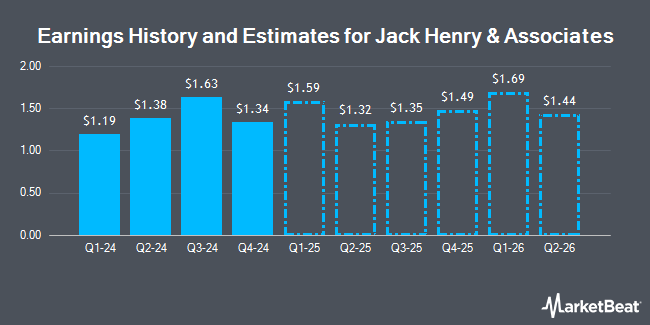

Jack Henry & Associates, Inc. (NASDAQ:JKHY - Free Report) - Research analysts at Zacks Research cut their Q2 2025 earnings per share estimates for Jack Henry & Associates in a research report issued to clients and investors on Tuesday, November 26th. Zacks Research analyst R. Department now anticipates that the technology company will post earnings per share of $1.31 for the quarter, down from their previous forecast of $1.33. The consensus estimate for Jack Henry & Associates' current full-year earnings is $5.80 per share. Zacks Research also issued estimates for Jack Henry & Associates' Q3 2025 earnings at $1.30 EPS, Q4 2025 earnings at $1.50 EPS, FY2025 earnings at $5.73 EPS, Q1 2026 earnings at $1.66 EPS, Q2 2026 earnings at $1.46 EPS, Q3 2026 earnings at $1.40 EPS, Q4 2026 earnings at $1.66 EPS, Q1 2027 earnings at $1.75 EPS and FY2027 earnings at $6.60 EPS.

Several other brokerages also recently commented on JKHY. Oppenheimer began coverage on Jack Henry & Associates in a research report on Tuesday, October 1st. They issued an "outperform" rating and a $206.00 price objective on the stock. Keefe, Bruyette & Woods upped their price target on Jack Henry & Associates from $180.00 to $190.00 and gave the stock a "market perform" rating in a research note on Thursday, November 7th. William Blair lowered shares of Jack Henry & Associates from a "strong-buy" rating to a "hold" rating in a report on Wednesday, November 6th. Robert W. Baird boosted their target price on shares of Jack Henry & Associates from $186.00 to $195.00 and gave the stock a "neutral" rating in a report on Thursday, October 17th. Finally, Compass Point initiated coverage on shares of Jack Henry & Associates in a research note on Wednesday, September 4th. They set a "neutral" rating and a $186.00 target price for the company. Eleven equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $188.73.

View Our Latest Analysis on Jack Henry & Associates

Jack Henry & Associates Price Performance

Shares of JKHY traded up $0.86 during trading hours on Thursday, reaching $173.96. 723,614 shares of the stock traded hands, compared to its average volume of 460,227. Jack Henry & Associates has a 52-week low of $153.23 and a 52-week high of $189.63. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 0.03. The company has a market cap of $12.69 billion, a P/E ratio of 31.86, a price-to-earnings-growth ratio of 3.25 and a beta of 0.63. The company's 50-day moving average price is $179.05 and its two-hundred day moving average price is $171.38.

Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The technology company reported $1.63 earnings per share for the quarter, beating the consensus estimate of $1.61 by $0.02. The business had revenue of $600.98 million for the quarter, compared to the consensus estimate of $599.56 million. Jack Henry & Associates had a net margin of 17.79% and a return on equity of 21.81%. The company's revenue for the quarter was up 5.2% on a year-over-year basis. During the same quarter in the previous year, the firm earned $1.39 earnings per share.

Jack Henry & Associates Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Monday, December 2nd will be given a dividend of $0.55 per share. The ex-dividend date is Monday, December 2nd. This represents a $2.20 dividend on an annualized basis and a yield of 1.26%. Jack Henry & Associates's dividend payout ratio (DPR) is presently 40.29%.

Insider Activity

In related news, insider David B. Foss sold 18,770 shares of the stock in a transaction on Tuesday, November 19th. The stock was sold at an average price of $171.32, for a total transaction of $3,215,676.40. Following the sale, the insider now owns 138,665 shares in the company, valued at approximately $23,756,087.80. This represents a 11.92 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Corporate insiders own 1.37% of the company's stock.

Institutional Inflows and Outflows

Several large investors have recently modified their holdings of the business. State Street Corp lifted its stake in shares of Jack Henry & Associates by 1.7% during the 3rd quarter. State Street Corp now owns 3,976,658 shares of the technology company's stock worth $702,039,000 after acquiring an additional 67,716 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC boosted its stake in shares of Jack Henry & Associates by 1.7% during the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 3,958,305 shares of the technology company's stock valued at $657,158,000 after purchasing an additional 67,386 shares during the period. Envestnet Asset Management Inc. boosted its stake in shares of Jack Henry & Associates by 2.3% during the second quarter. Envestnet Asset Management Inc. now owns 1,056,151 shares of the technology company's stock valued at $175,342,000 after purchasing an additional 23,617 shares during the period. Handelsbanken Fonder AB increased its stake in Jack Henry & Associates by 8.4% in the 3rd quarter. Handelsbanken Fonder AB now owns 863,800 shares of the technology company's stock worth $152,495,000 after buying an additional 66,600 shares during the period. Finally, Raymond James & Associates increased its stake in Jack Henry & Associates by 3.2% in the 3rd quarter. Raymond James & Associates now owns 631,974 shares of the technology company's stock worth $111,569,000 after buying an additional 19,846 shares during the period. Hedge funds and other institutional investors own 98.75% of the company's stock.

Jack Henry & Associates Company Profile

(

Get Free Report)

Jack Henry & Associates, Inc, a financial technology company that connects people and financial institutions through technology solutions and payment processing services that reduce the barriers to financial health. It operates through four segments: Core, Payments, Complementary, and Corporate and Other.

Featured Stories

Before you consider Jack Henry & Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jack Henry & Associates wasn't on the list.

While Jack Henry & Associates currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.