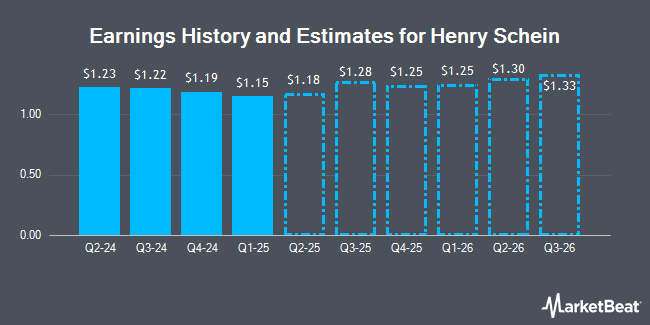

Henry Schein, Inc. (NASDAQ:HSIC - Free Report) - Investment analysts at Zacks Research upped their FY2024 earnings per share estimates for shares of Henry Schein in a report released on Tuesday, November 26th. Zacks Research analyst R. Department now forecasts that the company will post earnings of $4.76 per share for the year, up from their previous estimate of $4.73. The consensus estimate for Henry Schein's current full-year earnings is $4.78 per share. Zacks Research also issued estimates for Henry Schein's Q4 2024 earnings at $1.21 EPS, Q1 2025 earnings at $1.17 EPS, Q2 2025 earnings at $1.28 EPS, Q3 2025 earnings at $1.31 EPS, Q4 2025 earnings at $1.40 EPS, FY2025 earnings at $5.15 EPS, Q1 2026 earnings at $1.35 EPS, Q2 2026 earnings at $1.39 EPS and FY2026 earnings at $5.61 EPS.

Henry Schein (NASDAQ:HSIC - Get Free Report) last posted its quarterly earnings data on Tuesday, November 5th. The company reported $1.22 earnings per share for the quarter, topping the consensus estimate of $1.17 by $0.05. Henry Schein had a return on equity of 12.90% and a net margin of 2.51%. The business had revenue of $3.17 billion during the quarter, compared to analysts' expectations of $3.24 billion. During the same quarter in the previous year, the firm earned $1.32 EPS. The firm's revenue was up .4% compared to the same quarter last year.

Several other equities analysts have also issued reports on the company. JPMorgan Chase & Co. lowered their price target on Henry Schein from $88.00 to $80.00 and set an "overweight" rating on the stock in a research note on Monday, August 12th. Robert W. Baird lowered their price target on Henry Schein from $92.00 to $82.00 and set an "outperform" rating on the stock in a research note on Wednesday, August 7th. Evercore ISI boosted their price target on Henry Schein from $70.00 to $74.00 and gave the company an "in-line" rating in a research note on Tuesday, October 8th. Barrington Research restated an "outperform" rating and set a $82.00 price target on shares of Henry Schein in a research note on Wednesday, November 6th. Finally, UBS Group lowered their price objective on Henry Schein from $75.00 to $72.00 and set a "neutral" rating on the stock in a research note on Wednesday, August 7th. Six research analysts have rated the stock with a hold rating, four have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, Henry Schein presently has an average rating of "Moderate Buy" and a consensus target price of $79.38.

View Our Latest Analysis on Henry Schein

Henry Schein Stock Performance

HSIC traded up $0.38 on Thursday, hitting $77.66. 832,776 shares of the stock traded hands, compared to its average volume of 1,400,600. Henry Schein has a 52 week low of $63.67 and a 52 week high of $82.63. The company has a current ratio of 1.42, a quick ratio of 0.82 and a debt-to-equity ratio of 0.46. The firm has a market capitalization of $9.68 billion, a PE ratio of 31.96, a P/E/G ratio of 2.20 and a beta of 0.87. The business has a fifty day moving average price of $71.26 and a two-hundred day moving average price of $69.84.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the company. Cromwell Holdings LLC lifted its holdings in Henry Schein by 93.4% during the 3rd quarter. Cromwell Holdings LLC now owns 352 shares of the company's stock worth $26,000 after buying an additional 170 shares in the last quarter. Summit Securities Group LLC acquired a new position in shares of Henry Schein in the 2nd quarter valued at $31,000. Beach Investment Counsel Inc. PA acquired a new position in shares of Henry Schein in the 2nd quarter valued at $37,000. Blue Trust Inc. lifted its stake in shares of Henry Schein by 104.2% in the 2nd quarter. Blue Trust Inc. now owns 931 shares of the company's stock valued at $60,000 after purchasing an additional 475 shares during the period. Finally, Farther Finance Advisors LLC lifted its stake in shares of Henry Schein by 58.9% in the 3rd quarter. Farther Finance Advisors LLC now owns 933 shares of the company's stock valued at $68,000 after purchasing an additional 346 shares during the period. Institutional investors and hedge funds own 96.62% of the company's stock.

Insider Buying and Selling

In related news, COO Michael S. Ettinger sold 12,240 shares of the stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $75.00, for a total transaction of $918,000.00. Following the sale, the chief operating officer now directly owns 87,706 shares in the company, valued at $6,577,950. This represents a 12.25 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Lorelei Mcglynn sold 21,035 shares of the stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $69.30, for a total value of $1,457,725.50. Following the sale, the senior vice president now owns 71,833 shares in the company, valued at approximately $4,978,026.90. This trade represents a 22.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.14% of the stock is owned by corporate insiders.

Henry Schein Company Profile

(

Get Free Report)

Henry Schein, Inc provides health care products and services to dental practitioners, laboratories, physician practices, and ambulatory surgery centers, government, institutional health care clinics, and other alternate care clinics worldwide. It operates through two segments, Health Care Distribution, and Technology and Value-Added Services.

Further Reading

Before you consider Henry Schein, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Henry Schein wasn't on the list.

While Henry Schein currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.