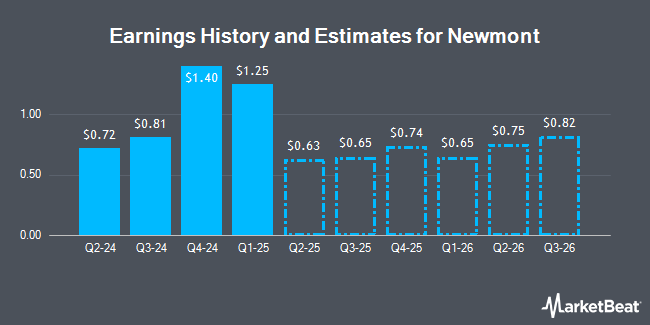

Newmont Co. (NYSE:NEM - Free Report) - Investment analysts at Zacks Research lowered their Q3 2025 earnings per share estimates for shares of Newmont in a research report issued on Tuesday, November 5th. Zacks Research analyst A. Barman now expects that the basic materials company will post earnings per share of $0.91 for the quarter, down from their previous estimate of $1.00. The consensus estimate for Newmont's current full-year earnings is $3.15 per share. Zacks Research also issued estimates for Newmont's FY2026 earnings at $4.24 EPS.

Newmont (NYSE:NEM - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The basic materials company reported $0.81 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.86 by ($0.05). The company had revenue of $4.61 billion during the quarter, compared to the consensus estimate of $4.67 billion. Newmont had a negative net margin of 7.03% and a positive return on equity of 9.80%. The business's quarterly revenue was up 84.7% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.36 earnings per share.

Several other brokerages also recently issued reports on NEM. Cibc World Mkts downgraded Newmont from a "strong-buy" rating to a "hold" rating in a research report on Monday, October 28th. Scotiabank lowered Newmont from a "sector outperform" rating to a "sector perform" rating and reduced their price target for the stock from $59.00 to $55.00 in a research report on Friday, October 25th. Raymond James raised their price target on Newmont from $65.00 to $66.00 and gave the company an "outperform" rating in a report on Friday, October 25th. BMO Capital Markets upped their price objective on shares of Newmont from $56.00 to $57.00 and gave the stock an "outperform" rating in a report on Thursday, July 25th. Finally, Royal Bank of Canada lowered their target price on shares of Newmont from $54.00 to $53.00 and set a "sector perform" rating on the stock in a research note on Thursday, October 24th. Nine research analysts have rated the stock with a hold rating, seven have issued a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, Newmont has a consensus rating of "Moderate Buy" and a consensus target price of $53.85.

Check Out Our Latest Stock Analysis on NEM

Newmont Price Performance

Newmont stock traded down $0.12 during midday trading on Friday, reaching $45.04. 9,500,273 shares of the stock traded hands, compared to its average volume of 11,803,636. Newmont has a fifty-two week low of $29.42 and a fifty-two week high of $58.72. The company has a current ratio of 1.96, a quick ratio of 1.73 and a debt-to-equity ratio of 0.30. The firm has a fifty day moving average price of $52.17 and a two-hundred day moving average price of $47.34.

Institutional Investors Weigh In On Newmont

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Avior Wealth Management LLC increased its position in Newmont by 191.8% in the 3rd quarter. Avior Wealth Management LLC now owns 496 shares of the basic materials company's stock worth $27,000 after purchasing an additional 326 shares during the last quarter. Hoese & Co LLP acquired a new position in Newmont in the third quarter worth approximately $27,000. Prospera Private Wealth LLC bought a new position in Newmont during the third quarter valued at approximately $28,000. Highline Wealth Partners LLC acquired a new stake in Newmont in the third quarter valued at approximately $32,000. Finally, Meeder Asset Management Inc. bought a new stake in Newmont in the second quarter worth approximately $27,000. Hedge funds and other institutional investors own 68.85% of the company's stock.

Insider Activity at Newmont

In other news, EVP Peter Toth sold 3,000 shares of the business's stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $53.81, for a total transaction of $161,430.00. Following the sale, the executive vice president now owns 91,596 shares in the company, valued at $4,928,780.76. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, EVP Peter Toth sold 3,000 shares of the company's stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $53.81, for a total transaction of $161,430.00. Following the transaction, the executive vice president now directly owns 91,596 shares of the company's stock, valued at approximately $4,928,780.76. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Thomas Ronald Palmer sold 20,000 shares of the firm's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $53.81, for a total value of $1,076,200.00. Following the sale, the chief executive officer now owns 271,469 shares of the company's stock, valued at $14,607,746.89. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 46,000 shares of company stock worth $2,444,440 in the last quarter. 0.06% of the stock is owned by company insiders.

Newmont Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Wednesday, November 27th will be issued a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a dividend yield of 2.22%. The ex-dividend date of this dividend is Wednesday, November 27th. Newmont's dividend payout ratio is -65.79%.

About Newmont

(

Get Free Report)

Newmont Corporation engages in the production and exploration of gold. It also explores for copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, Papua New Guinea, Ecuador, Fiji, and Ghana.

Featured Stories

Before you consider Newmont, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newmont wasn't on the list.

While Newmont currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.