Zevra Therapeutics (NASDAQ:ZVRA - Get Free Report) is scheduled to be releasing its earnings data after the market closes on Tuesday, November 12th. Analysts expect Zevra Therapeutics to post earnings of ($0.44) per share for the quarter. Individual that are interested in registering for the company's earnings conference call can do so using this link.

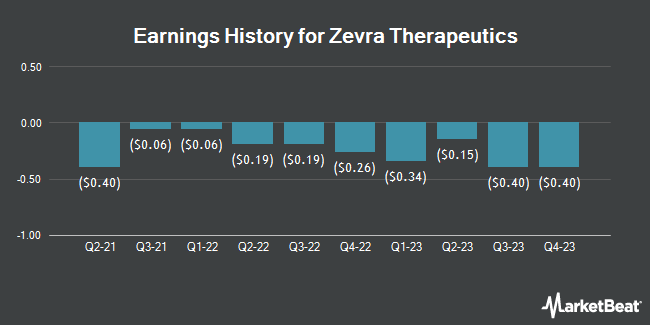

Zevra Therapeutics (NASDAQ:ZVRA - Get Free Report) last posted its quarterly earnings results on Tuesday, August 13th. The company reported ($0.48) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.47) by ($0.01). Zevra Therapeutics had a negative return on equity of 124.85% and a negative net margin of 274.10%. The firm had revenue of $4.45 million for the quarter, compared to the consensus estimate of $4.08 million. During the same period in the previous year, the company posted ($0.15) EPS. On average, analysts expect Zevra Therapeutics to post $-2 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Zevra Therapeutics Stock Up 0.7 %

ZVRA stock traded up $0.06 during trading on Tuesday, reaching $8.61. 426,215 shares of the company traded hands, compared to its average volume of 536,511. Zevra Therapeutics has a 12 month low of $3.89 and a 12 month high of $8.95. The business has a 50 day simple moving average of $7.80 and a 200 day simple moving average of $6.27. The company has a debt-to-equity ratio of 1.80, a quick ratio of 2.00 and a current ratio of 2.00. The company has a market capitalization of $453.06 million, a price-to-earnings ratio of -5.13 and a beta of 1.93.

Wall Street Analyst Weigh In

Several analysts have weighed in on ZVRA shares. William Blair upgraded Zevra Therapeutics to a "strong-buy" rating in a research note on Friday, August 30th. JMP Securities began coverage on Zevra Therapeutics in a research note on Tuesday, September 24th. They set an "outperform" rating and a $17.00 target price for the company. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Zevra Therapeutics in a research note on Friday, October 11th. Maxim Group raised their target price on Zevra Therapeutics from $18.00 to $25.00 and gave the stock a "buy" rating in a research note on Tuesday, September 24th. Finally, Guggenheim started coverage on Zevra Therapeutics in a research note on Monday, October 7th. They set a "buy" rating and a $20.00 target price for the company. Seven investment analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average target price of $20.83.

View Our Latest Stock Analysis on ZVRA

Zevra Therapeutics Company Profile

(

Get Free Report)

Zevra Therapeutics, Inc discovers and develops various proprietary prodrugs to treat serious medical conditions in the United States. The company develops its products through Ligand Activated Therapy platform. Its lead product candidate is KP1077, consisting of KP1077IH, which is under Phase 2 clinical trial for the treatment of idiopathic hypersomnia, and KP1077N, which is under Phase ½ clinical trial to treat narcolepsy.

Featured Articles

Before you consider Zevra Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zevra Therapeutics wasn't on the list.

While Zevra Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.