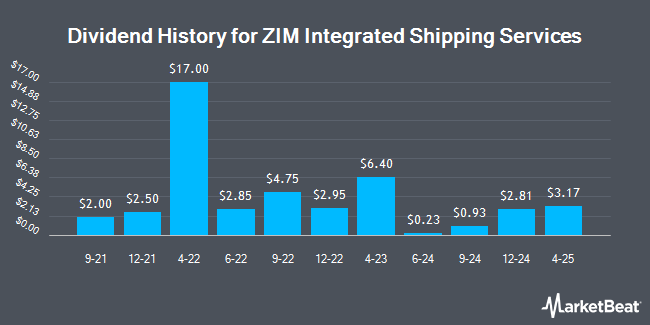

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM - Get Free Report) declared a quarterly dividend on Wednesday, March 12th, Wall Street Journal reports. Investors of record on Monday, March 24th will be paid a dividend of 3.17 per share on Thursday, April 3rd. This represents a $12.68 annualized dividend and a dividend yield of 69.71%. The ex-dividend date is Monday, March 24th. This is a 12.8% increase from ZIM Integrated Shipping Services's previous quarterly dividend of $2.81.

ZIM Integrated Shipping Services has increased its dividend payment by an average of 16.7% per year over the last three years. ZIM Integrated Shipping Services has a payout ratio of -2,081.5% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Research analysts expect ZIM Integrated Shipping Services to earn $2.99 per share next year, which means the company may not be able to cover its $11.24 annual dividend with an expected future payout ratio of 375.9%.

ZIM Integrated Shipping Services Stock Up 1.2 %

NYSE ZIM traded up $0.22 during trading on Friday, hitting $18.19. The stock had a trading volume of 8,467,197 shares, compared to its average volume of 5,552,937. The company has a market capitalization of $2.19 billion, a PE ratio of 1.52, a P/E/G ratio of 0.27 and a beta of 1.70. The company's 50-day moving average price is $19.10 and its two-hundred day moving average price is $20.59. The company has a debt-to-equity ratio of 1.11, a quick ratio of 1.26 and a current ratio of 1.33. ZIM Integrated Shipping Services has a 12 month low of $9.08 and a 12 month high of $30.15.

ZIM Integrated Shipping Services (NYSE:ZIM - Get Free Report) last posted its quarterly earnings results on Wednesday, March 12th. The company reported $4.66 earnings per share for the quarter, beating analysts' consensus estimates of $3.47 by $1.19. ZIM Integrated Shipping Services had a return on equity of 48.63% and a net margin of 19.26%. The business had revenue of $2.17 billion for the quarter, compared to analysts' expectations of $1.99 billion. As a group, sell-side analysts forecast that ZIM Integrated Shipping Services will post 16.75 EPS for the current year.

Analyst Upgrades and Downgrades

Several analysts have recently weighed in on the company. Barclays reduced their price target on ZIM Integrated Shipping Services from $16.50 to $16.00 and set an "underweight" rating on the stock in a report on Friday, January 10th. JPMorgan Chase & Co. cut their price target on ZIM Integrated Shipping Services from $10.00 to $9.50 and set an "underweight" rating on the stock in a report on Friday, March 7th. Fearnley Fonds cut ZIM Integrated Shipping Services from a "hold" rating to a "strong sell" rating in a report on Thursday, November 21st. Clarkson Capital raised ZIM Integrated Shipping Services from a "hold" rating to a "strong-buy" rating in a research report on Friday, November 22nd. Finally, Jefferies Financial Group reissued a "hold" rating and issued a $18.00 price target on shares of ZIM Integrated Shipping Services in a research report on Wednesday. Five investment analysts have rated the stock with a sell rating, one has issued a hold rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $14.04.

Read Our Latest Report on ZIM

ZIM Integrated Shipping Services Company Profile

(

Get Free Report)

ZIM Integrated Shipping Services Ltd., together with its subsidiaries, provides container shipping and related services in Israel and internationally. It provides door-to-door and port-to-port transportation services for various types of customers, including end-users, consolidators, and freight forwarders.

See Also

Before you consider ZIM Integrated Shipping Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZIM Integrated Shipping Services wasn't on the list.

While ZIM Integrated Shipping Services currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.