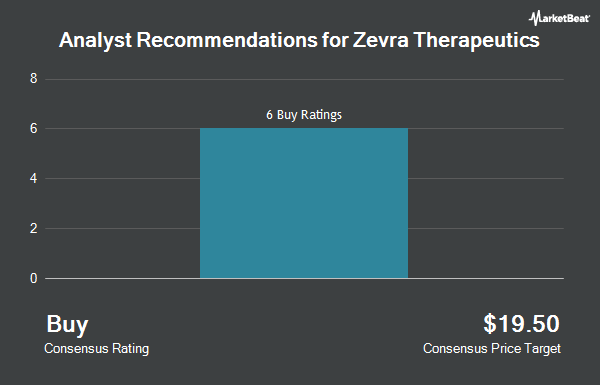

Shares of Zevra Therapeutics, Inc. (NASDAQ:ZVRA - Get Free Report) have been assigned a consensus rating of "Buy" from the eight brokerages that are presently covering the company, MarketBeat Ratings reports. Seven analysts have rated the stock with a buy recommendation and one has issued a strong buy recommendation on the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $21.00.

Several equities analysts have issued reports on the company. JMP Securities began coverage on Zevra Therapeutics in a report on Tuesday, September 24th. They set an "outperform" rating and a $17.00 price objective on the stock. Cantor Fitzgerald reissued an "overweight" rating on shares of Zevra Therapeutics in a report on Friday, October 11th. Roth Mkm increased their price target on shares of Zevra Therapeutics from $19.00 to $21.00 and gave the stock a "buy" rating in a research note on Tuesday, September 24th. Canaccord Genuity Group decreased their price target on Zevra Therapeutics from $25.00 to $23.00 and set a "buy" rating for the company in a report on Thursday, November 14th. Finally, Guggenheim began coverage on shares of Zevra Therapeutics in a report on Monday, October 7th. They issued a "buy" rating and a $20.00 target price on the stock.

View Our Latest Report on ZVRA

Hedge Funds Weigh In On Zevra Therapeutics

Several hedge funds and other institutional investors have recently bought and sold shares of the company. Sanctuary Advisors LLC purchased a new position in shares of Zevra Therapeutics in the second quarter valued at $474,000. Vestal Point Capital LP purchased a new position in Zevra Therapeutics during the 3rd quarter valued at about $3,644,000. Jacobs Levy Equity Management Inc. lifted its holdings in shares of Zevra Therapeutics by 102.4% in the first quarter. Jacobs Levy Equity Management Inc. now owns 34,707 shares of the company's stock valued at $201,000 after purchasing an additional 17,557 shares in the last quarter. Simplify Asset Management Inc. acquired a new stake in shares of Zevra Therapeutics in the third quarter valued at approximately $833,000. Finally, Propel Bio Management LLC purchased a new position in shares of Zevra Therapeutics during the 3rd quarter worth approximately $1,248,000. 35.03% of the stock is owned by institutional investors and hedge funds.

Zevra Therapeutics Stock Up 3.9 %

NASDAQ:ZVRA traded up $0.36 during trading hours on Monday, hitting $9.69. The company's stock had a trading volume of 438,462 shares, compared to its average volume of 547,518. The stock has a market capitalization of $517.21 million, a P/E ratio of -4.74 and a beta of 1.93. The company has a current ratio of 2.88, a quick ratio of 2.88 and a debt-to-equity ratio of 0.84. The stock has a fifty day moving average of $8.35 and a 200-day moving average of $6.82. Zevra Therapeutics has a 52-week low of $4.20 and a 52-week high of $9.76.

Zevra Therapeutics (NASDAQ:ZVRA - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The company reported ($0.69) EPS for the quarter, missing the consensus estimate of ($0.44) by ($0.25). Zevra Therapeutics had a negative net margin of 342.63% and a negative return on equity of 159.54%. The company had revenue of $3.70 million during the quarter, compared to analysts' expectations of $5.04 million. During the same quarter in the prior year, the company earned ($0.40) earnings per share. On average, equities analysts forecast that Zevra Therapeutics will post -1.96 earnings per share for the current year.

Zevra Therapeutics Company Profile

(

Get Free ReportZevra Therapeutics, Inc discovers and develops various proprietary prodrugs to treat serious medical conditions in the United States. The company develops its products through Ligand Activated Therapy platform. Its lead product candidate is KP1077, consisting of KP1077IH, which is under Phase 2 clinical trial for the treatment of idiopathic hypersomnia, and KP1077N, which is under Phase ½ clinical trial to treat narcolepsy.

Featured Articles

Before you consider Zevra Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zevra Therapeutics wasn't on the list.

While Zevra Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.