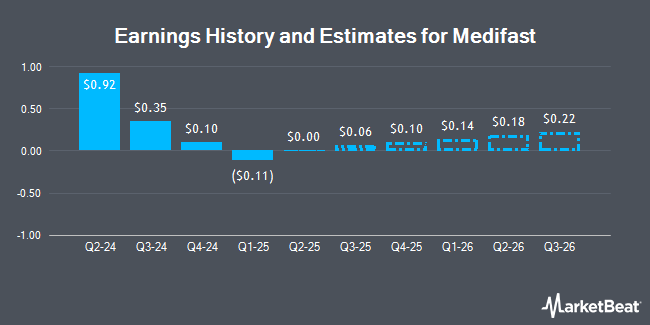

Medifast, Inc. (NYSE:MED - Free Report) - Research analysts at Zacks Research lowered their Q2 2025 earnings per share estimates for shares of Medifast in a research note issued to investors on Monday, November 25th. Zacks Research analyst A. Mohta now anticipates that the specialty retailer will earn $0.29 per share for the quarter, down from their previous estimate of $0.37. The consensus estimate for Medifast's current full-year earnings is $1.51 per share. Zacks Research also issued estimates for Medifast's Q3 2025 earnings at $0.34 EPS, Q4 2025 earnings at $0.38 EPS, Q1 2026 earnings at $0.42 EPS and Q2 2026 earnings at $0.43 EPS.

Medifast (NYSE:MED - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The specialty retailer reported $0.35 earnings per share for the quarter, beating the consensus estimate of ($0.15) by $0.50. Medifast had a net margin of 1.09% and a return on equity of 15.98%. The firm had revenue of $140.16 million for the quarter, compared to analyst estimates of $135.45 million. During the same quarter in the prior year, the business earned $2.12 EPS.

Separately, DA Davidson upgraded shares of Medifast from an "underperform" rating to a "neutral" rating and increased their price target for the stock from $16.50 to $17.00 in a research note on Tuesday, November 5th.

Read Our Latest Report on MED

Medifast Stock Up 5.7 %

Shares of NYSE MED traded up $1.05 during trading hours on Wednesday, hitting $19.37. The stock had a trading volume of 86,563 shares, compared to its average volume of 377,707. The company has a market capitalization of $211.91 million, a P/E ratio of 27.76 and a beta of 1.13. The firm's 50-day moving average price is $18.48 and its two-hundred day moving average price is $19.83. The company has a debt-to-equity ratio of 0.06, a quick ratio of 2.55 and a current ratio of 3.11. Medifast has a 52 week low of $17.07 and a 52 week high of $76.42.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. nVerses Capital LLC boosted its holdings in Medifast by 54.5% during the second quarter. nVerses Capital LLC now owns 1,700 shares of the specialty retailer's stock valued at $37,000 after acquiring an additional 600 shares during the period. Quarry LP increased its position in Medifast by 592.7% in the 2nd quarter. Quarry LP now owns 2,667 shares of the specialty retailer's stock worth $58,000 after buying an additional 2,282 shares during the period. CWM LLC lifted its holdings in shares of Medifast by 370.8% during the second quarter. CWM LLC now owns 4,684 shares of the specialty retailer's stock worth $102,000 after buying an additional 3,689 shares during the last quarter. Swedbank AB acquired a new stake in shares of Medifast in the first quarter worth $115,000. Finally, Public Employees Retirement System of Ohio increased its position in Medifast by 1,161.8% during the third quarter. Public Employees Retirement System of Ohio now owns 9,766 shares of the specialty retailer's stock worth $187,000 after acquiring an additional 8,992 shares during the period. 95.51% of the stock is currently owned by institutional investors and hedge funds.

About Medifast

(

Get Free Report)

Medifast, Inc, through its subsidiaries, engages in the manufacture and sale of weight loss, weight management, and healthy living products in the United States and the Asia-Pacific. It offers bars, puffs, cereal, crunchers, drinks, hearty choices, oatmeal, pancakes, pudding, soft serve, shakes, smoothies, soft bakes, and soups under the OPTAVIA, OPTAVIA ACTIVE, and Optimal Health brand names.

Recommended Stories

Before you consider Medifast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medifast wasn't on the list.

While Medifast currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.