ZIM Integrated Shipping Services (NYSE:ZIM - Get Free Report) will announce its earnings results before the market opens on Wednesday, November 20th. Analysts expect ZIM Integrated Shipping Services to post earnings of $6.19 per share for the quarter. Parties that are interested in registering for the company's conference call can do so using this link.

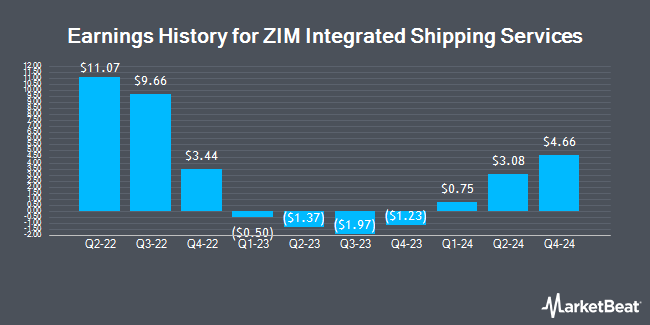

ZIM Integrated Shipping Services (NYSE:ZIM - Get Free Report) last issued its quarterly earnings data on Monday, August 19th. The company reported $3.08 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.07 by $1.01. ZIM Integrated Shipping Services had a positive return on equity of 2.89% and a negative net margin of 32.81%. The company had revenue of $1.93 billion for the quarter, compared to the consensus estimate of $1.71 billion. During the same quarter last year, the business posted ($1.37) earnings per share. On average, analysts expect ZIM Integrated Shipping Services to post $12 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

ZIM Integrated Shipping Services Trading Up 3.0 %

Shares of NYSE:ZIM traded up $0.72 on Wednesday, hitting $24.89. The company's stock had a trading volume of 2,986,393 shares, compared to its average volume of 5,999,704. The company has a debt-to-equity ratio of 1.41, a quick ratio of 0.97 and a current ratio of 1.04. The company has a 50-day simple moving average of $21.44 and a 200 day simple moving average of $19.87. ZIM Integrated Shipping Services has a 1 year low of $6.39 and a 1 year high of $26.20.

ZIM Integrated Shipping Services Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, September 5th. Investors of record on Thursday, August 29th were paid a $0.93 dividend. This represents a $3.72 dividend on an annualized basis and a yield of 14.95%. The ex-dividend date was Thursday, August 29th. This is a boost from ZIM Integrated Shipping Services's previous quarterly dividend of $0.23. ZIM Integrated Shipping Services's dividend payout ratio is currently -1.41%.

Analyst Upgrades and Downgrades

ZIM has been the subject of a number of recent research reports. JPMorgan Chase & Co. restated an "underweight" rating and issued a $10.50 target price on shares of ZIM Integrated Shipping Services in a research report on Tuesday, September 10th. Jefferies Financial Group cut shares of ZIM Integrated Shipping Services from a "buy" rating to a "hold" rating and set a $25.00 price objective for the company. in a research note on Wednesday, October 2nd. Bank of America boosted their price target on shares of ZIM Integrated Shipping Services from $12.20 to $13.70 and gave the stock an "underperform" rating in a research note on Wednesday, August 28th. Finally, Barclays raised their price objective on ZIM Integrated Shipping Services from $12.30 to $13.90 and gave the company an "underweight" rating in a research note on Wednesday, October 23rd. Four analysts have rated the stock with a sell rating and one has assigned a hold rating to the company's stock. Based on data from MarketBeat.com, ZIM Integrated Shipping Services presently has an average rating of "Reduce" and an average price target of $15.22.

Check Out Our Latest Research Report on ZIM

About ZIM Integrated Shipping Services

(

Get Free Report)

ZIM Integrated Shipping Services Ltd., together with its subsidiaries, provides container shipping and related services in Israel and internationally. It provides door-to-door and port-to-port transportation services for various types of customers, including end-users, consolidators, and freight forwarders.

Recommended Stories

Before you consider ZIM Integrated Shipping Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZIM Integrated Shipping Services wasn't on the list.

While ZIM Integrated Shipping Services currently has a "Strong Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.