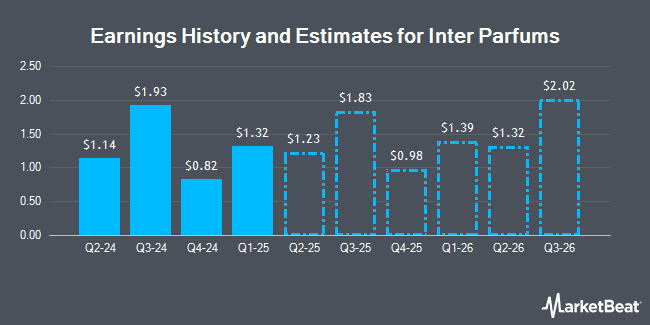

Inter Parfums, Inc. (NASDAQ:IPAR - Free Report) - Investment analysts at Zacks Research cut their Q3 2025 earnings estimates for shares of Inter Parfums in a report issued on Wednesday, November 20th. Zacks Research analyst V. Bagree now expects that the company will post earnings per share of $1.91 for the quarter, down from their prior forecast of $2.02. The consensus estimate for Inter Parfums' current full-year earnings is $5.15 per share. Zacks Research also issued estimates for Inter Parfums' Q1 2026 earnings at $1.48 EPS and Q3 2026 earnings at $2.11 EPS.

Inter Parfums (NASDAQ:IPAR - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported $1.93 EPS for the quarter, topping analysts' consensus estimates of $1.83 by $0.10. The firm had revenue of $425.00 million for the quarter, compared to the consensus estimate of $425.00 million. Inter Parfums had a return on equity of 16.34% and a net margin of 10.60%. The firm's revenue was up 15.5% compared to the same quarter last year. During the same quarter last year, the business posted $1.66 earnings per share.

Other equities analysts have also recently issued reports about the company. StockNews.com upgraded Inter Parfums from a "sell" rating to a "hold" rating in a report on Wednesday, August 7th. DA Davidson reiterated a "buy" rating and set a $163.00 price target on shares of Inter Parfums in a research report on Tuesday, November 12th. BWS Financial restated a "buy" rating and issued a $172.00 price objective on shares of Inter Parfums in a report on Monday, November 11th. Finally, Piper Sandler decreased their price objective on Inter Parfums from $158.00 to $155.00 and set an "overweight" rating for the company in a research note on Wednesday, November 13th. One research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $157.50.

Check Out Our Latest Analysis on Inter Parfums

Inter Parfums Trading Up 2.6 %

Shares of IPAR traded up $3.42 during mid-day trading on Friday, reaching $134.07. The stock had a trading volume of 169,132 shares, compared to its average volume of 145,087. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.82 and a quick ratio of 1.60. The business's fifty day moving average is $123.59 and its 200 day moving average is $122.84. Inter Parfums has a 52-week low of $108.39 and a 52-week high of $156.75. The firm has a market cap of $4.29 billion, a price-to-earnings ratio of 28.28 and a beta of 1.16.

Institutional Trading of Inter Parfums

Institutional investors have recently bought and sold shares of the business. Teachers Retirement System of The State of Kentucky raised its position in shares of Inter Parfums by 50.9% during the 3rd quarter. Teachers Retirement System of The State of Kentucky now owns 23,034 shares of the company's stock worth $2,982,000 after acquiring an additional 7,771 shares in the last quarter. Geode Capital Management LLC boosted its holdings in shares of Inter Parfums by 1.2% in the third quarter. Geode Capital Management LLC now owns 436,137 shares of the company's stock valued at $56,481,000 after acquiring an additional 5,056 shares during the period. Barclays PLC grew its position in Inter Parfums by 293.0% during the 3rd quarter. Barclays PLC now owns 34,689 shares of the company's stock worth $4,492,000 after purchasing an additional 25,862 shares during the last quarter. MML Investors Services LLC increased its position in Inter Parfums by 6.7% in the 3rd quarter. MML Investors Services LLC now owns 9,383 shares of the company's stock valued at $1,215,000 after acquiring an additional 590 shares during the period. Finally, Orion Portfolio Solutions LLC acquired a new position in shares of Inter Parfums in the third quarter valued at approximately $233,000. 55.57% of the stock is owned by hedge funds and other institutional investors.

Inter Parfums Company Profile

(

Get Free Report)

Inter Parfums, Inc, together with its subsidiaries, manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally. It operates in two segments, European Based Operations and United States Based Operations. The company offers its fragrance and cosmetic products under the Boucheron, Coach, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lanvin, Moncler, Montblanc, Rochas, S.T.

Recommended Stories

Before you consider Inter Parfums, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inter Parfums wasn't on the list.

While Inter Parfums currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.