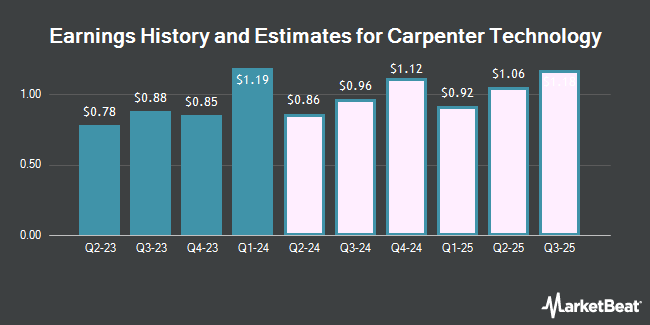

Carpenter Technology Co. (NYSE:CRS - Free Report) - Stock analysts at Zacks Research boosted their Q1 2026 earnings estimates for Carpenter Technology in a research report issued to clients and investors on Wednesday, November 20th. Zacks Research analyst S. Deb now forecasts that the basic materials company will post earnings of $1.75 per share for the quarter, up from their previous estimate of $1.74. The consensus estimate for Carpenter Technology's current full-year earnings is $6.61 per share. Zacks Research also issued estimates for Carpenter Technology's Q3 2026 earnings at $1.72 EPS, Q4 2026 earnings at $2.01 EPS, FY2026 earnings at $7.12 EPS, Q1 2027 earnings at $2.01 EPS and FY2027 earnings at $8.50 EPS.

Other equities analysts have also recently issued research reports about the stock. JPMorgan Chase & Co. assumed coverage on shares of Carpenter Technology in a research note on Friday. They set an "overweight" rating and a $220.00 target price on the stock. Benchmark reaffirmed a "buy" rating and issued a $175.00 target price on shares of Carpenter Technology in a research report on Friday, October 25th. Finally, BTIG Research boosted their target price on shares of Carpenter Technology from $120.00 to $165.00 and gave the company a "buy" rating in a research note on Tuesday, July 30th. One investment analyst has rated the stock with a sell rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Carpenter Technology presently has an average rating of "Moderate Buy" and a consensus target price of $153.00.

Read Our Latest Research Report on Carpenter Technology

Carpenter Technology Stock Performance

Shares of Carpenter Technology stock traded up $10.26 during trading on Friday, hitting $190.97. 1,076,043 shares of the company's stock traded hands, compared to its average volume of 592,642. Carpenter Technology has a 1 year low of $58.87 and a 1 year high of $192.34. The business has a 50-day simple moving average of $161.90 and a 200-day simple moving average of $134.76. The stock has a market capitalization of $9.52 billion, a P/E ratio of 42.53, a PEG ratio of 0.94 and a beta of 1.46. The company has a debt-to-equity ratio of 0.42, a current ratio of 3.84 and a quick ratio of 2.00.

Carpenter Technology (NYSE:CRS - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The basic materials company reported $1.73 earnings per share for the quarter, topping analysts' consensus estimates of $1.58 by $0.15. Carpenter Technology had a net margin of 8.05% and a return on equity of 18.01%. The company had revenue of $717.60 million during the quarter, compared to analyst estimates of $742.96 million. During the same period in the previous year, the business earned $0.88 EPS. The firm's revenue for the quarter was up 10.1% on a year-over-year basis.

Carpenter Technology Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 5th. Stockholders of record on Tuesday, October 22nd will be paid a dividend of $0.20 per share. This represents a $0.80 annualized dividend and a dividend yield of 0.42%. The ex-dividend date is Tuesday, October 22nd. Carpenter Technology's dividend payout ratio is presently 17.82%.

Hedge Funds Weigh In On Carpenter Technology

Institutional investors and hedge funds have recently bought and sold shares of the stock. FMR LLC lifted its holdings in Carpenter Technology by 47.1% during the third quarter. FMR LLC now owns 3,465,295 shares of the basic materials company's stock valued at $552,992,000 after purchasing an additional 1,108,963 shares in the last quarter. Wolf Hill Capital Management LP purchased a new position in shares of Carpenter Technology during the 2nd quarter valued at $73,850,000. Bayberry Capital Partners LP bought a new position in Carpenter Technology in the 1st quarter worth $35,887,000. American Century Companies Inc. increased its stake in Carpenter Technology by 129.5% in the 2nd quarter. American Century Companies Inc. now owns 849,097 shares of the basic materials company's stock worth $93,044,000 after buying an additional 479,047 shares in the last quarter. Finally, Assenagon Asset Management S.A. raised its holdings in Carpenter Technology by 1,538.1% during the third quarter. Assenagon Asset Management S.A. now owns 213,391 shares of the basic materials company's stock valued at $34,053,000 after acquiring an additional 200,364 shares during the period. 92.03% of the stock is currently owned by hedge funds and other institutional investors.

Carpenter Technology Company Profile

(

Get Free Report)

Carpenter Technology Corporation engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally. It operates in two segments, Specialty Alloys Operations and Performance Engineered Products. The company offers specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels, as well as additives, and metal powders and parts.

Featured Stories

Before you consider Carpenter Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carpenter Technology wasn't on the list.

While Carpenter Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.