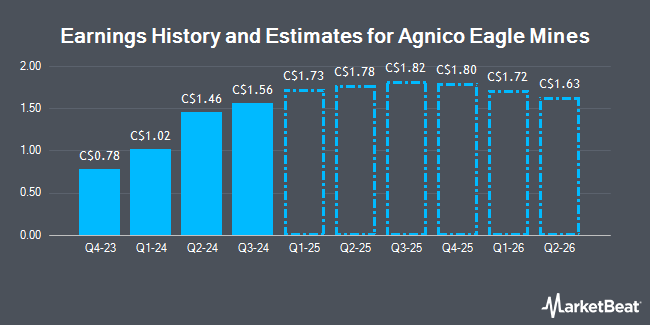

Agnico Eagle Mines Limited (TSE:AEM - Free Report) NYSE: AEM - Analysts at Zacks Research issued their FY2024 earnings estimates for Agnico Eagle Mines in a report released on Tuesday, November 12th. Zacks Research analyst A. Barman expects that the company will earn $5.47 per share for the year. The consensus estimate for Agnico Eagle Mines' current full-year earnings is $5.50 per share. Zacks Research also issued estimates for Agnico Eagle Mines' Q1 2025 earnings at $1.09 EPS, Q2 2025 earnings at $1.20 EPS, Q3 2025 earnings at $1.26 EPS, FY2025 earnings at $4.88 EPS, Q2 2026 earnings at $1.19 EPS, Q3 2026 earnings at $1.21 EPS and FY2026 earnings at $4.67 EPS.

AEM has been the subject of a number of other reports. UBS Group raised Agnico Eagle Mines to a "strong-buy" rating in a report on Tuesday, September 17th. Stifel Nicolaus lifted their price objective on Agnico Eagle Mines from C$114.00 to C$140.00 in a report on Monday, October 21st. Canaccord Genuity Group lifted their price target on Agnico Eagle Mines from C$105.00 to C$118.00 in a report on Tuesday, July 23rd. Finally, National Bankshares lifted their price target on Agnico Eagle Mines from C$143.00 to C$144.00 and gave the company an "outperform" rating in a report on Friday, November 1st. Four analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Agnico Eagle Mines currently has a consensus rating of "Buy" and a consensus price target of C$116.00.

Read Our Latest Stock Analysis on AEM

Agnico Eagle Mines Stock Performance

AEM stock traded down C$1.09 during midday trading on Friday, hitting C$108.15. The stock had a trading volume of 746,678 shares, compared to its average volume of 1,215,448. The firm has a market capitalization of C$54.19 billion, a price-to-earnings ratio of 68.28, a P/E/G ratio of 22.97 and a beta of 1.10. Agnico Eagle Mines has a 52 week low of C$60.17 and a 52 week high of C$123.86. The stock has a 50-day simple moving average of C$112.52 and a 200 day simple moving average of C$101.81. The company has a current ratio of 1.51, a quick ratio of 0.89 and a debt-to-equity ratio of 9.94.

Agnico Eagle Mines (TSE:AEM - Get Free Report) NYSE: AEM last announced its quarterly earnings data on Wednesday, October 30th. The company reported C$1.56 earnings per share (EPS) for the quarter, topping the consensus estimate of C$1.35 by C$0.21. The business had revenue of C$2.94 billion for the quarter, compared to the consensus estimate of C$2.50 billion. Agnico Eagle Mines had a net margin of 8.49% and a return on equity of 3.10%.

Insider Buying and Selling

In other Agnico Eagle Mines news, Senior Officer Christopher Charles Norman Vollmershausen sold 15,072 shares of the business's stock in a transaction on Monday, November 11th. The stock was sold at an average price of C$110.27, for a total value of C$1,661,989.44. Also, Senior Officer Carol-Ann Plummer-Theriault sold 10,000 shares of the business's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of C$110.34, for a total value of C$1,103,400.00. Insiders have sold a total of 118,972 shares of company stock valued at $13,275,384 over the last ninety days. 0.08% of the stock is owned by company insiders.

Agnico Eagle Mines Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 29th will be paid a $0.40 dividend. This represents a $1.60 dividend on an annualized basis and a dividend yield of 1.48%. The ex-dividend date is Friday, November 29th. Agnico Eagle Mines's dividend payout ratio is currently 135.63%.

About Agnico Eagle Mines

(

Get Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

Featured Articles

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.