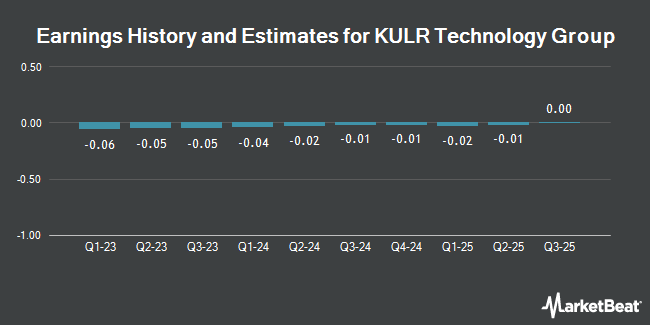

KULR Technology Group, Inc. (NYSEAMERICAN:KULR - Free Report) - Investment analysts at Zacks Small Cap issued their Q1 2025 earnings per share estimates for shares of KULR Technology Group in a research note issued to investors on Wednesday, April 2nd. Zacks Small Cap analyst L. Thompson anticipates that the company will earn ($0.01) per share for the quarter. The consensus estimate for KULR Technology Group's current full-year earnings is ($0.09) per share. Zacks Small Cap also issued estimates for KULR Technology Group's Q2 2025 earnings at ($0.01) EPS, Q3 2025 earnings at ($0.01) EPS, Q4 2025 earnings at $0.00 EPS and FY2025 earnings at ($0.01) EPS.

Separately, Benchmark reiterated a "buy" rating and set a $5.00 target price on shares of KULR Technology Group in a report on Tuesday, March 18th.

Get Our Latest Stock Report on KULR

KULR Technology Group Stock Up 0.8 %

Shares of KULR traded up $0.01 during midday trading on Monday, reaching $1.22. 4,876,319 shares of the company were exchanged, compared to its average volume of 14,215,353. KULR Technology Group has a 1-year low of $0.20 and a 1-year high of $5.49. The stock has a 50-day moving average price of $1.63 and a 200-day moving average price of $1.32. The company has a current ratio of 0.81, a quick ratio of 0.71 and a debt-to-equity ratio of 0.05. The company has a market cap of $333.73 million, a price-to-earnings ratio of -10.17 and a beta of 2.34.

Hedge Funds Weigh In On KULR Technology Group

A number of institutional investors have recently added to or reduced their stakes in KULR. Virtu Financial LLC purchased a new position in shares of KULR Technology Group during the 3rd quarter valued at approximately $29,000. Gotham Asset Management LLC bought a new position in KULR Technology Group during the 4th quarter valued at $39,000. Brevan Howard Capital Management LP bought a new position in KULR Technology Group during the 4th quarter valued at $41,000. Kellett Wealth Advisors LLC acquired a new position in KULR Technology Group during the 4th quarter worth $43,000. Finally, International Assets Investment Management LLC bought a new stake in shares of KULR Technology Group in the 4th quarter worth about $56,000. Institutional investors and hedge funds own 21.23% of the company's stock.

KULR Technology Group Company Profile

(

Get Free Report)

KULR Technology Group, Inc, through its subsidiary, KULR Technology Corporation, develops and commercializes thermal management technologies for electronics, batteries, and other components applications in the United States. It provides lithium-ion battery thermal runaway shields; automated battery cell screening and test systems; cellchecks; safecases; fiber thermal interface materials; phase change material heat sinks; internal short circuit devices; and CRUX cathodes.

Further Reading

Before you consider KULR Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KULR Technology Group wasn't on the list.

While KULR Technology Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.