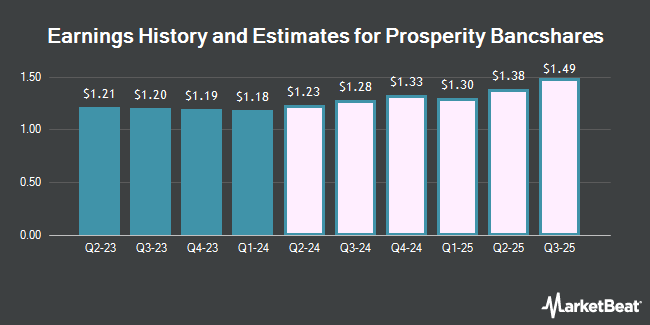

Prosperity Bancshares, Inc. (NYSE:PB - Free Report) - Equities researchers at Zacks Research upped their Q1 2026 EPS estimates for Prosperity Bancshares in a research report issued on Tuesday, March 11th. Zacks Research analyst R. Department now anticipates that the bank will post earnings per share of $1.49 for the quarter, up from their previous forecast of $1.48. The consensus estimate for Prosperity Bancshares' current full-year earnings is $5.83 per share. Zacks Research also issued estimates for Prosperity Bancshares' FY2026 earnings at $6.32 EPS.

PB has been the subject of several other research reports. Raymond James lifted their price target on shares of Prosperity Bancshares from $82.00 to $87.00 and gave the company an "outperform" rating in a research note on Thursday, January 30th. Morgan Stanley reduced their price objective on shares of Prosperity Bancshares from $102.00 to $94.00 and set an "overweight" rating for the company in a research note on Thursday, March 13th. Bank of America raised shares of Prosperity Bancshares from an "underperform" rating to a "neutral" rating and set a $80.00 price objective for the company in a research note on Tuesday, January 7th. UBS Group cut their price target on shares of Prosperity Bancshares from $77.00 to $76.00 and set a "buy" rating on the stock in a report on Thursday, December 26th. Finally, StockNews.com raised shares of Prosperity Bancshares from a "sell" rating to a "hold" rating in a report on Tuesday, March 11th. Seven analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $83.50.

View Our Latest Analysis on PB

Prosperity Bancshares Trading Down 0.5 %

Shares of Prosperity Bancshares stock traded down $0.35 on Friday, hitting $70.49. 592,677 shares of the company traded hands, compared to its average volume of 522,029. The stock's 50 day moving average price is $76.71 and its 200-day moving average price is $76.27. Prosperity Bancshares has a 52 week low of $57.16 and a 52 week high of $86.76. The company has a market cap of $6.72 billion, a PE ratio of 13.93, a PEG ratio of 0.94 and a beta of 0.94.

Prosperity Bancshares (NYSE:PB - Get Free Report) last posted its quarterly earnings results on Wednesday, January 29th. The bank reported $1.37 earnings per share for the quarter, beating the consensus estimate of $1.33 by $0.04. Prosperity Bancshares had a net margin of 26.79% and a return on equity of 6.64%.

Prosperity Bancshares Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 1st. Stockholders of record on Friday, March 14th will be issued a dividend of $0.58 per share. This represents a $2.32 dividend on an annualized basis and a dividend yield of 3.29%. The ex-dividend date is Friday, March 14th. Prosperity Bancshares's dividend payout ratio (DPR) is presently 45.85%.

Insider Activity

In other Prosperity Bancshares news, Director Ned S. Holmes sold 500 shares of the company's stock in a transaction on Thursday, December 26th. The shares were sold at an average price of $76.04, for a total value of $38,020.00. Following the sale, the director now directly owns 110,315 shares of the company's stock, valued at approximately $8,388,352.60. This represents a 0.45 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders have sold 5,500 shares of company stock valued at $421,905 over the last ninety days. 4.28% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Prosperity Bancshares

Several hedge funds have recently added to or reduced their stakes in PB. Norges Bank acquired a new position in shares of Prosperity Bancshares in the fourth quarter worth about $68,986,000. North Reef Capital Management LP acquired a new position in shares of Prosperity Bancshares in the fourth quarter worth about $29,211,000. Point72 Asset Management L.P. acquired a new position in shares of Prosperity Bancshares in the third quarter worth about $16,478,000. Northern Trust Corp raised its position in shares of Prosperity Bancshares by 25.5% in the fourth quarter. Northern Trust Corp now owns 937,108 shares of the bank's stock worth $70,611,000 after acquiring an additional 190,449 shares during the period. Finally, ExodusPoint Capital Management LP raised its position in shares of Prosperity Bancshares by 462.3% in the fourth quarter. ExodusPoint Capital Management LP now owns 169,778 shares of the bank's stock worth $12,793,000 after acquiring an additional 139,585 shares during the period. 80.69% of the stock is owned by hedge funds and other institutional investors.

About Prosperity Bancshares

(

Get Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Featured Articles

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.