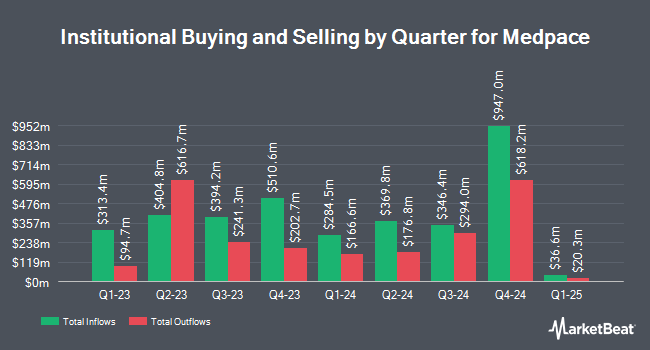

Zions Bancorporation N.A. increased its stake in Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 19.6% during the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 8,514 shares of the company's stock after buying an additional 1,396 shares during the period. Zions Bancorporation N.A.'s holdings in Medpace were worth $2,829,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. R Squared Ltd purchased a new stake in shares of Medpace in the fourth quarter worth $30,000. SBI Securities Co. Ltd. purchased a new stake in Medpace during the 4th quarter valued at about $31,000. Stone House Investment Management LLC bought a new stake in Medpace during the 3rd quarter valued at about $33,000. Jones Financial Companies Lllp raised its holdings in Medpace by 2,750.0% in the fourth quarter. Jones Financial Companies Lllp now owns 114 shares of the company's stock worth $38,000 after buying an additional 110 shares during the last quarter. Finally, Lindbrook Capital LLC lifted its stake in shares of Medpace by 27.6% in the fourth quarter. Lindbrook Capital LLC now owns 134 shares of the company's stock worth $45,000 after buying an additional 29 shares in the last quarter. Institutional investors own 77.98% of the company's stock.

Analysts Set New Price Targets

MEDP has been the subject of a number of recent analyst reports. Leerink Partners assumed coverage on shares of Medpace in a report on Monday, March 24th. They issued a "market perform" rating and a $330.00 price objective for the company. Robert W. Baird upped their target price on shares of Medpace from $354.00 to $362.00 and gave the company a "neutral" rating in a research note on Monday, January 27th. Finally, Leerink Partnrs upgraded shares of Medpace to a "hold" rating in a research note on Monday, March 24th. Nine research analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $376.30.

Get Our Latest Stock Report on Medpace

Medpace Stock Down 1.3 %

MEDP traded down $4.25 during trading on Friday, hitting $312.36. The company's stock had a trading volume of 343,137 shares, compared to its average volume of 298,736. The business's 50 day simple moving average is $335.90 and its 200-day simple moving average is $339.15. The firm has a market cap of $9.52 billion, a PE ratio of 24.73, a P/E/G ratio of 3.81 and a beta of 1.47. Medpace Holdings, Inc. has a one year low of $302.01 and a one year high of $459.77.

Medpace (NASDAQ:MEDP - Get Free Report) last released its earnings results on Monday, February 10th. The company reported $3.67 earnings per share for the quarter, beating the consensus estimate of $2.96 by $0.71. Medpace had a return on equity of 51.48% and a net margin of 19.17%. Equities research analysts expect that Medpace Holdings, Inc. will post 12.29 EPS for the current fiscal year.

Medpace Company Profile

(

Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

Recommended Stories

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.