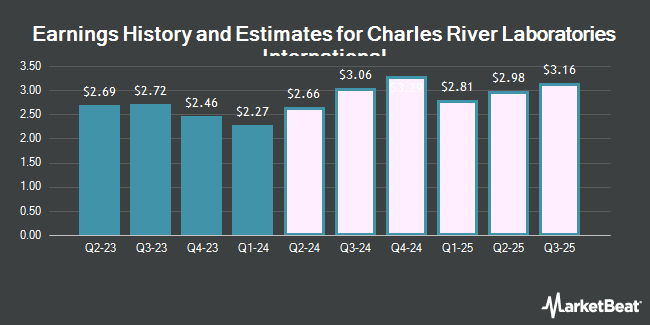

Charles River Laboratories International, Inc. (NYSE:CRL - Free Report) - Analysts at Zacks Research dropped their Q4 2024 EPS estimates for Charles River Laboratories International in a research report issued on Wednesday, November 27th. Zacks Research analyst R. Department now expects that the medical research company will post earnings of $2.47 per share for the quarter, down from their previous forecast of $2.50. The consensus estimate for Charles River Laboratories International's current full-year earnings is $10.19 per share. Zacks Research also issued estimates for Charles River Laboratories International's Q1 2025 earnings at $2.42 EPS, Q2 2025 earnings at $2.44 EPS, Q3 2025 earnings at $2.59 EPS, Q4 2025 earnings at $2.62 EPS, FY2025 earnings at $10.07 EPS, Q3 2026 earnings at $2.88 EPS and FY2026 earnings at $11.70 EPS.

Other analysts have also recently issued reports about the stock. CLSA cut shares of Charles River Laboratories International from a "hold" rating to an "underperform" rating and set a $164.00 target price on the stock. in a report on Monday, November 18th. JPMorgan Chase & Co. downgraded shares of Charles River Laboratories International from an "overweight" rating to a "neutral" rating and cut their price target for the company from $270.00 to $205.00 in a report on Thursday, August 8th. TD Cowen lifted their target price on Charles River Laboratories International from $203.00 to $227.00 and gave the stock a "hold" rating in a report on Monday, November 11th. Evercore ISI raised their price objective on shares of Charles River Laboratories International from $190.00 to $225.00 and gave the stock an "in-line" rating in a research note on Thursday, November 7th. Finally, Barclays decreased their target price on shares of Charles River Laboratories International from $230.00 to $210.00 and set an "equal weight" rating for the company in a research note on Thursday, August 8th. Three equities research analysts have rated the stock with a sell rating, eleven have issued a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $214.38.

Get Our Latest Research Report on Charles River Laboratories International

Charles River Laboratories International Stock Up 1.2 %

CRL traded up $2.38 on Monday, reaching $201.44. The company's stock had a trading volume of 383,336 shares, compared to its average volume of 619,927. The stock has a market cap of $10.30 billion, a price-to-earnings ratio of 25.04, a price-to-earnings-growth ratio of 5.13 and a beta of 1.38. The business's 50 day moving average is $194.32 and its 200 day moving average is $204.56. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.48 and a quick ratio of 1.14. Charles River Laboratories International has a 1 year low of $176.48 and a 1 year high of $275.00.

Charles River Laboratories International (NYSE:CRL - Get Free Report) last announced its earnings results on Wednesday, November 6th. The medical research company reported $2.59 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.43 by $0.16. The company had revenue of $1.01 billion during the quarter, compared to analysts' expectations of $975.99 million. Charles River Laboratories International had a net margin of 10.44% and a return on equity of 14.29%. The firm's quarterly revenue was down 1.6% compared to the same quarter last year. During the same quarter in the previous year, the business posted $2.72 earnings per share.

Hedge Funds Weigh In On Charles River Laboratories International

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Wellington Management Group LLP lifted its position in Charles River Laboratories International by 135,927.9% in the third quarter. Wellington Management Group LLP now owns 3,740,768 shares of the medical research company's stock worth $736,819,000 after buying an additional 3,738,018 shares during the last quarter. State Street Corp grew its holdings in Charles River Laboratories International by 2.0% during the 3rd quarter. State Street Corp now owns 2,130,279 shares of the medical research company's stock worth $419,601,000 after acquiring an additional 41,421 shares in the last quarter. Kayne Anderson Rudnick Investment Management LLC increased its holdings in Charles River Laboratories International by 1.7% during the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 1,908,989 shares of the medical research company's stock valued at $394,359,000 after buying an additional 31,359 shares during the period. Allspring Global Investments Holdings LLC grew its stake in Charles River Laboratories International by 40.7% in the third quarter. Allspring Global Investments Holdings LLC now owns 1,760,781 shares of the medical research company's stock valued at $346,821,000 after purchasing an additional 509,163 shares during the last quarter. Finally, Earnest Partners LLC raised its stake in shares of Charles River Laboratories International by 12.4% during the 2nd quarter. Earnest Partners LLC now owns 1,004,486 shares of the medical research company's stock worth $207,507,000 after acquiring an additional 110,725 shares in the last quarter. 98.91% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Charles River Laboratories International

In other Charles River Laboratories International news, Director Richard F. Wallman sold 6,621 shares of the business's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $216.12, for a total value of $1,430,930.52. Following the completion of the transaction, the director now owns 12,386 shares of the company's stock, valued at approximately $2,676,862.32. The trade was a 34.83 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 1.30% of the stock is currently owned by company insiders.

Charles River Laboratories International declared that its board has initiated a share buyback program on Wednesday, August 7th that authorizes the company to repurchase $1.00 billion in shares. This repurchase authorization authorizes the medical research company to buy up to 9.6% of its shares through open market purchases. Shares repurchase programs are usually an indication that the company's management believes its stock is undervalued.

Charles River Laboratories International Company Profile

(

Get Free Report)

Charles River Laboratories International, Inc provides drug discovery, non-clinical development, and safety testing services in the United States, Europe, Canada, the Asia Pacific, and internationally. It operates through three segments: Research Models and Services (RMS), Discovery and Safety Assessment (DSA), and Manufacturing Solutions (Manufacturing).

See Also

Before you consider Charles River Laboratories International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles River Laboratories International wasn't on the list.

While Charles River Laboratories International currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.