Public Employees Retirement System of Ohio lessened its stake in shares of Zimmer Biomet Holdings, Inc. (NYSE:ZBH - Free Report) by 6.3% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 80,034 shares of the medical equipment provider's stock after selling 5,363 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Zimmer Biomet were worth $8,640,000 at the end of the most recent reporting period.

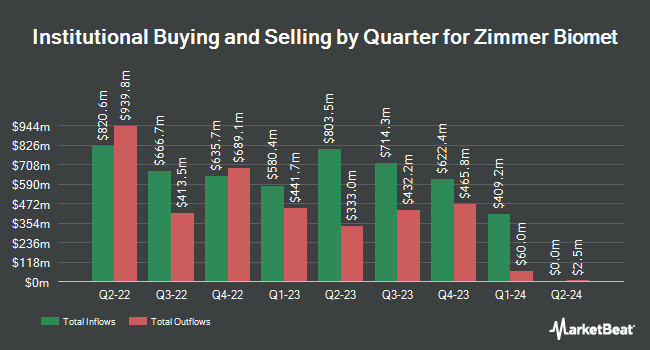

Other large investors have also recently made changes to their positions in the company. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA purchased a new position in shares of Zimmer Biomet in the 2nd quarter worth approximately $43,000. Assenagon Asset Management S.A. raised its position in shares of Zimmer Biomet by 3.5% in the 2nd quarter. Assenagon Asset Management S.A. now owns 24,286 shares of the medical equipment provider's stock valued at $2,636,000 after purchasing an additional 815 shares during the last quarter. Rovin Capital UT ADV boosted its stake in Zimmer Biomet by 13.6% in the 2nd quarter. Rovin Capital UT ADV now owns 5,397 shares of the medical equipment provider's stock worth $586,000 after purchasing an additional 645 shares in the last quarter. Gradient Investments LLC grew its position in Zimmer Biomet by 17.3% during the 2nd quarter. Gradient Investments LLC now owns 130,350 shares of the medical equipment provider's stock worth $14,147,000 after purchasing an additional 19,224 shares during the last quarter. Finally, Boomfish Wealth Group LLC increased its stake in Zimmer Biomet by 19.5% during the 2nd quarter. Boomfish Wealth Group LLC now owns 11,387 shares of the medical equipment provider's stock valued at $1,236,000 after purchasing an additional 1,855 shares in the last quarter. 88.89% of the stock is owned by institutional investors.

Analysts Set New Price Targets

ZBH has been the topic of several research reports. Canaccord Genuity Group cut their target price on Zimmer Biomet from $120.00 to $115.00 and set a "hold" rating on the stock in a research report on Tuesday, September 10th. Evercore ISI reduced their target price on shares of Zimmer Biomet from $113.00 to $110.00 and set an "in-line" rating for the company in a report on Tuesday, October 1st. Wells Fargo & Company increased their price target on Zimmer Biomet from $110.00 to $117.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 31st. Royal Bank of Canada boosted their price objective on Zimmer Biomet from $120.00 to $125.00 and gave the company an "outperform" rating in a report on Monday, November 4th. Finally, BTIG Research dropped their target price on Zimmer Biomet from $134.00 to $126.00 and set a "buy" rating on the stock in a report on Thursday, October 3rd. Two equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating and seven have given a buy rating to the company. According to MarketBeat.com, Zimmer Biomet has a consensus rating of "Hold" and an average price target of $122.83.

Get Our Latest Stock Report on ZBH

Zimmer Biomet Trading Down 0.1 %

Shares of NYSE ZBH traded down $0.10 during trading on Friday, hitting $106.74. 1,186,438 shares of the company were exchanged, compared to its average volume of 1,485,392. The company has a debt-to-equity ratio of 0.38, a quick ratio of 0.70 and a current ratio of 1.36. Zimmer Biomet Holdings, Inc. has a 12-month low of $101.47 and a 12-month high of $133.90. The company has a fifty day moving average price of $107.65 and a 200-day moving average price of $108.82. The firm has a market capitalization of $21.25 billion, a PE ratio of 20.31, a P/E/G ratio of 1.96 and a beta of 1.02.

Zimmer Biomet (NYSE:ZBH - Get Free Report) last posted its earnings results on Wednesday, October 30th. The medical equipment provider reported $1.74 earnings per share for the quarter, meeting the consensus estimate of $1.74. The company had revenue of $1.82 billion for the quarter, compared to analyst estimates of $1.80 billion. Zimmer Biomet had a net margin of 14.27% and a return on equity of 12.95%. Zimmer Biomet's revenue was up 4.1% on a year-over-year basis. During the same period in the previous year, the business posted $1.65 EPS. As a group, equities research analysts expect that Zimmer Biomet Holdings, Inc. will post 7.99 EPS for the current year.

About Zimmer Biomet

(

Free Report)

Zimmer Biomet Holdings, Inc, together with its subsidiaries, operates as a medical technology company worldwide. The company designs, manufactures, and markets orthopedic reconstructive products, such as knee and hip products; S.E.T. products, including sports medicine, biologics, foot and ankle, extremities, and trauma products; craniomaxillofacial and thoracic products comprising face and skull reconstruction products, as well as products that fixate and stabilize the bones of the chest to facilitate healing or reconstruction after open heart surgery, trauma, or for deformities of the chest.

Featured Articles

Before you consider Zimmer Biomet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zimmer Biomet wasn't on the list.

While Zimmer Biomet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.