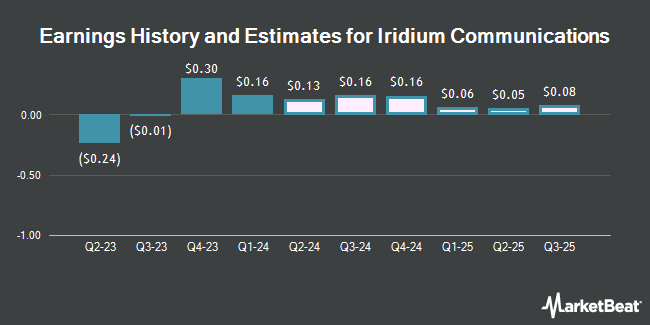

Iridium Communications Inc. (NASDAQ:IRDM - Free Report) - Zacks Research decreased their Q4 2024 EPS estimates for shares of Iridium Communications in a report issued on Thursday, November 7th. Zacks Research analyst R. Department now expects that the technology company will post earnings of $0.16 per share for the quarter, down from their prior estimate of $0.20. The consensus estimate for Iridium Communications' current full-year earnings is $0.80 per share. Zacks Research also issued estimates for Iridium Communications' Q1 2025 earnings at $0.15 EPS, Q2 2025 earnings at $0.17 EPS, Q3 2025 earnings at $0.23 EPS, Q4 2025 earnings at $0.23 EPS, Q2 2026 earnings at $0.24 EPS, Q3 2026 earnings at $0.31 EPS and FY2026 earnings at $1.10 EPS.

IRDM has been the topic of a number of other research reports. BWS Financial restated a "neutral" rating and issued a $30.00 price objective on shares of Iridium Communications in a report on Monday, October 21st. Barclays upped their price target on Iridium Communications from $44.00 to $45.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 24th. Two equities research analysts have rated the stock with a hold rating, one has given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $41.00.

View Our Latest Report on IRDM

Iridium Communications Stock Up 2.8 %

Shares of NASDAQ:IRDM traded up $0.84 during midday trading on Monday, reaching $30.37. The company's stock had a trading volume of 719,055 shares, compared to its average volume of 1,081,502. Iridium Communications has a 12-month low of $24.14 and a 12-month high of $41.66. The firm has a market capitalization of $3.46 billion, a P/E ratio of 31.42 and a beta of 0.65. The firm has a 50 day moving average of $29.17 and a 200-day moving average of $28.36. The company has a quick ratio of 2.01, a current ratio of 2.62 and a debt-to-equity ratio of 2.68.

Iridium Communications (NASDAQ:IRDM - Get Free Report) last released its quarterly earnings results on Thursday, October 17th. The technology company reported $0.21 earnings per share for the quarter, beating the consensus estimate of $0.20 by $0.01. The company had revenue of $212.77 million for the quarter, compared to analyst estimates of $205.68 million. Iridium Communications had a return on equity of 14.34% and a net margin of 14.09%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. Victory Capital Management Inc. boosted its holdings in shares of Iridium Communications by 6,491.3% in the second quarter. Victory Capital Management Inc. now owns 1,598,532 shares of the technology company's stock worth $42,553,000 after buying an additional 1,574,280 shares during the last quarter. Sumitomo Mitsui Trust Holdings Inc. boosted its stake in shares of Iridium Communications by 18.5% during the 2nd quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 2,475,472 shares of the technology company's stock worth $65,897,000 after acquiring an additional 385,872 shares during the last quarter. Vanguard Group Inc. increased its stake in shares of Iridium Communications by 2.9% in the 1st quarter. Vanguard Group Inc. now owns 12,090,326 shares of the technology company's stock worth $316,283,000 after purchasing an additional 336,989 shares in the last quarter. American Century Companies Inc. raised its holdings in Iridium Communications by 429.2% in the 2nd quarter. American Century Companies Inc. now owns 334,396 shares of the technology company's stock worth $8,902,000 after purchasing an additional 271,203 shares during the period. Finally, Van Berkom & Associates Inc. lifted its position in Iridium Communications by 4.6% during the second quarter. Van Berkom & Associates Inc. now owns 3,480,051 shares of the technology company's stock valued at $92,639,000 after purchasing an additional 152,232 shares in the last quarter. 84.36% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, insider Suzanne E. Mcbride sold 4,420 shares of the stock in a transaction on Monday, November 4th. The stock was sold at an average price of $29.48, for a total transaction of $130,301.60. Following the sale, the insider now directly owns 182,797 shares of the company's stock, valued at $5,388,855.56. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other news, Director Robert H. Niehaus sold 38,355 shares of the stock in a transaction on Wednesday, October 23rd. The stock was sold at an average price of $29.39, for a total transaction of $1,127,253.45. Following the transaction, the director now directly owns 254,824 shares of the company's stock, valued at $7,489,277.36. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, insider Suzanne E. Mcbride sold 4,420 shares of Iridium Communications stock in a transaction on Monday, November 4th. The stock was sold at an average price of $29.48, for a total value of $130,301.60. Following the completion of the sale, the insider now directly owns 182,797 shares of the company's stock, valued at $5,388,855.56. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 2.00% of the company's stock.

Iridium Communications announced that its Board of Directors has approved a share repurchase program on Thursday, September 19th that authorizes the company to repurchase $500.00 million in shares. This repurchase authorization authorizes the technology company to buy up to 14.2% of its stock through open market purchases. Stock repurchase programs are usually an indication that the company's leadership believes its stock is undervalued.

Iridium Communications Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Friday, September 13th were given a $0.14 dividend. The ex-dividend date of this dividend was Friday, September 13th. This represents a $0.56 annualized dividend and a yield of 1.84%. Iridium Communications's dividend payout ratio (DPR) is presently 59.58%.

Iridium Communications Company Profile

(

Get Free Report)

Iridium Communications Inc provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide. The company offers postpaid mobile voice and data satellite communications; prepaid mobile voice satellite communications; push-to-talk; broadband data; and Internet of Things (IoT) services.

Featured Articles

Before you consider Iridium Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iridium Communications wasn't on the list.

While Iridium Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report