This represents a 21.18 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 17,401 shares of company stock worth $2,631,741. Insiders own 2.58% of the company's stock.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the stock. Mutual of America Capital Management LLC raised its holdings in Abercrombie & Fitch by 228.9% in the 3rd quarter. Mutual of America Capital Management LLC now owns 27,621 shares of the apparel retailer's stock valued at $3,864,000 after acquiring an additional 19,222 shares during the period. Public Sector Pension Investment Board increased its holdings in shares of Abercrombie & Fitch by 8.8% during the second quarter. Public Sector Pension Investment Board now owns 112,381 shares of the apparel retailer's stock worth $19,986,000 after purchasing an additional 9,061 shares during the period. Y Intercept Hong Kong Ltd increased its holdings in shares of Abercrombie & Fitch by 115.8% during the third quarter. Y Intercept Hong Kong Ltd now owns 25,483 shares of the apparel retailer's stock worth $3,565,000 after purchasing an additional 13,677 shares during the period. Wedge Capital Management L L P NC increased its holdings in shares of Abercrombie & Fitch by 37.0% during the third quarter. Wedge Capital Management L L P NC now owns 362,479 shares of the apparel retailer's stock worth $50,711,000 after purchasing an additional 97,893 shares during the period. Finally, Zacks Investment Management bought a new position in shares of Abercrombie & Fitch during the third quarter worth approximately $3,027,000.

About Abercrombie & Fitch

(

Get Free Report)

Abercrombie & Fitch Co, through its subsidiaries, operates as an omnichannel retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally. The company offers an assortment of apparel, personal care products, and accessories for men, women, and kids under the Abercrombie & Fitch, abercrombie kids, Hollister, and Gilly Hicks brands.

Recommended Stories

Before you consider Abercrombie & Fitch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abercrombie & Fitch wasn't on the list.

While Abercrombie & Fitch currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.