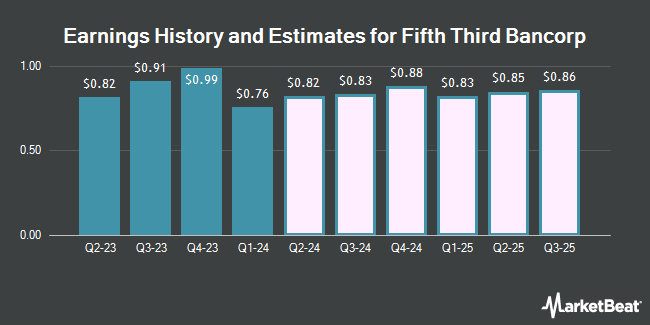

Fifth Third Bancorp (NASDAQ:FITB - Free Report) - Investment analysts at Zacks Research increased their Q3 2025 earnings per share (EPS) estimates for Fifth Third Bancorp in a research report issued to clients and investors on Tuesday, February 11th. Zacks Research analyst R. Department now anticipates that the financial services provider will earn $0.96 per share for the quarter, up from their prior estimate of $0.92. The consensus estimate for Fifth Third Bancorp's current full-year earnings is $3.67 per share. Zacks Research also issued estimates for Fifth Third Bancorp's FY2025 earnings at $3.56 EPS, Q1 2026 earnings at $0.91 EPS, Q2 2026 earnings at $1.03 EPS, Q3 2026 earnings at $1.05 EPS, Q4 2026 earnings at $1.01 EPS, FY2026 earnings at $4.00 EPS and FY2027 earnings at $4.87 EPS.

FITB has been the topic of a number of other research reports. Keefe, Bruyette & Woods increased their price target on Fifth Third Bancorp from $45.00 to $51.00 and gave the stock a "market perform" rating in a research report on Wednesday, December 4th. Citigroup increased their price target on Fifth Third Bancorp from $43.00 to $52.00 and gave the stock a "neutral" rating in a research report on Friday, November 22nd. Truist Financial increased their price target on Fifth Third Bancorp from $51.00 to $52.00 and gave the stock a "buy" rating in a research report on Wednesday, January 22nd. StockNews.com cut Fifth Third Bancorp from a "hold" rating to a "sell" rating in a report on Wednesday, November 6th. Finally, Barclays increased their target price on Fifth Third Bancorp from $51.00 to $56.00 and gave the company an "overweight" rating in a report on Monday, January 6th. One investment analyst has rated the stock with a sell rating, nine have given a hold rating and ten have issued a buy rating to the company's stock. According to data from MarketBeat, Fifth Third Bancorp currently has an average rating of "Hold" and an average target price of $46.75.

View Our Latest Research Report on FITB

Fifth Third Bancorp Price Performance

FITB stock traded up $0.48 during mid-day trading on Thursday, reaching $44.06. 4,676,808 shares of the company's stock were exchanged, compared to its average volume of 4,714,024. The company has a market cap of $29.54 billion, a price-to-earnings ratio of 14.03, a price-to-earnings-growth ratio of 1.44 and a beta of 1.23. The stock's 50 day moving average is $43.70 and its 200 day moving average is $43.52. The company has a debt-to-equity ratio of 0.82, a current ratio of 0.80 and a quick ratio of 0.80. Fifth Third Bancorp has a 12-month low of $33.03 and a 12-month high of $49.07.

Fifth Third Bancorp Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st were paid a dividend of $0.37 per share. The ex-dividend date was Tuesday, December 31st. This represents a $1.48 annualized dividend and a yield of 3.36%. Fifth Third Bancorp's dividend payout ratio (DPR) is 47.13%.

Institutional Investors Weigh In On Fifth Third Bancorp

Several hedge funds and other institutional investors have recently added to or reduced their stakes in FITB. Mufg Securities Americas Inc. purchased a new position in shares of Fifth Third Bancorp during the fourth quarter worth $470,000. Man Group plc boosted its position in shares of Fifth Third Bancorp by 36.5% during the fourth quarter. Man Group plc now owns 72,395 shares of the financial services provider's stock worth $3,061,000 after buying an additional 19,371 shares during the period. Nomura Holdings Inc. purchased a new position in shares of Fifth Third Bancorp during the fourth quarter worth $934,000. NorthRock Partners LLC purchased a new position in shares of Fifth Third Bancorp during the fourth quarter worth $457,000. Finally, Hudson Bay Capital Management LP purchased a new position in shares of Fifth Third Bancorp during the fourth quarter worth $9,515,000. Institutional investors and hedge funds own 83.79% of the company's stock.

Fifth Third Bancorp Company Profile

(

Get Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Recommended Stories

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.