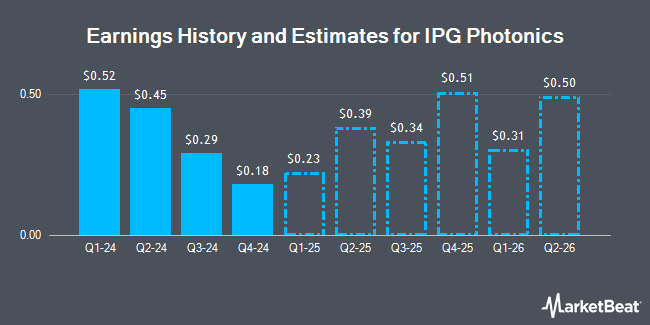

IPG Photonics Co. (NASDAQ:IPGP - Free Report) - Equities researchers at Zacks Research issued their FY2024 earnings per share estimates for shares of IPG Photonics in a research note issued to investors on Tuesday, November 19th. Zacks Research analyst R. Department forecasts that the semiconductor company will post earnings per share of $1.48 for the year. The consensus estimate for IPG Photonics' current full-year earnings is $1.53 per share. Zacks Research also issued estimates for IPG Photonics' Q4 2024 earnings at $0.22 EPS, Q1 2025 earnings at $0.30 EPS, Q2 2025 earnings at $0.36 EPS, Q3 2025 earnings at $0.52 EPS, Q4 2025 earnings at $0.69 EPS, FY2025 earnings at $1.87 EPS, Q1 2026 earnings at $0.49 EPS, Q2 2026 earnings at $0.54 EPS, Q3 2026 earnings at $0.75 EPS and FY2026 earnings at $2.61 EPS.

A number of other equities research analysts have also weighed in on the stock. Needham & Company LLC reissued a "hold" rating on shares of IPG Photonics in a report on Wednesday, October 30th. Stifel Nicolaus cut their price target on shares of IPG Photonics from $115.00 to $100.00 and set a "buy" rating on the stock in a research report on Wednesday, July 31st. Raymond James lowered their price objective on IPG Photonics from $127.00 to $100.00 and set a "strong-buy" rating for the company in a research report on Wednesday, July 31st. Finally, Benchmark restated a "hold" rating on shares of IPG Photonics in a research report on Wednesday, October 30th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $93.50.

View Our Latest Research Report on IPGP

IPG Photonics Stock Up 3.0 %

Shares of IPGP stock traded up $2.28 during mid-day trading on Friday, reaching $77.09. 110,817 shares of the stock traded hands, compared to its average volume of 263,458. The company has a market cap of $3.33 billion, a price-to-earnings ratio of -22.14 and a beta of 0.98. The stock's fifty day simple moving average is $75.53 and its two-hundred day simple moving average is $78.51. IPG Photonics has a 1-year low of $61.86 and a 1-year high of $111.11.

IPG Photonics (NASDAQ:IPGP - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The semiconductor company reported $0.29 EPS for the quarter, beating the consensus estimate of $0.19 by $0.10. The business had revenue of $233.14 million during the quarter, compared to the consensus estimate of $227.89 million. IPG Photonics had a negative net margin of 14.20% and a positive return on equity of 4.32%. The firm's revenue was down 22.6% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $1.16 EPS.

Hedge Funds Weigh In On IPG Photonics

Large investors have recently modified their holdings of the company. Innealta Capital LLC acquired a new position in IPG Photonics during the second quarter worth $85,000. KBC Group NV raised its holdings in shares of IPG Photonics by 50.6% in the 3rd quarter. KBC Group NV now owns 1,086 shares of the semiconductor company's stock worth $81,000 after acquiring an additional 365 shares during the last quarter. Assetmark Inc. lifted its position in IPG Photonics by 28.3% in the 3rd quarter. Assetmark Inc. now owns 1,336 shares of the semiconductor company's stock valued at $99,000 after acquiring an additional 295 shares in the last quarter. FMR LLC boosted its stake in IPG Photonics by 10.4% during the 3rd quarter. FMR LLC now owns 1,620 shares of the semiconductor company's stock valued at $120,000 after purchasing an additional 153 shares during the last quarter. Finally, Covestor Ltd increased its holdings in IPG Photonics by 7.7% during the 3rd quarter. Covestor Ltd now owns 1,869 shares of the semiconductor company's stock worth $139,000 after purchasing an additional 133 shares in the last quarter. 93.79% of the stock is currently owned by institutional investors.

IPG Photonics Company Profile

(

Get Free Report)

IPG Photonics Corporation develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in various applications primarily in materials processing worldwide. Its laser products include hybrid fiber-solid state lasers with green and ultraviolet wavelengths; fiber pigtailed packaged diodes and fiber coupled direct diode laser systems; high-energy pulsed lasers, multi-wavelength and tunable lasers, and single-polarization and single-frequency lasers; and high-power optical fiber delivery cables, fiber couplers, beam switches, chillers, scanners, and other accessories.

Further Reading

Before you consider IPG Photonics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IPG Photonics wasn't on the list.

While IPG Photonics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.