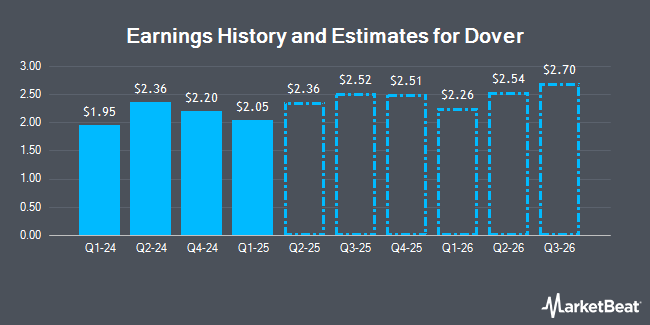

Dover Co. (NYSE:DOV - Free Report) - Zacks Research boosted their Q2 2025 earnings per share (EPS) estimates for Dover in a report released on Thursday, December 12th. Zacks Research analyst R. Department now anticipates that the industrial products company will earn $2.36 per share for the quarter, up from their previous forecast of $2.35. The consensus estimate for Dover's current full-year earnings is $8.17 per share. Zacks Research also issued estimates for Dover's Q2 2026 earnings at $2.48 EPS and FY2026 earnings at $9.72 EPS.

DOV has been the subject of a number of other research reports. UBS Group began coverage on Dover in a report on Wednesday, November 13th. They set a "neutral" rating and a $217.00 target price for the company. StockNews.com cut Dover from a "buy" rating to a "hold" rating in a research report on Wednesday. Citigroup increased their price objective on Dover from $226.00 to $236.00 and gave the stock a "buy" rating in a research report on Monday. The Goldman Sachs Group upped their price objective on shares of Dover from $202.00 to $223.00 and gave the stock a "buy" rating in a research report on Thursday. Finally, JPMorgan Chase & Co. lifted their price target on Dover from $210.00 to $212.00 and gave the company an "overweight" rating in a research note on Friday, October 25th. Five equities research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat, Dover presently has a consensus rating of "Moderate Buy" and a consensus price target of $213.91.

Read Our Latest Stock Report on Dover

Dover Stock Down 0.3 %

Shares of DOV traded down $0.57 on Friday, hitting $200.79. The company's stock had a trading volume of 185,355 shares, compared to its average volume of 935,813. The company has a quick ratio of 1.06, a current ratio of 1.57 and a debt-to-equity ratio of 0.53. The firm has a market capitalization of $27.55 billion, a price-to-earnings ratio of 18.01, a P/E/G ratio of 2.70 and a beta of 1.22. The firm's fifty day moving average price is $197.08 and its 200-day moving average price is $187.28. Dover has a fifty-two week low of $143.96 and a fifty-two week high of $208.26.

Hedge Funds Weigh In On Dover

Institutional investors have recently added to or reduced their stakes in the business. Blue Trust Inc. lifted its stake in shares of Dover by 33.2% in the second quarter. Blue Trust Inc. now owns 2,044 shares of the industrial products company's stock valued at $362,000 after buying an additional 509 shares in the last quarter. MBL Wealth LLC bought a new stake in Dover during the 2nd quarter valued at $207,000. First Citizens Bank & Trust Co. boosted its holdings in Dover by 6.5% in the 2nd quarter. First Citizens Bank & Trust Co. now owns 4,456 shares of the industrial products company's stock valued at $804,000 after purchasing an additional 270 shares during the period. SeaCrest Wealth Management LLC purchased a new position in Dover in the 2nd quarter worth approximately $256,000. Finally, Atria Wealth Solutions Inc. boosted its holdings in shares of Dover by 36.9% in the 2nd quarter. Atria Wealth Solutions Inc. now owns 9,009 shares of the industrial products company's stock worth $1,626,000 after purchasing an additional 2,427 shares in the last quarter. 84.46% of the stock is owned by institutional investors and hedge funds.

Dover Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be paid a $0.515 dividend. This represents a $2.06 dividend on an annualized basis and a dividend yield of 1.03%. The ex-dividend date of this dividend is Friday, November 29th. Dover's dividend payout ratio is currently 18.43%.

Dover Company Profile

(

Get Free Report)

Dover Corporation provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide. The company's Engineered Products segment provides various equipment, component, software, solution, and services that are used in vehicle aftermarket, waste handling, industrial automation, aerospace and defense, industrial winch and hoist, and fluid dispensing end-market.

Featured Articles

Before you consider Dover, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dover wasn't on the list.

While Dover currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.