Zevra Therapeutics (NASDAQ:ZVRA - Get Free Report)'s stock had its "buy" rating reissued by analysts at HC Wainwright in a research report issued to clients and investors on Wednesday,Benzinga reports. They currently have a $20.00 price target on the stock. HC Wainwright's price objective points to a potential upside of 122.97% from the stock's current price.

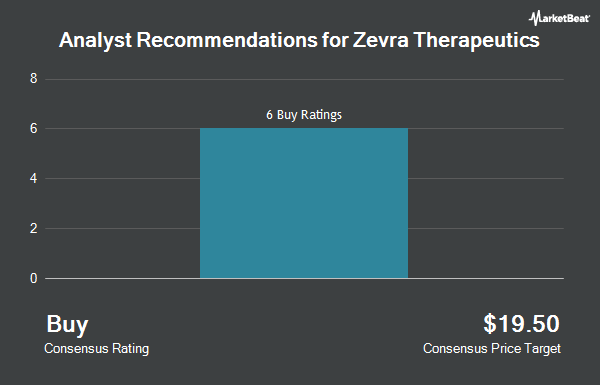

A number of other equities analysts also recently commented on ZVRA. Canaccord Genuity Group cut their price objective on Zevra Therapeutics from $25.00 to $23.00 and set a "buy" rating on the stock in a report on Thursday, November 14th. JMP Securities initiated coverage on Zevra Therapeutics in a research note on Tuesday, September 24th. They set an "outperform" rating and a $17.00 price objective for the company. Cantor Fitzgerald reiterated an "overweight" rating on shares of Zevra Therapeutics in a report on Friday, October 11th. William Blair upgraded Zevra Therapeutics to a "strong-buy" rating in a report on Friday, August 30th. Finally, Guggenheim began coverage on Zevra Therapeutics in a report on Monday, October 7th. They set a "buy" rating and a $20.00 target price on the stock. Seven equities research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $21.00.

Check Out Our Latest Stock Analysis on Zevra Therapeutics

Zevra Therapeutics Stock Performance

Shares of ZVRA remained flat at $8.97 during trading hours on Wednesday. 581,081 shares of the stock were exchanged, compared to its average volume of 550,617. Zevra Therapeutics has a 1 year low of $4.20 and a 1 year high of $9.27. The stock has a market capitalization of $478.78 million, a price-to-earnings ratio of -4.64 and a beta of 1.93. The company has a current ratio of 2.88, a quick ratio of 2.88 and a debt-to-equity ratio of 0.84. The stock has a 50-day moving average of $8.09 and a two-hundred day moving average of $6.57.

Zevra Therapeutics (NASDAQ:ZVRA - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.69) EPS for the quarter, missing the consensus estimate of ($0.44) by ($0.25). Zevra Therapeutics had a negative net margin of 342.63% and a negative return on equity of 159.54%. The firm had revenue of $3.70 million during the quarter, compared to analyst estimates of $5.04 million. During the same period in the prior year, the company posted ($0.40) earnings per share. On average, research analysts forecast that Zevra Therapeutics will post -1.92 earnings per share for the current year.

Institutional Trading of Zevra Therapeutics

Institutional investors have recently modified their holdings of the company. Sanctuary Advisors LLC purchased a new position in shares of Zevra Therapeutics during the 2nd quarter valued at $474,000. Jacobs Levy Equity Management Inc. increased its stake in shares of Zevra Therapeutics by 102.4% in the first quarter. Jacobs Levy Equity Management Inc. now owns 34,707 shares of the company's stock worth $201,000 after acquiring an additional 17,557 shares during the period. Simplify Asset Management Inc. purchased a new stake in Zevra Therapeutics during the third quarter worth $833,000. Price T Rowe Associates Inc. MD purchased a new position in Zevra Therapeutics during the first quarter valued at $64,000. Finally, Vanguard Group Inc. lifted its holdings in Zevra Therapeutics by 3.6% during the first quarter. Vanguard Group Inc. now owns 1,704,006 shares of the company's stock valued at $9,883,000 after purchasing an additional 58,866 shares in the last quarter. 35.03% of the stock is currently owned by hedge funds and other institutional investors.

About Zevra Therapeutics

(

Get Free Report)

Zevra Therapeutics, Inc discovers and develops various proprietary prodrugs to treat serious medical conditions in the United States. The company develops its products through Ligand Activated Therapy platform. Its lead product candidate is KP1077, consisting of KP1077IH, which is under Phase 2 clinical trial for the treatment of idiopathic hypersomnia, and KP1077N, which is under Phase ½ clinical trial to treat narcolepsy.

Read More

Before you consider Zevra Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zevra Therapeutics wasn't on the list.

While Zevra Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.